As Chinese stocks have seen a decline amid mixed economic signals, including concerns about deflationary pressures and uneven growth, investors are increasingly looking for stability in dividend-paying stocks. In this environment, good dividend stocks can offer not only regular income but also potential resilience to market volatility.

The 10 largest dividend stocks in China

| name | Dividend yield | Dividend valuation |

| Midea Group (SZSE:000333) | 4.89% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.79% | ★★★★★★ |

| Wuliangye Yibin Ltd (SZSE:000858) | 3.72% | ★★★★★★ |

| Kweichow Moutai (SHSE:600519) | 3.51% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.23% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.98% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 5.15% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.67% | ★★★★★★ |

| Zhejiang Jiaxin Silk Ltd (SZSE:002404) | 5.55% | ★★★★★★ |

Click here to see the full list of 260 stocks from our Top China Dividend Stocks screener.

We examine a selection of our screener results.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNSIG Inner Mongolia Chemical Industry Ltd (SHSE:600328) is engaged in chemical manufacturing and has a market capitalization of CN¥11.56 billion.

Operations: CNSIG Inner Mongolia Chemical Industry Ltd (SHSE:600328) generates revenue from various segments of the chemical manufacturing sector.

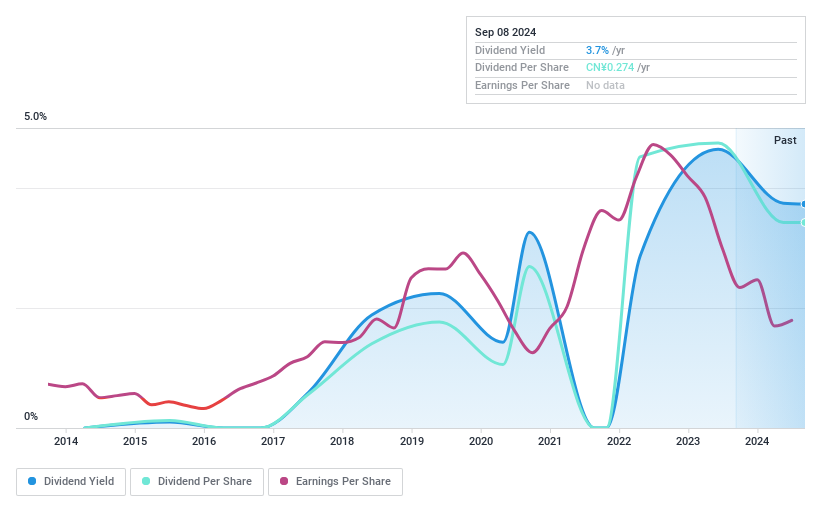

Dividend yield: 3.5%

CNSIG Inner Mongolia Chemical Industry Ltd. has a mixed dividend history. The company has been paying dividends for less than 10 years, with payments being volatile and unreliable. Despite this, the current dividend yield of 3.49% is above the market average of 2.64%. Recent earnings showed a decline, with net profit of CNY440.78 million compared to CNY763.09 million last year, but dividends continue to be covered by both profits (52.9%) and cash flows (55.3%).

Simply Wall St Dividend Rating: ★★★★★★

Overview: China South Publishing & Media Group Co., Ltd. has a market capitalization of CNY 22.45 billion and, through its subsidiaries, is engaged in publishing, printing, distribution, media and financing in China.

Operations: China South Publishing & Media Group Co., Ltd generates revenue from its core activities of publishing, printing, distribution, media and financing in China.

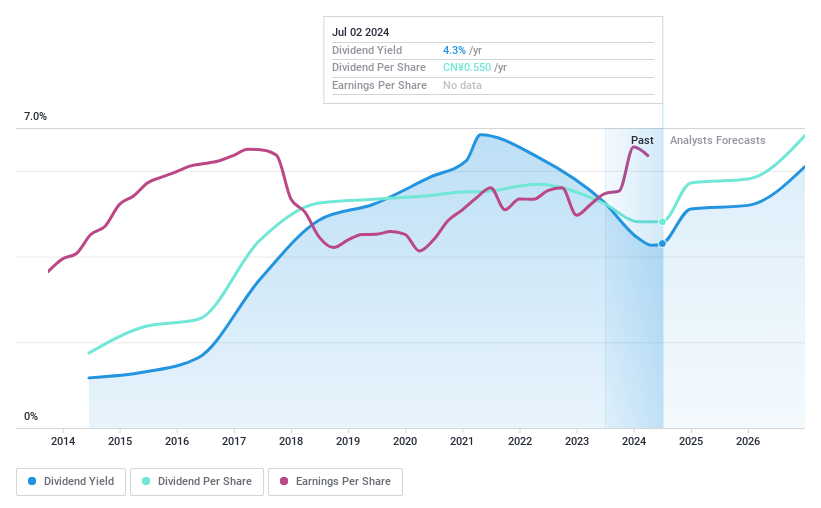

Dividend yield: 4.4%

China South Publishing & Media Group offers a high and reliable dividend yield of 4.4%, putting it among the top 25% of dividend payers in the Chinese market. The company’s dividends are well covered by both earnings (payout ratio: 55.1%) and cash flows (payout ratio: 34.9%). Despite a forecast annual earnings decline of 1.9% over the next three years, dividends have been stable and increasing over the past decade, supported by recent earnings growth of 21.2%.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing Sifang Automation Co., Ltd. supplies power transmission, transformation protection, automation systems and various power-related systems in China and internationally with a market capitalization of CNY 14.72 billion.

Operations: Beijing Sifang Automation Co., Ltd. generates revenue by providing power transmission, transformation protection, automation systems, power generation, enterprise power solutions, and power distribution and consumption systems at home and abroad.

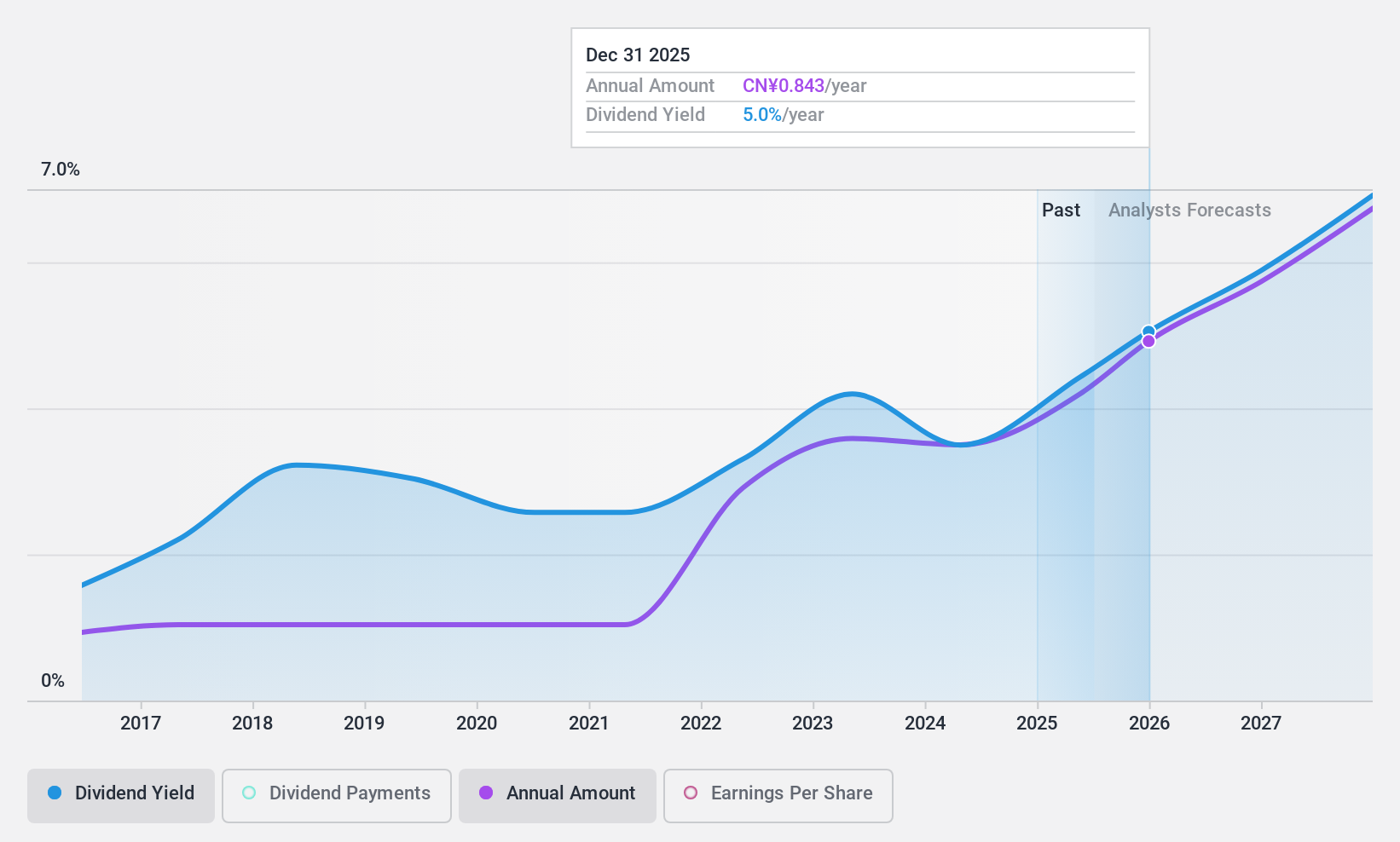

Dividend yield: 3.4%

Beijing Sifang Automation Ltd. offers a dividend yield of 3.39%, putting it in the top 25% of Chinese dividend payers. Although dividends have increased over the past decade, they have been volatile and unreliable at times. The current payout ratio is 75%, suggesting that dividends are covered by earnings. With a cash payout ratio of 39.8%, they are also well covered by cash flows. Recent earnings growth of 19.8% makes the company even more attractive to dividend investors.

Next Steps

Curious about other options?

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Valuation is complex, but we are here to simplify it.

Discover if Beijing Sifang AutomationLtd could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]