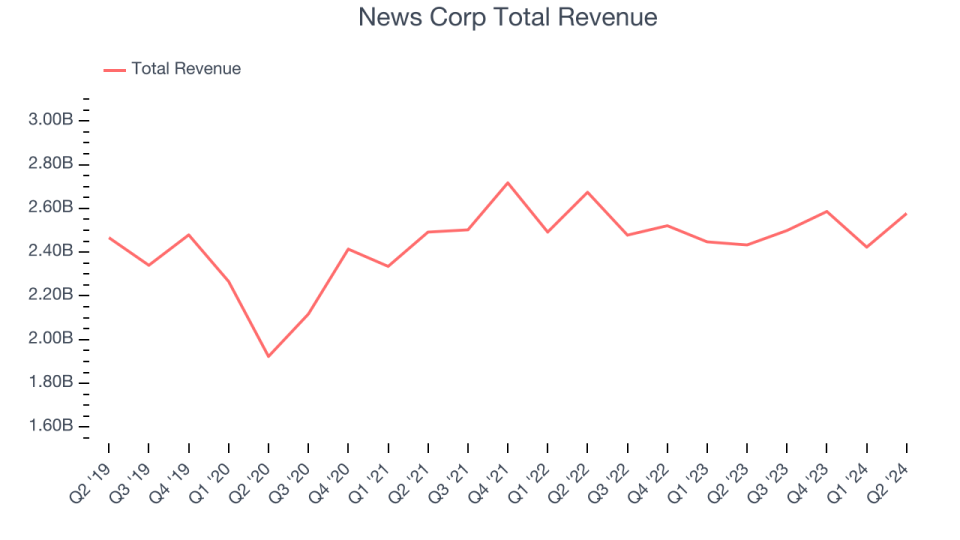

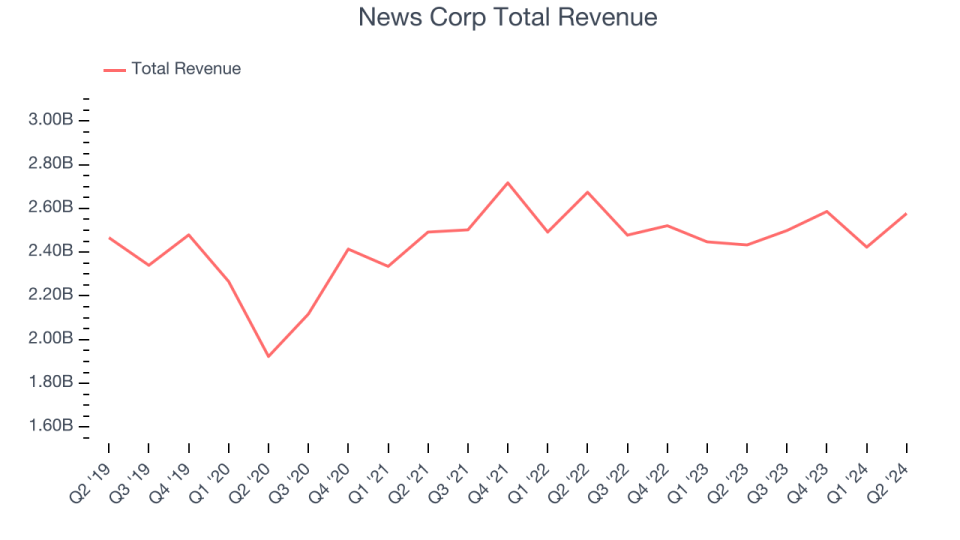

Global media and publishing company News Corp (NASDAQ:NWSA) reported results for the second quarter of calendar year 2024 that beat analysts’ expectations. Revenue rose 5.9% year over year to $2.58 billion. Non-GAAP earnings were $0.17 per share, up from earnings of $0.14 per share in the same quarter last year.

Is now the right time to buy News Corp? Find out in our full research report.

News Corp (NWSA) Q2 CY2024 Highlights:

-

Revenue: $2.58 billion versus analyst estimates of $2.50 billion (up 3%)

-

Earnings per share (non-GAAP): $0.17 versus analyst expectations of $0.17 (in line)

-

Gross margin (GAAP): 149%, compared to 49.7% in the same quarter last year

-

EBITDA margin: 14.9%, corresponding to the same quarter last year

-

Free cash flow of $111 million, a decrease of 75.6% from the previous quarter

-

Market capitalization: 14.99 billion US dollars

Founded in 2013 following a restructuring, News Corp (NASDAQ:NWSA) is a multinational conglomerate known for its news and broadcast publishing, digital media and book publishing operations.

media

The advent of the internet has changed the way shows, movies, music and the general flow of information. As a result, many media companies now face long-term headwinds as attention shifts online. Some have made a concerted effort to adapt by launching digital subscriptions, podcasts and streaming platforms. Time will tell if their strategies are successful and which companies will emerge as long-term winners.

Sales growth

A company’s long-term performance can be an indicator of its business quality. Any company can have one or two good quarters, but many companies that show consistency grow for years. Demand for News Corp has been weak over the past five years as revenues have stagnated, a poor basis for our analysis.

Long-term growth is key, but in the consumer goods sector, product cycles are short and sales can decline due to rapidly changing trends and consumer preferences. News Corp’s recent performance shows that demand has remained suppressed, with sales declining 1.5% annually over the past two years.

We can examine the company’s revenue dynamics even more closely by analyzing its three main segments: Dow Jones, News Media and Book Publishing, which account for 22%, 21.1% and 19.9% of revenue. Over the past two years, News Corp’s Dow Jones (media subsidiary) revenue grew by an average of 5.8% year-on-year, while News Media (general media) and Book Publishing (general publishing) revenues declined by an average of 4.9% and 1.7%, respectively.

This quarter, News Corp reported solid year-over-year revenue growth of 5.9%, beating Wall Street estimates by 3% on revenue of $2.58 billion. For the next 12 months, Wall Street expects revenue growth of 2.8%, a slowdown from this quarter.

Unless you live in isolation, it should be obvious by now that generative AI will have a huge impact on how major companies do business. While Nvidia and AMD are trading near all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock that is benefiting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash is king

If you’ve been following StockStory for a while, you know we value free cash flow. Why, you ask? We believe that in the end, cash is king and you can’t pay your bills with accounting profits.

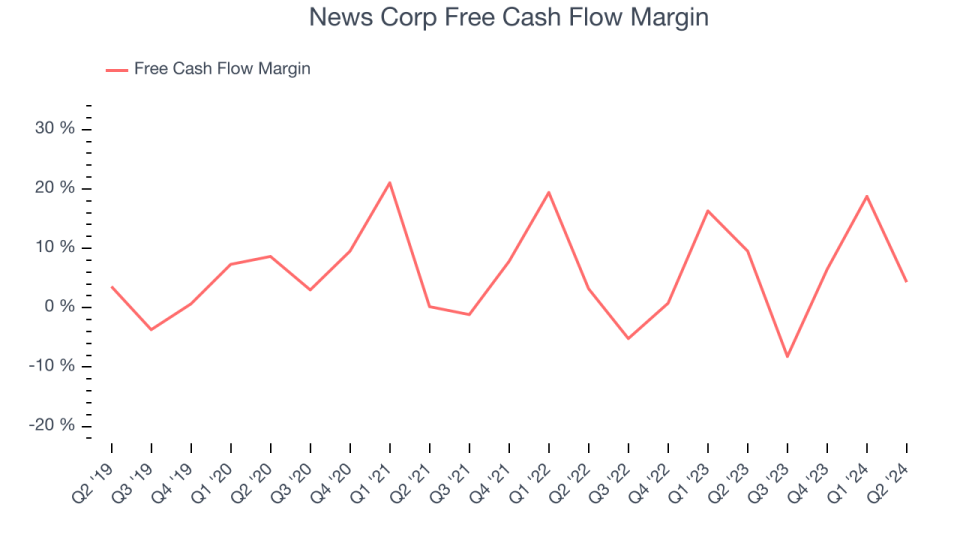

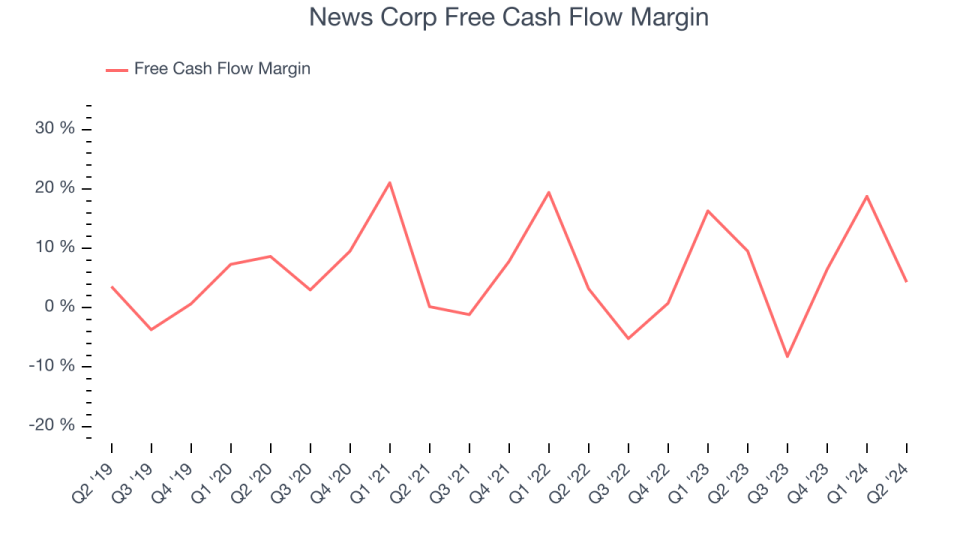

News Corp has demonstrated weak cash profitability over the past two years, giving the company limited opportunities to return capital to shareholders. Free cash flow margins have averaged 5.3 percent, which is below average for a consumer goods company.

News Corp.’s free cash flow in the second quarter was $111 million, representing a margin of 4.3%. The company’s cash profitability declined as it was 5.2 percentage points lower than the same quarter last year, prompting us to take a closer look. Short-term fluctuations aren’t usually a big deal as capital expenditure needs can be seasonal, but we’ll be watching to see if the trend carries over to future quarters.

Analysts forecast News Corp’s cash conversion to improve next year. Their consensus estimates call for free cash flow margin to increase to 8.8% from 5.2% over the past twelve months, giving the company more options.

Key takeaways from News Corp.’s Q2 results

We were pleased to see Alarm.com beat analysts’ revenue expectations this quarter. We were also happy to see its revenue beat Wall Street estimates. Overall, we think this was still a solid quarter with some important upside. Even so, shares traded down 2.4% to $64.04 immediately after the results were released.

News Corp may have had a good quarter, but does that mean you should invest now? When making this decision, it’s important to consider the valuation, business qualities as well as what happened last quarter. We cover that in our actionable full research report, which you can read for free here.