In this story

Another telemedicine company has jumped on the cheap, no-name weight-loss product bandwagon.

Lemonaid Health, a 23andMe ME subsidiary, announced on Wednesday that it will offer an off-brand version of semaglutide, the active ingredient in Novo Nordisk’s NVO Ozempic and Wegovy for only $299 per month.

It joins other online health platforms that offer these cheaper drugs, including the men-focused Rothe Millennial-focused Hims & Hers series HIMS, Costco’s health partner Sesameand Henry Meds – some of which also offer no-name versions of Eli Lilly’s LLY Mounjaro and Zepbound.

All of these digital healthcare providers offer in-demand weight loss treatments for hundreds of dollars less than the list prices of official drugs, which are over $1,000.

And the pharmaceutical industry, with Eli Lilly, is becoming increasingly aware of the issue LLYthis week, reducing the price of some cans of Zepbound by about half of the original price.

Telemedicine relies on weight loss medication

The skyrocketing popularity of weight-loss drugs has been a boon for the telemedicine industry, which has been able to exploit existing drug laws to sell cheap and unofficial weight-loss drugs online. And the strategy appears to be paying off, at least for now.

For him and her HIMSwhich first launched the off-brand version of Wegovy on its platform in May, expects that 2024 will see its first profitable yearpartly due to the weight loss medication.

The company’s shares have risen 65% since the beginning of the year, and in August it raised its full-year revenue forecast to between $1.37 billion and $1.40 billion. The previous forecast was $1.2 billion.

And even though the clock is ticking and companies don’t yet know how long they will be allowed to sell no-name slimming products, the industry seems to be doubling down on its efforts.

In July, Hims & Hers announced that it Kåre Schultz, long-time Novo Nordisk manager, to the Board. Schultz said Bloomberg at the time when the company had a “long future” in the sale of compounded semaglutide.

Compounding is the process of customizing an approved drug by a licensed pharmacist or physician to meet the specific needs of an individual patient.

Normally, the Food, Drug, and Cosmetic Act prohibits the manufacture of drugs that are merely copies of commercially available drugs. However, drugs that are in short supply are not considered commercially available by the Food and Drug Administration (FDA). Wegovy and Zepbound are currently on the FDA’s drug shortage database.

When asked whether pharmacies would be able to continue producing semaglutide drugs once the shortages ended, Schulz said he was not concerned because there would still be cases where patients would need individual prescriptions.

The big pharmaceutical companies react with lower prices

Big pharmaceutical companies didn’t wait long to make a move that could shake up the no-name slimming drug market for telemedicine companies.

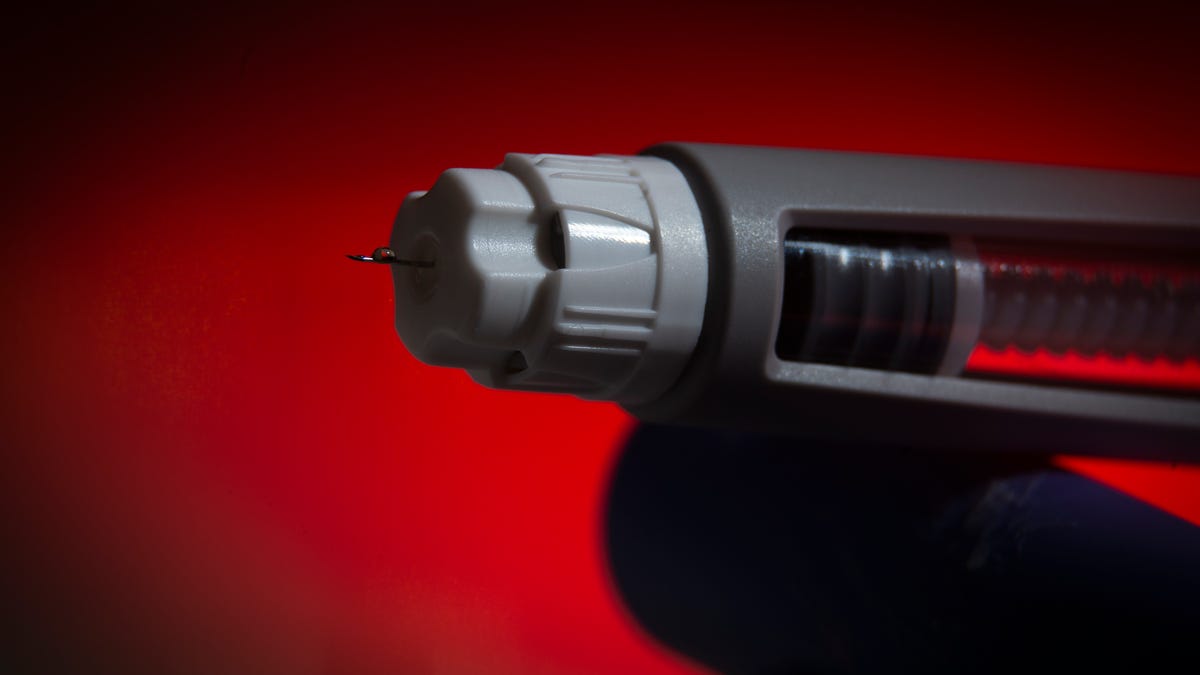

This week Eli Lilly launched a new Single dose vial as option for the lowest doses of Zepbound, giving people an alternative to the common auto-injection pens in which the drug is administered. This move is designed to help keep up with the increasing demand for the treatment. The lower prices also make the drug more competitive against the cheaper alternatives offered by online pharmacies and telemedicine platforms.

A four-week supply of the 2.5 mg Zepbound single-dose vials costs $399, while a four-week supply of the 5 mg dose costs $549. That’s about half of Zepbound’s regular list price of $1,060 and closer to the price of the compounded versions.

City C Analyst Daniel Grosslight called the move “a warning shot” in a note this week.

“We expect supply to take market share away from compounders as patients are likely to choose the branded product over compounded tirzepatide (the active ingredient in Zepbound) because of (1) somewhat more flexible pricing and (2) security of supply,” Grosslight wrote.

Manufacturers of weight-loss drugs are also under government pressure to lower their prices

In addition to growing competition from telemedicine companies, weight loss drug makers Novo Nordisk NVO and Eli Lilly are also under political pressure to lower their prices.

Novo Nordisk CEO Lars Fruergaard Jørgensen agreed testify voluntarily in September before the Senate Health Committee to address the pharmaceutical giant’s high prices for its diabetes and weight loss drugs in the US

In April, the Senate Committee on Health, Education, Labor and Pensions (HELP) launched an investigation into the high prices The company charges money for its blockbuster drugs.

Committee chairman Senator Bernie Sanders said the committee’s investigation found that the net cost of Ozempic in the United States is about $600 per month, well above the drug’s list price in other countries. In Germany, Ozempic costs just $59 for a month’s supply. The net price of Wegovy in the United States is $809, while in the United Kingdom it is available for $92.

Some Wall Street analysts also expect Ozempic to be selected for Medicare price negotiations next year.