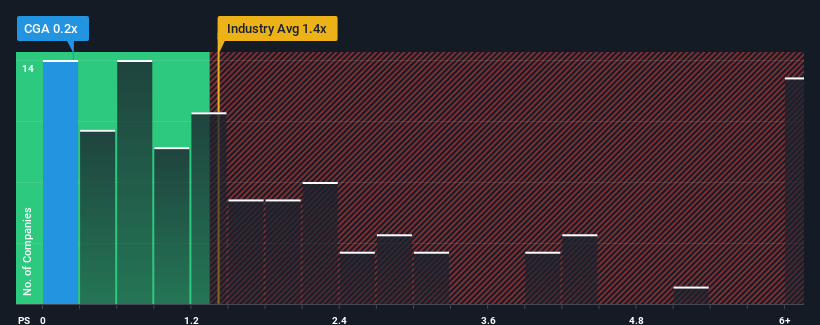

The (NYSE:CGA) price-to-sales (or “P/S”) ratio of 0.2x may seem like a fairly attractive investment opportunity considering that nearly half of the chemicals industry companies in the United States have a P/S ratio above 1.4x. However, the P/S might be low for a reason and further research is needed to determine if it is justified.

Read our latest analysis on China Green Agriculture

What does China Green Agriculture’s P/S mean for shareholders?

For example, China Green Agriculture’s recent declining sales should give cause for concern. Perhaps the market believes that the recent sales performance is not good enough to sustain the industry, hurting the P/S ratio. Those betting on China Green Agriculture will hope that this is not the case so they can buy the stock at a lower price.

We don’t have analyst forecasts, but you can see how recent trends are positioning the company for the future by checking out our free China Green Agriculture earnings, revenue and cash flow report.

Do the sales forecasts match the low P/S ratio?

A P/S ratio as low as China Green Agriculture’s would only be truly comfortable if the company’s growth lagged behind that of the industry.

First, if we look back, the company’s revenue growth last year wasn’t exactly exciting as it posted a disappointing 25% decline. This means that there has been a decline in revenue in the long run as well, as revenue has declined by a total of 46% over the last three years. So, unfortunately, we have to admit that the company hasn’t done a great job of increasing revenue during this time.

If you compare this medium-term sales development with the one-year forecast for the entire industry, which assumes growth of 3.7 percent, this is not a good prospect.

With this in mind, we understand why China Green Agriculture’s P/S ratio is lower than most of its peers in the industry. However, we believe that declining revenues are unlikely to result in a stable P/S ratio over the long term, which could disappoint shareholders in the future. There is a possibility that the P/S ratio could fall even further if the company fails to improve its revenue growth.

The last word

We usually caution against reading too much into the price-to-sales ratio when making investment decisions, even though it can say a lot about what other market participants think about the company.

Our research into China Green Agriculture confirms that the company’s declining revenues over the medium term are a key factor in its low price-to-sales ratio, given that the industry is forecast to grow. At this point, investors believe that the potential for revenue growth is not large enough to justify a higher price-to-sales ratio. Under these circumstances, if recent medium-term revenue trends continue, it is difficult to imagine the share price moving much in one direction or the other in the near future.

Before you take the next step, you should know about the Three warning signals for China’s green agriculture that we uncovered.

If you are looking for companies with solid earnings growth in the pastyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.