David Iben put it well when he said, “Volatility is not a risk we care about. What we care about is avoiding permanent loss of capital.” It is only natural to consider a company’s balance sheet when examining how risky it is, because when a company collapses, debt is often involved. What is important is Tangshan Jidong Cement Co., Ltd. (SZSE:000401) is in debt. The real question, however, is whether this debt makes the company a risk.

Why is debt risky?

Debt and other liabilities become risky for a company when it cannot easily meet those obligations, either through free cash flow or by raising capital at an attractive price. A key part of capitalism is the process of “creative destruction,” in which failed companies are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that the company must raise new equity at a low price, permanently diluting shareholders’ interest. By replacing dilution, however, debt can be an extremely good tool for companies that need capital to invest in growth with high returns. When we think about a company’s use of debt, we first consider cash and debt together.

Check out our latest analysis for Tangshan Jidong CementLtd

How much debt does Tangshan Jidong Cement Ltd. have?

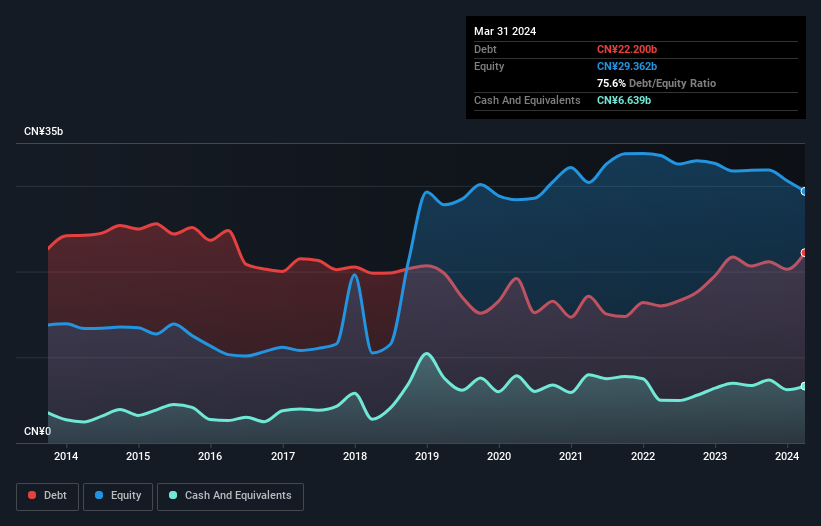

The chart below, which you can click on for more details, shows that Tangshan Jidong Cement Ltd had CNY22.2 billion in debt at March 2024, roughly the same as a year earlier. However, this compares with CNY6.64 billion in cash, resulting in net debt of about CNY15.6 billion.

How healthy is the balance sheet of Tangshan Jidong Cement Ltd.?

According to the latest balance sheet data, Tangshan Jidong Cement Ltd. has CNY 15.0 billion in liabilities due within one year and CNY 15.7 billion in accounts payable due thereafter. On the other hand, the company had CNY 6.64 billion in cash and CNY 3.16 billion in receivables due within one year. So, total liabilities are CNY 20.9 billion more than cash and short-term receivables combined.

This deficit is weighing so heavily on the CNY11.4 billion company itself that it would be like a child struggling under the weight of a huge backpack full of books, its sports equipment, and a trumpet. So we would no doubt keep a close eye on its balance sheet. Ultimately, Tangshan Jidong Cement Ltd. would likely need to undertake a large recapitalization if its creditors demanded repayment. When analyzing debt levels, the balance sheet is the obvious place to start. But ultimately, the company’s future profitability will determine whether Tangshan Jidong Cement Ltd. can strengthen its balance sheet over time. So if you’re focused on the future, you might want to look at free Report with analysts’ profit forecasts.

Last year, Tangshan Jidong Cement Ltd. posted a loss before interest and taxes and saw its revenues shrink by 24% to 26 billion Chinese yen. This makes us nervous, to say the least.

Reservation by the buyer

Not only has Tangshan Jidong Cement Ltd.’s revenue declined over the last twelve months, but the company has also posted negative earnings before interest and tax (EBIT). The EBIT loss was a whopping CN¥1.8 billion. When we consider that along with the significant liabilities, we are not particularly confident about the company. We would like to see some strong near-term improvements before getting too interested in the stock. It’s fair to say that the CN¥1.8 billion loss didn’t encourage us either; we would like to see a profit. In the meantime, we think the stock is risky. The balance sheet is clearly the area to focus on when analyzing debt. However, not all investment risk lies in the balance sheet – quite the opposite. To that end, you should be aware of the following points: 1 warning sign we discovered Tangshan Jidong Cement Ltd.

If you are interested in investing in companies that can grow profits without the burden of debt, check this out free List of growing companies that have net cash on their balance sheet.

Valuation is complex, but we are here to simplify it.

Discover whether Tangshan Jidong CementLtd could be under- or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.