Ideally, your overall portfolio should outperform the market average. But even the best stock picker will only win with some Selection. At this point, some shareholders may suspend their investment in International Consolidated Airlines Group SA (LON:IAG) as the share price has fallen 59% over the past five years.

While the stock is up 3.3% in the past week, long-term shareholders are still in the red, so let’s see what the fundamentals tell us.

Check out our latest analysis for International Consolidated Airlines Group

While the efficient markets hypothesis is still taught by some, it is well established that markets are over-reactive dynamic systems and investors do not always act rationally. By comparing earnings per share (EPS) and share price changes over time, we can get a sense of how investor attitudes toward a company have changed over time.

During its five-year share price increase, International Consolidated Airlines Group managed to turn the company from losses to profitability. Most would see this as a positive, so it is counterintuitive to see the share price falling. Other metrics may better explain the price movement.

Unlike the share price, revenue has actually grown 11% per year over this five-year period. So it seems that one needs to look more closely at the fundamentals to understand why the share price is weakening. After all, there could be an opportunity here.

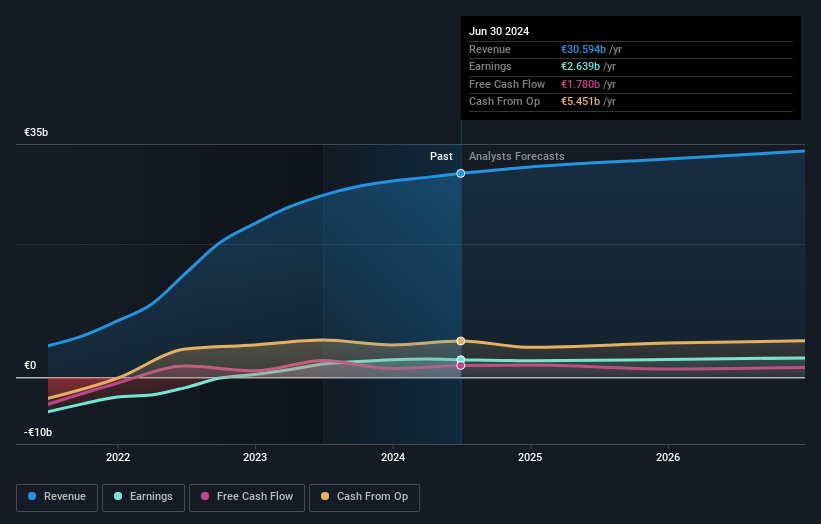

You can see below how earnings and sales have developed over time (you can find out the exact values by clicking on the image).

International Consolidated Airlines Group is a well-known stock with a lot of analyst coverage, which suggests some visibility into future growth, so we recommend checking it out free Report with consensus forecasts

What about dividends?

When considering investment returns, the difference must be taken into account between Total return for shareholders (TSR) and Share price return. While the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. One could argue that the TSR gives a more comprehensive picture of the return generated by a stock. In fact, International Consolidated Airlines Group’s TSR over the last 5 years was -36%, which exceeds the share price return mentioned earlier. And there’s no prize for guessing that the dividend payments largely explain the divergence!

A different perspective

International Consolidated Airlines Group shareholders are up 9.9% for the year (even including dividends). But that was below the market average. On the positive side, it’s still a gain, and it’s certainly better than the annual loss of around 6% we’ve suffered over half a decade. So this could be a sign that the company has turned its fortunes around. I find it very interesting to look at the share price as an indicator of company performance over the long term. But to really gain insight, we need to consider other information as well. Consider, for example, the ever-present specter of investment risk. We have identified 2 warning signs with International Consolidated Airlines Group (at least 1, which makes us a little uncomfortable), and understanding them should be part of your investment process.

If you would rather check out another company — one with potentially better financials — then don’t miss this free List of companies that have proven their ability to increase their earnings.

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on UK exchanges.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.