Today is negative for DATRON-AG (ETR:DAR) shareholders, with the analyst providing a significant negative revision to this year’s forecasts. Both revenue and earnings per share (EPS) estimates were significantly reduced as the analyst considered the latest business outlook and concluded that they were previously too optimistic. Shares are up 5.1% to €8.25 over the past week. We’ll be curious to see if the downgrade is enough to change investor sentiment towards the company.

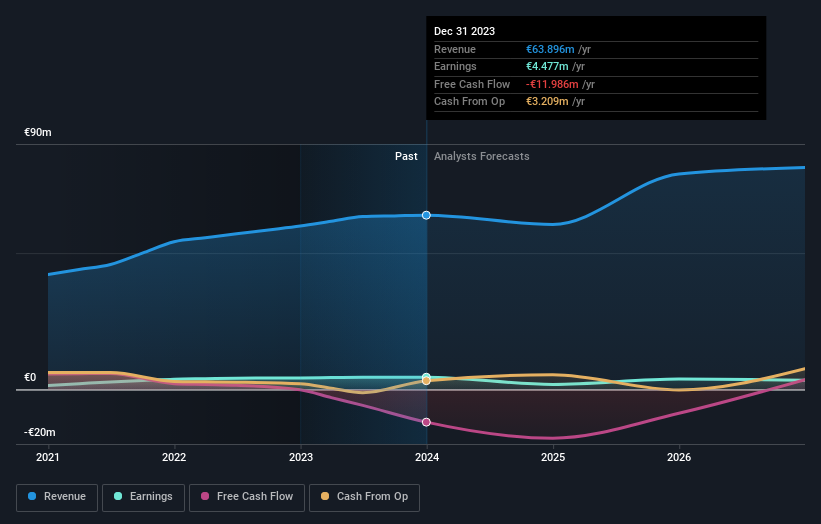

Following the downgrade, an analyst covering DATRON is now in consensus for revenues of €61 million in 2024, representing a measurable 5.3% decline in sales compared to the last 12 months. Statutory earnings per share are expected to fall 59% to €0.46 over the same period. Prior to this update, the analyst had been forecasting revenues of €68 million and earnings per share (EPS) of €0.90 in 2024. It looks like analyst sentiment has deteriorated considerably, with a significant decline in revenue estimates and a fairly sharp decline in earnings per share numbers.

Check out our latest analysis for DATRON

The consensus price target fell 11% to €15.91, with weaker earnings prospects significantly exceeding analysts’ valuation estimates.

Now, looking at the bigger picture, one of the ways we can understand these forecasts is to evaluate them against both past performance and industry growth estimates. We’d like to highlight that we expect a reversal in revenues, with revenues forecast to decline 5.3% on an annualized basis by the end of 2024. This is a notable change from the historical growth of 4.1% over the past five years. Compare this to our data, which suggests other companies in the same industry are expected to grow revenues by 4.5% per year overall. So while revenues are forecast to decline, there is no silver lining to this cloud – DATRON is expected to underperform the wider industry.

The conclusion

The biggest issue with the new estimates is that the analyst has lowered their earnings per share estimates, suggesting that DATRON is facing business difficulties ahead. Unfortunately, they have also lowered their revenue estimates, and the latest forecasts suggest that the company’s revenue growth will be slower than the wider market. Given a significant cut to this year’s expectations and a declining price target, we wouldn’t be surprised if investors became cautious on DATRON.

As you can see, the analyst is clearly not optimistic, and there could be good reasons for that. We’ve identified some potential issues with DATRON’s financials, such as concerns about the quality of earnings. Click here to discover this and another issue we’ve identified.

Another way to search for interesting companies that reach a turning point is to track whether management is buying or selling, with our free List of growing companies supported by insiders.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.