Delta Airlines Company Overview

Zacks Rank 5 (Strong Sell) Stock Delta Air Lines ((DAL – Free report) ) is known for its travel services for passengers and cargo. Delta, the second largest U.S. airline, connects customers to destinations in the United States and around the world. The company operates a hub-and-spoke system with hubs in cities such as Atlanta and New York. Delta offers a range of seating options and amenities through its SkyTeam alliance partnerships. The airline is also known for its SkyMiles Delta customer rewards program.

The inherent unpredictability of airline stocks

Warren Buffett, the most successful value investor of all time, once joked: “The worst business is the one that grows fast, requires a lot of capital to grow, and then makes little or no money.”

When the COVID-19 pandemic reared its ugly head in 2020, Buffett was forced to panic sell $10 billion worth of Delta shares. American Airlines ((EEL – Free report) ) United Airlines ((UAL – Free report) ), And Southwest Airlines ((LOVE – Free report) ) stocks. Although Buffett made the mistake of buying airlines in 2016, like any great investor, he learned from his mistake, limited his losses, licked his wounds, and moved on.

Below are five reasons why the aviation industry is more unpredictable than ever.

1. High fuel costs are pessimistic for Delta

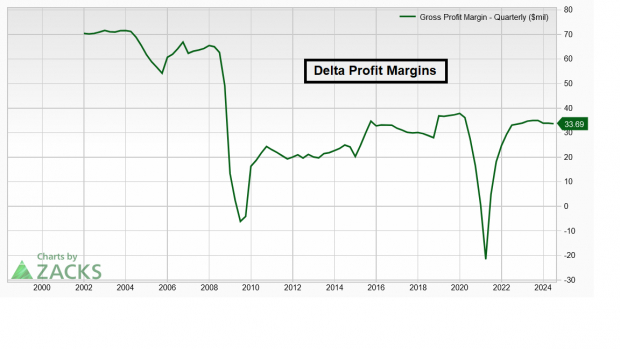

OPEC’s ongoing production cuts have led to high fuel costs. Since fuel costs are a major factor for Delta, the company has seen its margins shrink as energy prices have risen.

Image source: Zacks Investment Research

2. Geopolitical tensions are damaging the aviation industry

If the world war escalates further, the increasing geopolitical tensions in Europe and the Middle East pose a major threat to the travel industry.

3. Delta suffers from price war with low-cost airlines

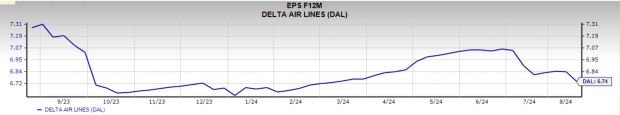

Weak pricing power is hurting Delta’s earnings per share. Low-cost airlines like Spirit Airlines ((SAVE – Free report) ) currently have too many seats available, forcing them to lower fares and take business away from larger airlines like Delta.

Image source: Zacks Investment Research

4. Rising costs without energy

In addition to rising fuel costs, DAL is also being weighed down by rising non-energy costs. For example, salaries and related costs rose 12%. While rising salaries are not bearish in and of themselves, I view them as a negative if the stock continues to perform as it has done so far.

5. Unknown: IT failure, Boeing problems

The global IT outage is caused by CrowdStrike ((CRWD – Free report) ) had a dramatic impact on Delta and resulted in the cancellation of thousands of flights. Another unforeseen problem is that Delta has several Boeing ((BA – Free report) ) aircraft in its fleet. Boeing aircraft have been plagued by a number of mechanical and safety issues in recent years.

Continuation of the Delta Bear thesis:

Weak technical picture

Delta is showing some troubling relative weakness. The stock is flat on the year while the S&P 500 is up nearly 18%. Worse still, DAL’s chart shows a bear flag pattern forming on the daily chart.

Image source: TradingView

Negative ESP score

Zacks internal research shows that a stock that has a negative Earnings Surprise Prediction (ESP) Score combined with a Zacks Rank of 3 or worse, as is the case with Delta, tends to underperform over the next year.

Weak consumer

Strength in credit stocks such as upstart ((UPST – Free report) ) shows that the average US consumer is weak.

Conclusion

The airline industry is notoriously unpredictable. Rising fuel costs and fierce competition mean that Delta shares tend to be avoided.