Chinese equities have proven resilient despite weaker than expected economic activity. The Shanghai Composite Index rose 0.6% and the blue-chip CSI 300 index gained 0.42%. In this environment, dividend stocks can provide a stable source of income and potential for value appreciation. When reviewing dividend stocks in China, it is important to look for companies with strong fundamentals and consistent payout history.

The 10 largest dividend stocks in China

| name | Dividend yield | Dividend valuation |

| Midea Group (SZSE:000333) | 4.86% | ★★★★★★ |

| Wuliangye Yibin Ltd (SZSE:000858) | 3.74% | ★★★★★★ |

| Kweichow Moutai (SHSE:600519) | 3.49% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.10% | ★★★★★★ |

| Huangshan Novel Ltd (SZSE:002014) | 6.05% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.20% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.75% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 5.32% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.85% | ★★★★★★ |

| Zhejiang Jiaxin Silk Ltd (SZSE:002404) | 5.63% | ★★★★★★ |

Click here to see the full list of 266 stocks from our Top China Dividend Stocks screener.

Let’s take a closer look at some of our favorites among the companies we reviewed.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Publishing & Media Co., Ltd. is engaged in publishing, distribution and printing in China and has a market capitalization of CNY 19.13 billion.

Operations: Zhejiang Publishing & Media Co., Ltd. derives revenue from its publishing, distribution and printing activities in China.

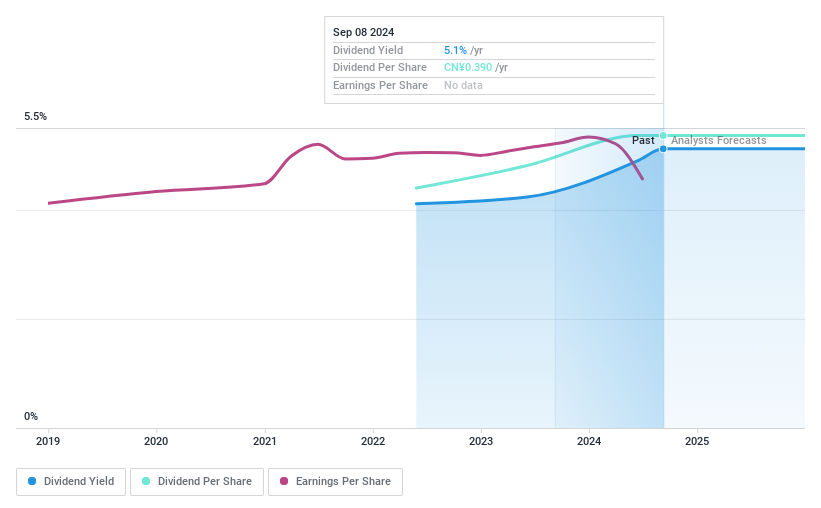

Dividend yield: 4.5%

Zhejiang Publishing & Media offers a compelling dividend profile with a yield of 4.53%, putting it in the top 25% of dividend payers in China. The company’s dividends are well covered by earnings (58.8%) and cash flows (74.8%) despite a relatively short two-year track record. Although the company trades 15.8% below estimated fair value, earnings are forecast to decline by an average of 7.1% per year over the next three years, potentially impacting future dividends.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teyi Pharmaceutical Group Co., Ltd specializes in the research, development, production and sale of Chinese patent drugs, pharmaceutical preparations, raw materials and products in China and has a market capitalization of 4.29 billion Chinese yen.

Operations: Teyi Pharmaceutical Group Co., Ltd generates revenue in the People’s Republic of China from Chinese patent drugs, pharmaceutical preparations and raw materials.

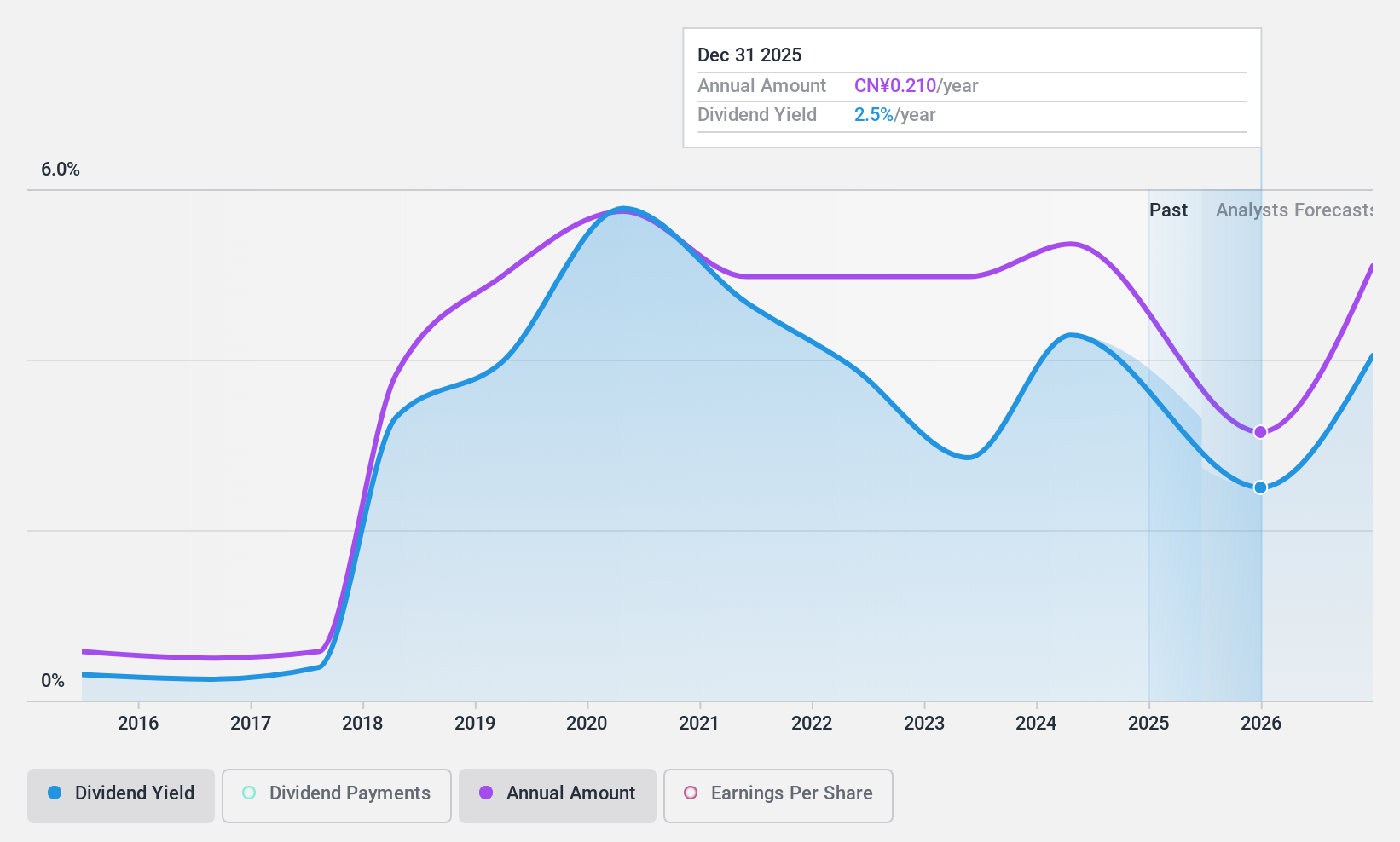

Dividend yield: 4.2%

Teyi Pharmaceutical Group’s latest earnings report shows a significant decline, with half-year revenue coming in at CNY313.75 million and net profit coming in at CNY2.69 million, compared to CNY538.38 million and CNY152.13 million respectively last year. Despite a stable dividend history over the past decade, the current dividend yield of 4.25% is not well covered by earnings or free cash flow, raising sustainability concerns given ongoing share buybacks totaling CNY4.15 million, recently completed in July 2024.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HangZhou Everfine Photo-e-info Co., Ltd. offers a range of products including photoelectric, biometric, infrared, UV, EMC and DNA diagnostic technologies in China and has a market capitalization of CNY 2.50 billion.

Operations: HangZhou Everfine Photo-e-info Co., Ltd. generates revenue in the Chinese market through its diverse product offerings in the areas of photoelectric, biometric, infrared, UV, EMC and DNA diagnostic technologies.

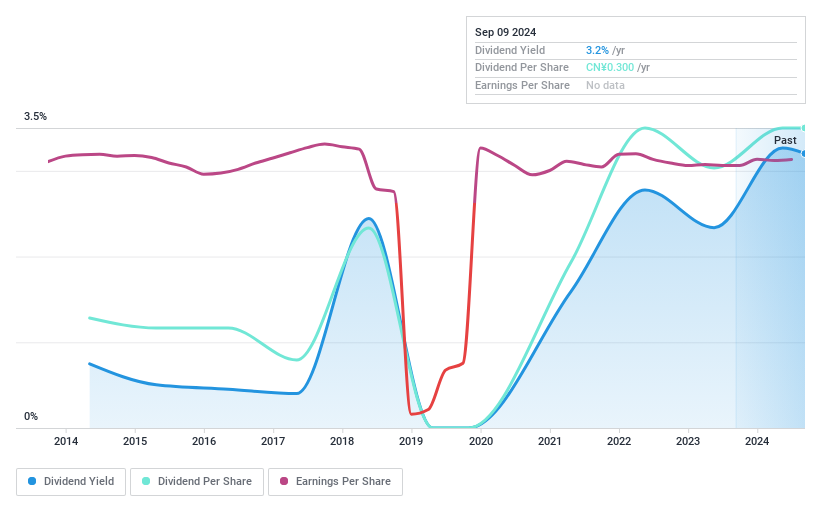

Dividend yield: 3.2%

Trading 48.4% below its estimated fair value, HangZhou Everfine Photo-e-info has managed to grow earnings by 8.9% over the past year. Despite a volatile share price and an unstable dividend history with significant annual declines, the current payout ratio of 88.2% ensures that dividends are covered by earnings and cash flows (56.7%). The dividend yield of 3.23%, which is in the top quarter of CN market payers, is quite attractive despite the historical unreliability and volatility of payments over the past decade.

Summarize everything

- Discover even more treasures! Our best Chinese dividend stocks screener has discovered 263 more companies for you. Click here to see our expert-curated list of the 266 best Chinese dividend stocks.

- Have you already invested in these stocks? Stay up to date with all the developments by setting up a portfolio with Simply Wall St. We make it easy for investors like you to stay informed and proactive.

- Join a community of smart investors with Simply Wall St. The app is free and offers expert analysis of global markets.

Ready for a different approach?

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Valuation is complex, but we are here to simplify it.

Discover whether Teyi Pharmaceutical GroupLtd could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]

:max_bytes(150000):strip_icc()/alicia-silverstone-082024-ba8582aa974b475b804697017304900f.jpg)