Summary

- Ryanair’s withdrawal from Bordeaux and the cancellation of flights to Warsaw demonstrate its power over smaller airports.

- Some airports are heavily dependent on airlines and are therefore vulnerable to fee negotiations and flight cuts.

- Rising costs and regulations could herald the end of low-cost airlines in Europe.

Ryanair recently announced that it would completely cancel flights from Bordeaux-Mérignac Airport (BOD) and halve the number of flights at Warsaw’s secondary airport, Modlin Airport (WMI). This will impact the operations of airports, which depend to varying degrees on the low-cost carrier.

This reflects a phenomenon in Europe where low-cost airlines, and Ryanair in particular, have a stranglehold on smaller airports in terms of airport fees and other demands. Simple Flying spoke to Wouter Dewulf, professor of air transport management at the University of Antwerp, and Marcin Walkow, aviation journalist at the Polish financial portal money.pl, examine the dynamics of this influence in the face of these cuts both in Warsaw and elsewhere..

Complete exit from Bordeaux in November

In May, Ryanair announced it would leave BOD altogether after the two parties failed to reach an agreement on airport fees. Bordeaux, which planned to increase fees from November 2024, will lose three aircraft based at Ryanair and 90 jobs among pilots and cabin crew. Ryanair’s withdrawal represents a loss of investment of $300 million, the airline argues. The airline’s commercial director, Jason McGuinness, spoke about the closure of its base in BOD.

“We are disappointed that Bordeaux Airport has not agreed to expand our low-cost base from November 2024. Due to rising costs, we have no financial alternative but to close our Bordeaux base in November and relocate these aircraft and jobs to cheaper bases elsewhere in the Ryanair Group’s vast airport network across Europe.”

Related

Ryanair closes base at Bordeaux airport for cost reasons and opens second maintenance hangar in Lithuania

While one airport lost a base, another gained more jobs and routes.

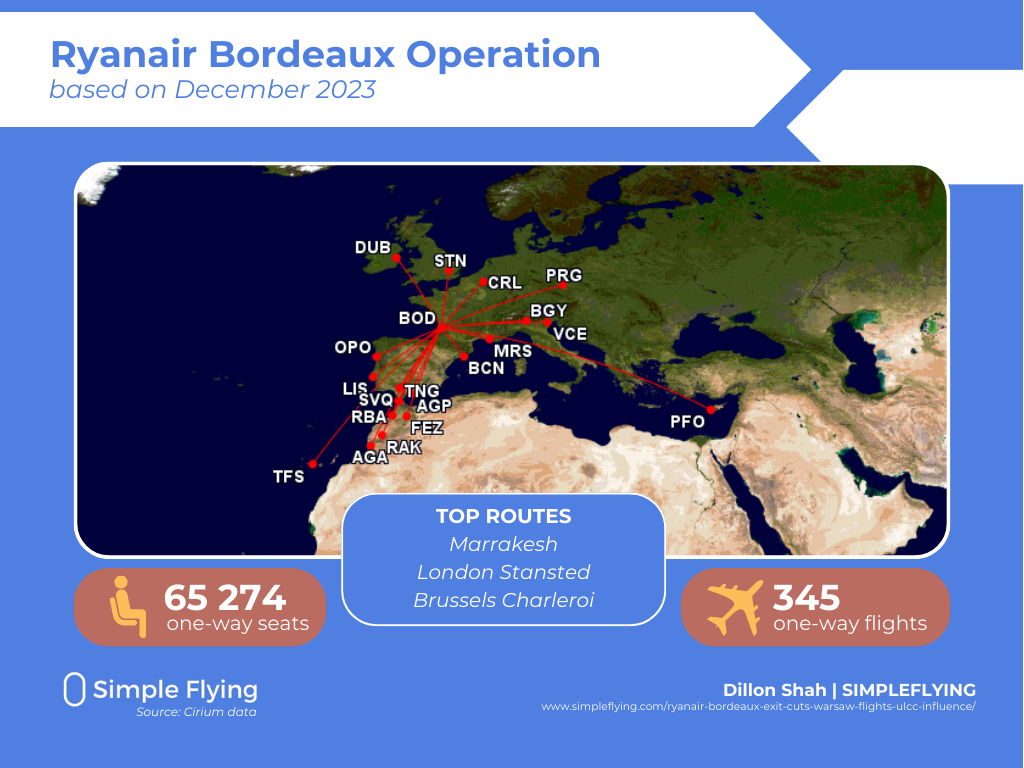

When Ryanair closes a base at a particular airport, it often continues to fly to it with aircraft based elsewhere in Europe. However, Bordeaux will leave the Ryanair network entirely, according to aviation data and analytics company Cirium. The infographic below shows the airline’s BOD network, flights and seats in December 2023 for comparison.

Photo: Dillon Shah | Easy Flying

Frustration over Warsaw-Modlin

Earlier this week, Ryanair took a swipe at WMI, which is mainly served by the airline and other budget carriers. The airline announced it would reduce the airport’s capacity by 50% from this winter and remove one aircraft from the airport. The move will cut 50 jobs and again follows a dispute over airport charges, which WMI will address.

Ryanair will continue its operations as usual from Warsaw’s main airport, Chopin Airport (WAW), offering six routes during the coming winter season.

Photo: Ceri Breeze | Shutterstock

How realistic is a complete withdrawal of Ryanair from WMI? We asked Walkow this question.

“I don’t think Ryanair will abandon Warsaw Modlin Airport altogether. Maybe in a really small airport with 50 or 100,000 passengers it can afford to take its toys to another sandbox. But three million passengers a year? Ryanair has a dominant position in Modlin.

(The main) Chopin Airport is to be expanded, not with a view to Ryanair, but to create more opportunities for the development of transit traffic for LOT Polish Airlines. This is to be an intermediate step before the transfer of commercial traffic to the Central Airport (CPK) in Baranów, planned for around 2032.”

He explains that a ten-year contract with Ryanair limited WMI’s ability to adjust prices and attract other airlines, “dependent on a carrier.”

“Anyone who wants to fly to Modlin today has to reckon with much lower traffic volumes and consequently much higher airport fees (which fall as the number of passengers checked in there increases). This gives Ryanair a cost advantage.”

Cirium data shows that Ryanair offered a total of 224 return flights to 15 destinations in January this year. In November this year, only 116 return flights are offered to 8 destinations.

Trust in Ryanair

Some airports, usually smaller ones, are now almost entirely dependent on Ryanair or other low-cost airlines. There are three reasons for this: connectivity, employment and reputation. Dewulf explains:

“Airports like this are very often owned by local governments and they really want to use that to create connectivity, create jobs and promote the region. If you look at Brussels-Charleroi (Belgium, CRL), this was clearly about jobs. If you look at Carcassonne (France, CCF), this is clearly about developing the local economy. You can see that property prices in Carcassonne have increased significantly because of the tourists.

Photo: Jake Hardiman | Easy Flying

Ryanair is a very strong negotiator. They see what they pay in Charleroi: they pay almost nothing, but they create several thousand jobs. And the airport gets some money from non-aeronautical revenues such as parking fees and commissions on food and drinks. In the end, everyone is happy. The only problem is that once this symbiosis is established, it’s like a coward’s game and Ryanair threatens to turn off the money tap to put pressure on them. Who will give in first, and that leads to a delicate situation.”

The business model allows Ryanair to essentially dictate smaller airports and their fees. This all-important situation means that many airports are making losses. According to The Connexion, several French airports, including Béziers-Cap d’Agde, Nîmes, La Rochelle, Tarbes, Quimper and Perpignan, are being criticised by France for relying on loss-making contracts with Ryanair.

Walkow says:

“Low-cost airlines like Ryanair and Wizz Air know that they are the ones who decide on the existence of smaller airports. The regular airlines only offer simple feeder connections to their hubs from there, if at all. If there is anyone who should build a route network there, it is the low-cost airlines. That is why Ryanair is trying to make as much money as possible. Because they know that every cent, multiplied by millions of passengers, counts heavily.”

Larger airports are less vulnerable to Ryanair’s influence. Bordeaux, for example, has announced that it expects a 25% drop in passenger numbers with Ryanair’s departure. Cyrielle Clément, the airline’s head of route development at Bordeaux-Mérignac, told The Connexion:

“We had been planning to increase fees for some time and had envisaged a number of scenarios. A complete withdrawal of Ryanair was the worst case scenario, but not entirely unexpected given the nature of the company.

It might take some time to make up for the loss. We expect two to three years of less traffic. But we see this as an opportunity to expand with other airlines, which is our long-term goal.”

Photo: Lukas Souza | Simple Flying

Is this the end of ultra-low-cost airlines in Europe?

The dynamics of the low-cost airline market in the US have changed. Poor financial results recently have led some to believe that the end of the low-cost airline in the US is near. Scott Kirby, CEO of United Airlines, said last year when releasing third-quarter results:

“(…) the airlines with the lowest margins are the so-called low-cost carriers, and that’s where I think the changes will happen. As a result, United will emerge in a structurally stronger and sustainable position.”

Related

CEO of United Airlines criticizes low-cost airline for “fundamental deficiencies”

Scott Kirby is convinced that low-cost airlines will go out of business.

A report by Business Traveler USA confirmed this assessment, finding that significant cost increases had had a serious impact on the overall financial situation.

Ryanair also suffered losses in the first quarter. Profits fell by 46 percent and CEO Michael O’Leary announced that passengers were no longer willing to pay higher last-minute fares, which make up a significant portion of revenue. With fixed costs rising and environmental regulations tightening in Europe, Dewulf wonders whether this could also mean the beginning of the end for low-cost airlines in Europe.

“I think the biggest problem for Ryanair is the fact that all their operational costs such as fuel, maintenance, ATC, pilot salaries, etc. are increasing at least at the same pace as full-service airlines. In addition, all the operational low-cost advantages such as more seats on an aircraft and short turnaround times are already visible in their CASK (Cost per Available Seat Kilometre).

The problem is, if you’re a low-cost carrier and you add in fixed costs like the impact of ETS and SAF requirements, it has a proportionally greater impact on them than it does on full-service airlines. That’s why they’re so focused on their costs at the airports, because that’s one of the few things they can still influence.”

In other words, if a regulation requires a $25 surcharge on a plane ticket that already costs $150, the increase is less severe than if the fee is levied on a $15 ticket on an airline like Ryanair.

“So when you look at the costs that they can affect, there’s not much left, apart from airport and ground handling fees. That’s why they are like that.

aggressive

‘ when they talk to airports.”