Both models are becoming increasingly popular – but which is right for your company? That depends on the business needs and the phase of the startup.

More and more large corporations are interested in cooperation with startups. But how can this best be achieved?

In recent years, two different approaches have gained popularity: investing in a startup and then collaborating with it on projects, or simply collaborating without equity participation, an approach known as “venture clienting.”

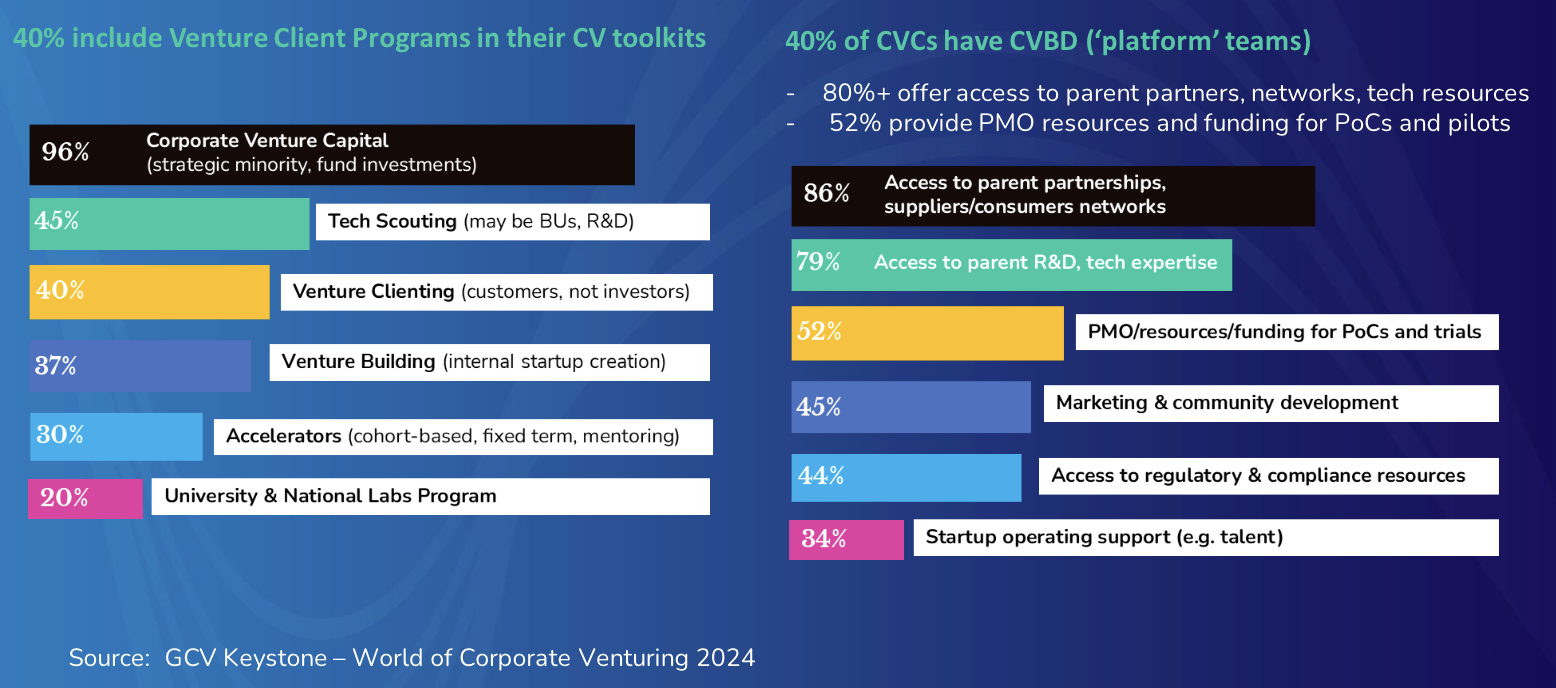

Firms that have made VC-style equity investments in startups are increasingly placing importance on those portfolio companies entering into some sort of working relationship with the company. According to data from the recent GCV Keystone survey, around 40% of corporate venture units now have an integrated professional business development or platform team that drives startup-corporate partnerships.

Inga Grieger, for example, is one of a growing number of business development managers being hired by corporate venture units, in her case BMW i Ventures. The position was created by BMW i Ventures about three years ago after it was discovered that companies in its investment portfolio were not making the most of opportunities to collaborate with the carmaker.

“What I’ve learned in these three years is that it’s a challenge to find the right people, the right needs and the right timing (at BMW). The models and processes in the mobility industry can be very complex,” says Grieger. This can be a challenge for startups. “That’s why we stay with our portfolio companies longer and knock on many doors in the company to find the right partner.”

At the same time, many large companies have developed “venture clienting” units where they can quickly form partnerships with a number of small startups without investing in them. This is somewhat different from a normal supplier relationship – with younger startups, different, less rigorous procurement processes are often required, and the collaboration is more experimental.

Siemens Energy Ventures already had a corporate venturing team when it was spun out of Siemens as a standalone energy-focused company, but shortly thereafter, in 2021, the group added a venture clienting function led by Eva Harasewycz to respond to slightly different times of innovation needs.

Led by Amy Burr, JetBlue Ventures manages CVC activities and venture clientele under one roof from the start.

Although the two collaboration models sound similar on the surface, in practice there is surprisingly little overlap, says Burr. They are two tools for very different situations.

“We have done proof of concept with 50 companies and invested in 55, and there is not much overlap between the two areas,” she says.

Grieger, Harasewycz and Burr participated in our recent webinar Collaboration with startups: CVC platforms or venture client programs to explain how these tools differ. These are some of the key points from the talk:

1. Venture client units enable companies to explore more technologies

The venture clienting practice at Siemens Energy Ventures only started in 2021, but Harasewycz says it has already managed more than 78 pilot projects between startups and the parent company. About 40% of those projects resulted in Siemens acquiring the technology or deepening the partnership. Harasewycz estimates that the program has generated about $80 million in financial impact for the company.

This has been one of the key selling points for venture client deals. As Gregor Gimmy, founder of 27Pilots and one of the “godfathers” of the venture client movement, explained to GCV back in 2022, CVC units only invest in a handful of startups each year, but with a venture client approach, a company can explore ten times as much new technology.

2. But investing in startups is still valuable

Why invest in startups at all when you can work with hundreds of startups through venture clienting without having to provide capital? This is a question CVC teams are often asked, but Burr has an answer:

“We invest so we have a voice, and we invest in early-stage startups so we can help them build a product that actually works for the industry and for us. We benefit greatly from working very closely with a startup that we’ve also invested in. They build things for us, and we get a first-mover advantage,” she says.

“We never tell a startup that they can’t work with other clients in the travel industry. There’s definitely no exclusivity, but because we’re part of the conversation, we can influence how it’s developed, and that helps us.”

3. Venture clienting is more of a pull – CVC investments are a push

Venture client and CVC platform development are being used in very different ways to meet very different corporate needs. “It’s a push versus a pull,” says Burr.

The venture client – what Burr calls the “operations” team – works closely with the business units to identify a need that needs to be solved and then goes looking for startups that fit the bill.

According to Harasewycz, the starting point for venture clienting at Siemens Energy Ventures is also close coordination with the business unit. “We generally carry out larger market analyses in order to strategically align ourselves with trends. But for each use case we have a dedicated person (who works with the business unit).” This scout, says Harasewycz, “must find out what the person in the company actually needs.”

In the meantime, Burr said, JetBlue’s investment team will “scan the entire travel technology horizon and find interesting things that they think are coming to market next” and then propose them to the company.

Both enable the company to ensure that it solves immediate problems while not being caught off guard by the introduction of disruptive new technologies.

4. CVC investors and venture client teams look for different companies

The Venture Client team generally looks for more mature startups – they must already have a product and preferably one or two customers.

“We have looked at thousands of startups on my team so far. And what is really a success criteria for startups to work with us is a certain level where there is a product that maybe one or two customers have already tested. Otherwise, it will take longer to be successful and even scale through our facilities or with customers,” says Harasewycz. “The more mature a startup is, the better we can pull it off after a pilot project.

In contrast, CVC investors can invest earlier – before a startup is even ready to engage with the startup commercially.

5. Platform teams do not participate as much in pilot projects and proof-of-concept projects

Although Grieger at BMW I Ventures is focused on connecting her startups with BMW, she has clear boundaries for her role to avoid conflicts of interest. She will coach the startup and help connect it with the right person at BMW, but then leave it up to the two parties to take things from there.

“I usually take over after the investment and support our portfolio company so that we find the right partner on the corporate side. After that, I hand it over. We are not involved in procurement decisions,” says Grieger.

6. Venture client teams spend a lot of time training the company in the art of running a pilot project

In contrast, venture client teams often spend a lot of time guiding business units through the process of developing and executing proof-of-concept pilot projects with startups.

“We discovered very early on that the people at JetBlue just didn’t understand how to do a proof of concept. It has to be short and quick so we can find out if it solves problems X, Y and Z,” says Burr.

Proof-of-concept projects need clear metrics that can help develop a business model for a long-term partnership. And if it doesn’t work, the company needs to move on quickly.

Burr and her team also developed some tools, such as a short-form proof-of-concept contract that bypassed some of the more stringent legal requirements to get projects up and running faster.

“We spent a lot of time with the legal department to make it clear to them that this is not a full implementation, just a quick test. We are looking for the minimum we can do to make it work.”

JetBlue Ventures will even cover the costs of the proof-of-concept projects if it helps get things off the ground. This is usually done through warrant deals where the company buys shares in the startups in exchange for the costs of the proof-of-concept project.

At Siemens Energy Ventures, Harasewycz developed a template with the KPIs and milestones for the proof-of-concept project, keeping the scope manageable and facilitating evaluation.

“My team always sets a clear timeline and also KPIs that we need to achieve in the project to assess whether we want to continue and what the next step is,” she says.

You will also spend a lot of time advising the business unit involved in the collaboration and coaching them in the implementation of the project.

“We discuss with the company what it should look like… and we advise our company to keep it simple so it doesn’t cost as much,” Harasewycz adds.

These were just a few of the many insights from the webinar. Watch the full discussion below:

This webinar is part of GCV’s The Next Wave webinar series. We host a webinar every second Wednesday of the month, alternating between advice for CVC practitioners and in-depth insights into specific investment areas. Our next webinar is: Media for Equity – Why It Can Work for Your Startups. Register here to secure your place.