Guangdong Wenke Green Technology Corp., Ltd. (SZSE:002775) Shareholders will no doubt be pleased to see the share price rise 29% over the past month, although it is still trying to regain the ground recently lost. Not all shareholders will be cheering, as the share price is still down a very disappointing 47% over the past twelve months.

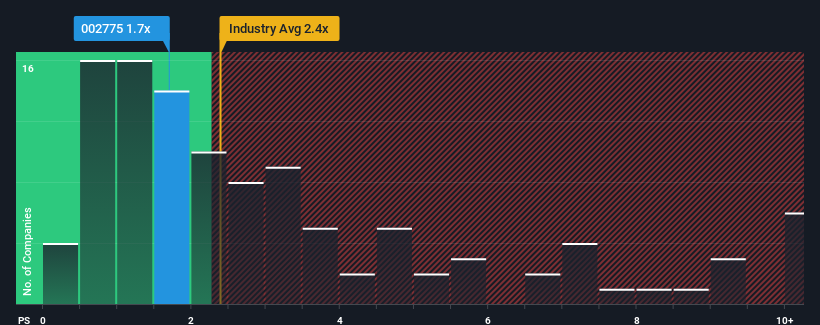

Even after such a big jump in price, Guangdong Wenke Green Technology Ltd.’s price-to-sales (or “P/S”) ratio of 1.7 may still be sending buy signals right now, considering that nearly half of all commercial services companies in China have P/S ratios above 2.4x, and even P/S readings above 5x are not uncommon. However, it’s not wise to simply take the P/S at face value, as there may be an explanation as to why it’s capped.

Check out our latest analysis for Guangdong Wenke Green TechnologyLtd

What does Guangdong Wenke Green Technology Ltd.’s P/S mean for shareholders?

For example, let’s say that Guangdong Wenke Green Technology Ltd.’s financial performance has been poor recently as revenue has been declining. Perhaps the market believes that the recent revenue performance is not good enough to sustain the industry, which hurts the P/S ratio. However, if this does not happen, existing shareholders may be optimistic about the future direction of the share price.

Although there are no analyst estimates for Guangdong Wenke Green TechnologyLtd, take a look at these free Data-rich visualization to see how the company is performing in terms of profit, revenue and cash flow.

How is Guangdong Wenke Green Technology Ltd.’s sales growth developing?

Guangdong Wenke Green Technology Ltd.’s price-to-sales ratio is typical of a company that is expected to have limited growth and, more importantly, is underperforming the industry average.

First, if we look back, the company’s revenue growth last year wasn’t exactly exciting as it posted a disappointing 28% decline. The last three years don’t look great either as the company saw its revenue shrink by a total of 68%. Therefore, we’re sad to admit that the company hasn’t done a great job of growing its revenue during this time.

When compared to the industry, which is forecast to grow by 29 percent over the next twelve months, the company’s downward momentum based on its latest medium-term sales figures paints a sobering picture.

Given this information, we are not surprised to see that Guangdong Wenke Green Technology Ltd. trades at a lower P/E than the industry average. Still, there is no guarantee that the P/E has already bottomed out as revenues are declining. There is a possibility that the P/E could fall even further if the company fails to improve its revenue growth.

What does Guangdong Wenke Green Technology Ltd.’s P/S mean for investors?

Guangdong Wenke Green Technology Ltd.’s share price has risen sharply recently, but its price-to-sales ratio remains modest. We normally caution against reading too much into the price-to-sales ratio when making investment decisions, although it can say a lot about what other market participants think of the company.

Our research of Guangdong Wenke Green Technology Ltd. confirms that the company’s declining revenues over the past few medium-term years are a key factor behind its low price-to-sales ratio, given that the industry is forecast to grow. At this point, investors believe that the potential for revenue growth is not large enough to justify a higher price-to-sales ratio. Unless recent medium-term conditions improve, they will continue to form a barrier to the share price around these levels.

Before you form an opinion, we found out 3 warning signs for Guangdong Wenke Green TechnologyLtd (2 must not be ignored!) that you should know.

It is important, Make sure you are looking for a great company and not just the first idea that comes to mind. So if increasing profitability matches your idea of a great company, take a look at this free List of interesting companies with strong recent earnings growth (and low P/E ratios).

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.