Finding a company that has the potential to grow significantly is not easy, but it is possible if we look at some key financial metrics. First, we want to find a proven return on the capital employed (ROCE), which is increasing, and secondly a growing base of the capital employed. This shows us that it is a compound interest machine that is able to continuously reinvest its profits into the company and generate higher returns. Although when we looked at Spring Airlines (SHSE:601021), it didn’t seem to check all of those boxes.

Return on Capital Employed (ROCE): What is it?

Just to clarify if you’re not sure, ROCE is a ratio that measures how much pre-tax profit (in percent) a company generates from the capital invested in its business. The formula for this calculation at Spring Airlines is:

Return on capital = earnings before interest and taxes (EBIT) ÷ (total assets – current liabilities)

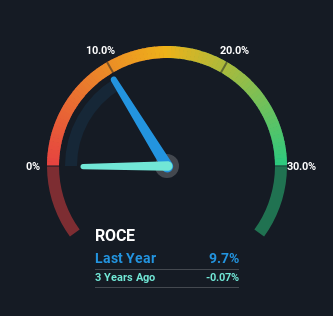

0.097 = CNY 3.2 billion ÷ (CNY 43 billion – CNY 9.9 billion) (Based on the last twelve months to March 2024).

Therefore, Spring Airlines has a ROCE of 9.7%. In absolute terms, this is a low return, but it is roughly in line with the airline industry average of 8.7%.

Check out our latest analysis for Spring Airlines

Above you can see how Spring Airlines’ current ROCE compares to previous returns on capital, but there is only so much to infer from the past. If you are interested, you can check out analyst forecasts in our free Analyst report for Spring Airlines.

What does the ROCE trend tell us for Spring Airlines?

There are better returns on capital than what we see at Spring Airlines. Over the last five years, the return on capital has remained relatively stable at around 9.7% and the company has invested 61% more capital into its operations. This poor return on capital does not inspire confidence at present and given the increased capitalization, it is obvious that the company is not investing the funds in high-return investments.

What we can learn from Spring Airlines’ ROCE

In short, although Spring Airlines has reinvested its capital, the earnings it has generated have not increased. And given that the stock has only returned 22% to shareholders over the past five years, one could argue that they are aware of these lackluster trends. So if you’re looking for a multibagger, we think you’ll have better luck elsewhere.

However, Spring Airlines does pose some risks and we have found 2 warning signs for Spring Airlines that might interest you.

For those who like to invest in solid companies, look at this free List of companies with solid balance sheets and high returns on equity.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.