Some investors rely on dividends to grow their wealth. If you are one of these dividend sleuths, you might be interested to know that Northern United Publishing & Media (Group) Company Limited (SHSE:601999) will trade ex-dividend in just 3 days. The ex-dividend date is a business day before a company’s record date on which the company determines which shareholders are entitled to a dividend. The ex-dividend date is significant because trading takes a minimum of two business days each time a share is bought or sold. This means that investors who purchase Northern United Publishing & Media (Group) shares on or after August 16th will not receive the dividend, which will be paid on August 16th.

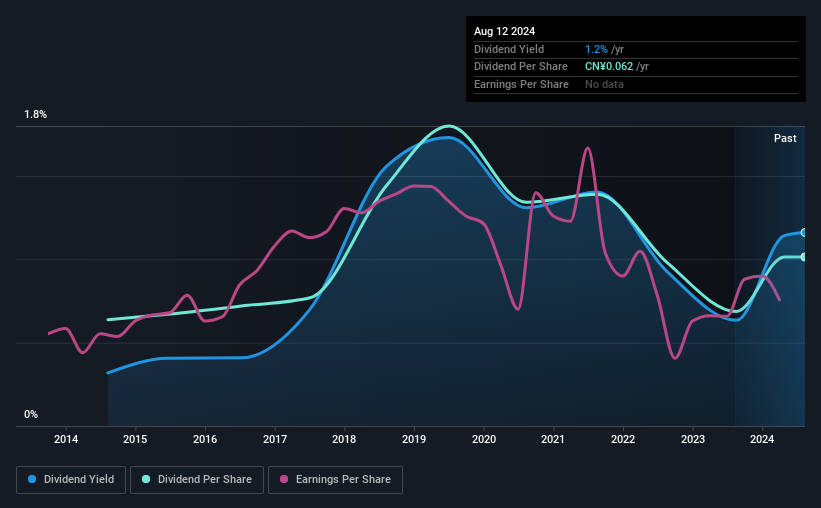

The company’s next dividend payment will be CN¥0.062 per share, following on from last year’s payout of a total of CN¥0.062 to shareholders. Based on last year’s payments, Northern United Publishing & Media (Group) has a yield of 1.2% on the current share price of CN¥5.34. Dividends are an important contributor to investment returns for long-term holders, but only if the dividend continues to be paid. Therefore, we should always check if dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Northern United Publishing & Media (Group)

If a company pays out more in dividends than it earns, the dividend can become unsustainable – far from an ideal situation. Northern United Publishing & Media (Group) paid out a comfortable 37% of its profits last year. However, even highly profitable companies sometimes don’t generate enough money to pay the dividend, so we should always check if the dividend is covered by cash flow. Fortunately, the company only paid out 21% of its free cash flow last year.

It’s positive to see that Northern United Publishing & Media (Group)’s dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually means a greater margin of safety before the dividend gets cut.

Click here to see how much profit Northern United Publishing & Media (Group) paid out over the last 12 months.

Have earnings and dividends increased?

Companies with declining profits are tricky from a dividend perspective. If profits fall and the company is forced to cut its dividend, investors could see the value of their investment go up in smoke. With this in mind, we are concerned by Northern United Publishing & Media (Group)’s 9.2% per year decline in profits over the past five years. Such a sharp decline raises doubts about the future sustainability of the dividend.

Another important way to measure a company’s dividend prospects is to measure its historical dividend growth rate. Northern United Publishing & Media (Group) has increased its dividend by an average of 4.7% annually, based on the last 10 years of dividend payments.

Last Takeaway

Does Northern United Publishing & Media (Group) have what it takes to sustain its dividend payments? Northern United Publishing & Media (Group) has comfortably low cash and profit payout ratios, which could mean the dividend is sustainable even if earnings per share fall sharply. Still, we view declining earnings as a warning sign. While the company has some good things going for it, we’re a bit ambivalent and it’ll take more to convince us of Northern United Publishing & Media (Group)’s dividend merits.

Even though Northern United Publishing & Media (Group) looks good from a dividend perspective, it is still worth keeping yourself informed about the risks associated with this stock. Our analysis shows 3 warning signs for Northern United Publishing & Media (Group) We strongly recommend that you check this out before investing in the company.

In general, we would not recommend simply buying the first dividend stock you see. Here is a curated list of interesting stocks with high dividend numbers.

Valuation is complex, but we are here to simplify it.

Find out if Northern United Publishing & Media (Group) could be undervalued or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.