PM Pictures

I continue to advocate for value over growth investing, primarily because I believe tech (which dominates growth) is the most crowded sector in the world right now. I still believe in cycles, and value increasingly seems to have bottomed out. here relative to growth. If you agree, you should consider the WisdomTree US Value Fund (NYSEARCA:WTV). This fund takes a unique approach to defining value through shareholder return through active management and focuses on those stocks that return money to shareholders in the form of dividends and share buybacks.

By combining future dividend yield, past dividend growth and share buybacks into one overall measure, the fund attempts to search the equity universe for companies that return capital to their investors while remaining financially healthy and profitable. By sorting the companies by shareholder return, The portfolio naturally avoids companies with over-leveraged balance sheets. The portfolio is reconstructed and rebalanced annually, but the investment team may opt for a more active approach depending on market conditions and investment opportunities.

A look at the stocks

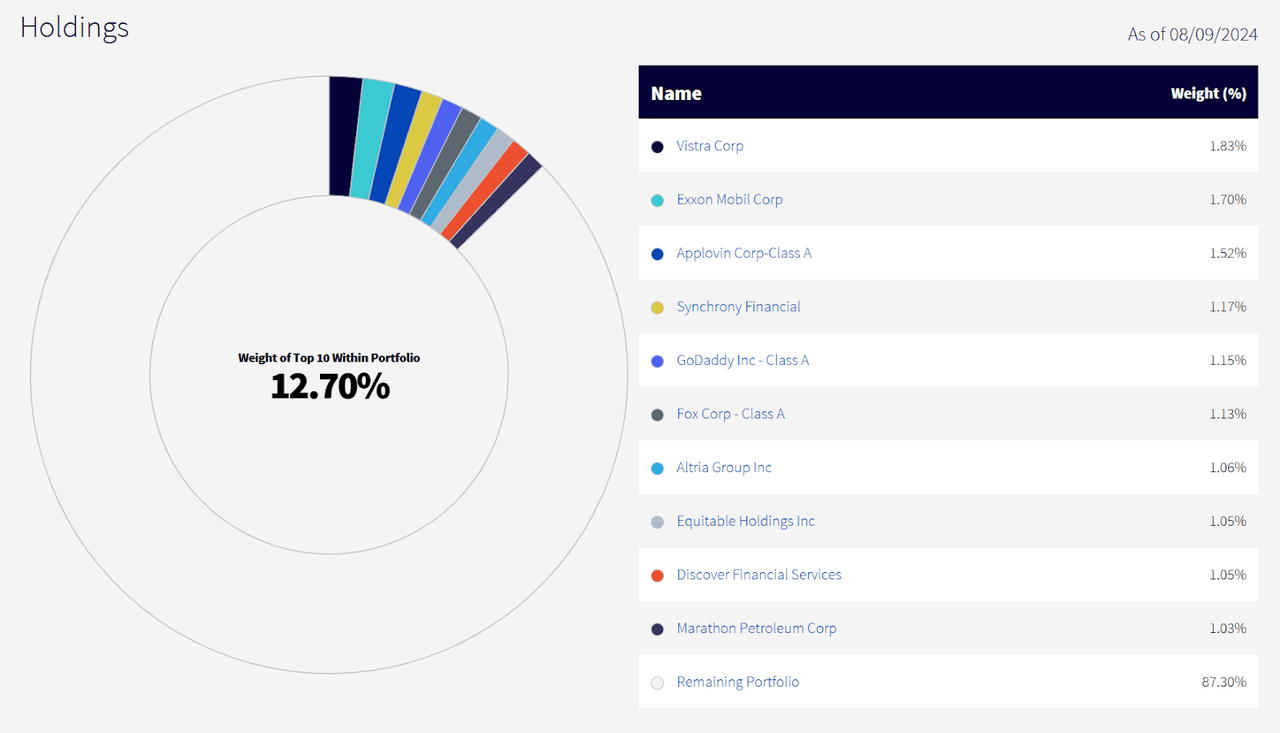

WTV holds 159 individual positions, with no one position representing more than 1.85% of the fund. I’m a big fan of this, considering how high the concentration risk is in core portfolios like the S&P 500 at this point in the cycle.

www.wisenschaftsbaum.com

What do some of these companies do? Vistra Corp is an integrated electric and energy utility company in the United States. Exxon Mobil Corporation is the largest publicly traded international oil and gas company in the world. Applovin Corp is a leading global technology company that provides software that enables mobile application developers and marketers to build, monetize, and market their apps. And Synchrony Financial is a consumer finance company that offers private label credit cards, promotional financing, and installment loans to a range of retailers, manufacturers, and other businesses.

Together, these top holdings represent exposure to sectors such as utilities, energy, information technology, financials and consumer goods, providing investors with a balanced portfolio that remains focused on growth and income and delivers strong total return for shareholders.

Sector composition and weighting

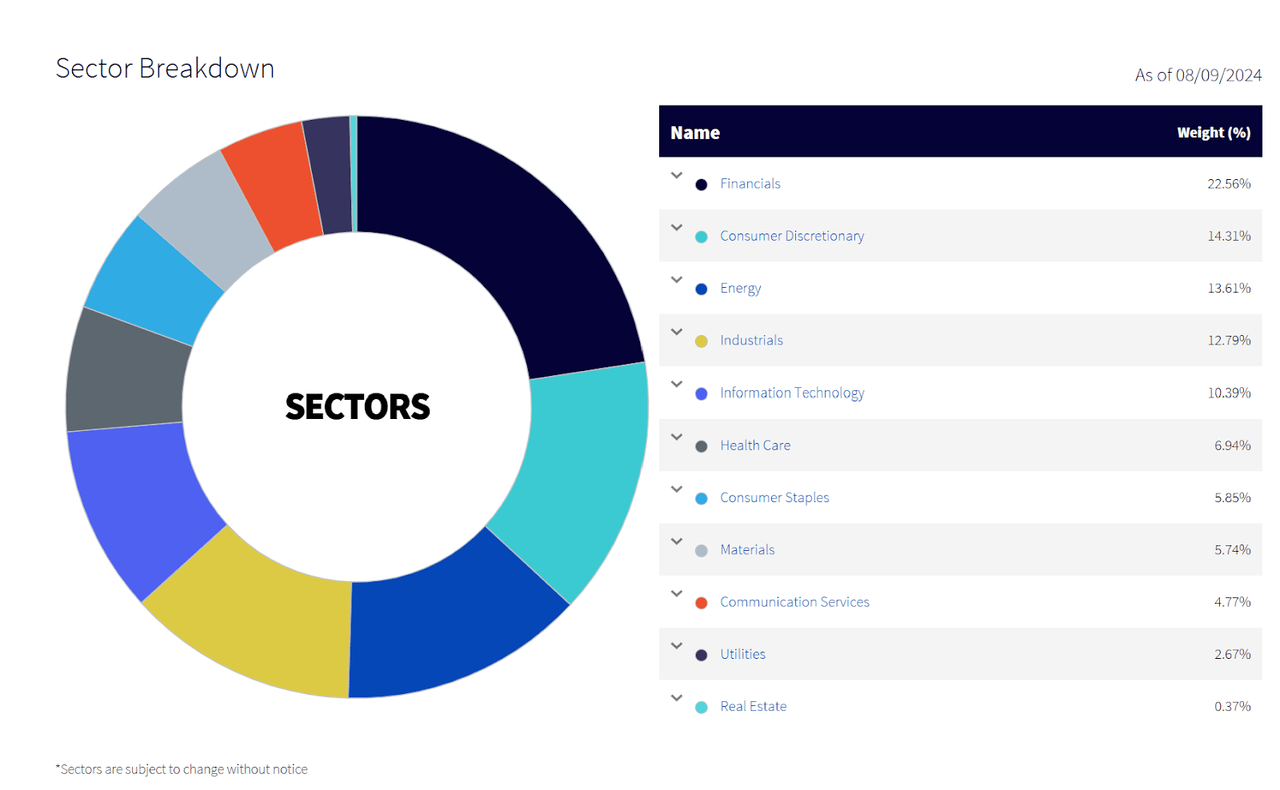

As is common with value-oriented portfolios, financials make up the largest share, followed by consumer cyclicals.

www.wisenschaftsbaum.com

Frankly, I’m a little nervous about the discretionary sector, as many of the stocks there are struggling after their 2021 highs and some are burdened with high debt on razor-thin margins. The hope is that the shareholder return filter means that the most fundamentally vulnerable companies would be excluded here anyway.

Comparison with competitors

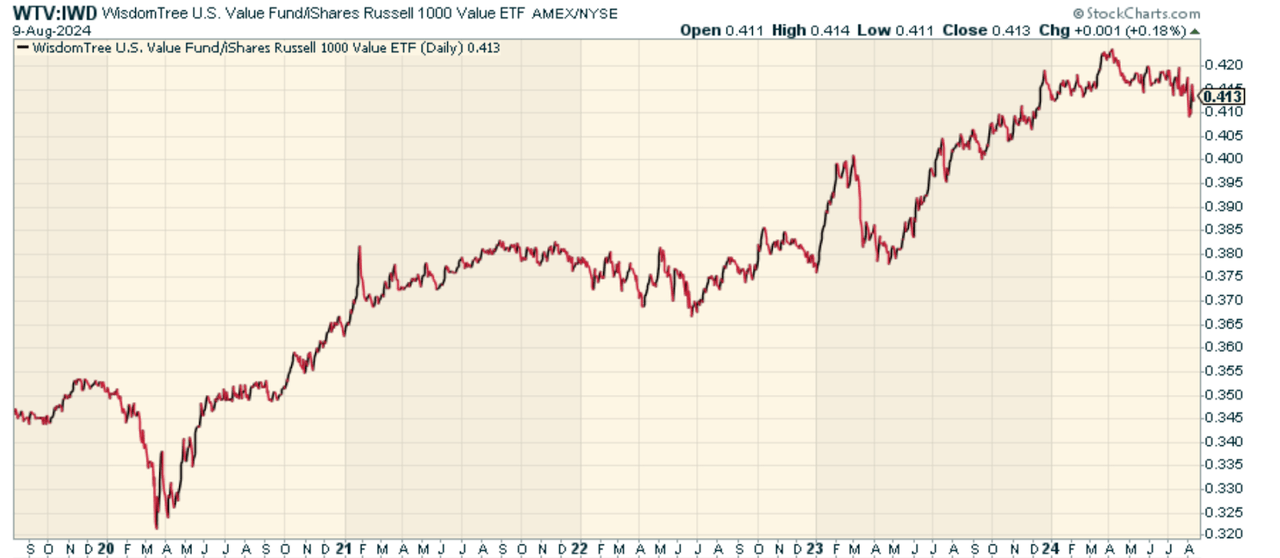

Since it is a value fund focused on large-cap stocks, it is worth comparing WTV to the Russell 1000 Value ETF (IWD), which tracks the Russell 1000 Value Index. This index is passive and is often used as a benchmark for defining value stocks. If we look at the price ratio of WTV to IWD, we see that WTV has performed significantly better in recent years, so shareholder returns seem to be quite strong.

stockcharts.com

pros and cons

On the positive side, the fund’s focus on shareholder returns and additional quality characteristics give it the potential to benefit from companies that return capital and exhibit other financial and profitability characteristics that suggest the company could be a quality winner over the long term. This can potentially deliver not only higher yields but also higher returns for shareholders over time. The fund’s active management could add flexibility and adaptability to its quantitative, information-driven buy-and-hold investment process.

The downside? Although share buybacks can be a shareholder-friendly activity for a traditional, actively managed equity fund, they can also be poorly managed or mistimed, resulting in capital being returned at the wrong time or at the wrong value. In addition, some investors view share buybacks as a less permanent form of capital return than dividends, which could reduce the fund’s appeal to income-seeking investors.

Diploma

For those who believe value will make a strong comeback, the WisdomTree US Value Fund represents an interesting way for value investors to participate in rising shareholder returns that drive style. The ETF targets undervalued US companies that perform well within a framework that prioritizes companies with characteristics such as shareholder returns and quality. I actually really like this fund and think it has a lot of potential to continue to perform in the coming years. Worth considering.