ASML (ASML) is one of the most underrated chip stocks on the market and is currently on the rise. The stock has increased by about 20% over the course of the year and there is plenty of space to walk, but you have to be patient.

The Netherlands-based company manufactures photolithography systems used by the world’s leading foundries to produce sophisticated chips for AI, high-performance computing and other resource-intensive use cases. Its key customers include Taiwan Semiconductor Manufacturing Company (TSM) and Intel (INTC).

I am bullish on ASML because the company has a clear moat in the semiconductor industry, a list of high-profile customers, and long-term prospects for success given that the company is on the cusp of a cyclical recovery in the semiconductor equipment industry.

ASML has a clear economic moat

One of the main reasons I like ASML is its long-term, sustainable competitive advantage in the global semiconductor scene with its lithography systems. As I alluded to above, ADML creates systems that are used by leading foundries to make chips for semiconductor giants like Nvidia (NVDA) and Advanced Micro Devices (AMD).

In addition, ASML has a near-monopoly in extreme ultraviolet (EUV) lithography systems, commanding a market share of approximately 83% (data from Khaveen Investments). But what is EUV lithography and why is it important?

Photolithography (the broader term for EUV lithography) is the process used to create integrated circuits (ICs). Lithography machines engrave complex circuit patterns onto silicon wafers. These wafers are then used in numerous electronic devices, from smartphones to the powerful graphics processing units (GPUs) we use for crypto mining or training an AI model.

You can think of ASML as the back end of the back end of the chip world. Without ASML, we wouldn’t have Nvidia chips. That’s how important this company is to the semiconductor industry.

ASML is still at the very beginning

The key to my bullish stance is the fact that ASML is just getting started. While 2024 is expected to be lackluster for the company, as management emphasized during the Q2 2024 investor presentation, 2025 is expected to be great.

ASML’s revenue fell nearly 11.7% year-on-year to $6.8 billion in the second quarter of 2024, but beat analysts’ expectations by $212.7 million. The group’s earnings per share were $4.39, beating Wall Street expectations by 36 cents.

Although revenue and profit are down year-on-year, they are recovering quarter-on-quarter. This revenue was above the $5.6 billion ASML reported in the first quarter of 2024.

The semiconductor industry is experiencing a broad-based slowdown this year, and ASML in particular is facing some macroeconomic headwinds on top of that. The US doesn’t want China to get its hands on high-performance chips, so it has imposed a ban on chip exports to China. This is not good for ASML, as China accounted for about 50% of its revenue in Q2 2024, but this is the main reason why the pessimists have overreacted.

However, it is not as bad as the bears say. Management says 2024 is a “transition year” for them, and I agree. ASML’s revenue may have collapsed, but its backlog of €39 billion ($43.5 billion) at the end of the second quarter of 2024 should not be ignored. The industry is near its bottom, but I expect it to gain momentum and recover in 2025 due to strong demand from AI customers.

For the full year 2024, ASML expects sales growth to remain stagnant. However, the company is increasing its production capacity and investing heavily in technology to prepare for next year. In fact, the semiconductor industry is expected to experience a cyclical upturn in 2025, and ASML is at a turning point.

In addition, management expects a growing application area and increasing demand for lithography. They are optimistic that the energy transition, electrification and artificial intelligence will bring long-term growth to the company.

I like this story and believe it will become a reality. ASML is preparing to deliver its industry-leading lithography systems to factories in different regions.

As end markets recover by 2025, I expect management will not miss its 2025 revenue target of €30-40 billion ($33.4-44.5 billion). In fact, I expect it to exceed that target.

In addition, its revenue target for 2030 remains unchanged at 44 to 60 billion euros (49 – 67 billion US dollars). The company will update this at its investor day on November 14. Call me a crazy optimist, but I expect an upward revision.

More on “What the bears are missing”

I believe that China issues are not a sufficient reason to dislike ASML stock, even though this business segment is large and still underrepresented. It is simply not worth ignoring a monopoly holder with ~$350 billion in assets, and uninformed investors should pay attention to more important things when evaluating a company.

For one, as noted earlier in this article, ASML has a monopoly position in its market. This monopoly position gives it pricing power, which is reflected in the improvement in gross margin. Gross margin in Q2 2024 was 51.5%, compared to 51% in the previous quarter. This tells me that customers love the product and are willing to pay a premium for it.

In addition, management provided a conservative margin outlook for Q3 2024 for strategic reasons, and ASML is likely to beat expectations as it has done in previous quarters. Under-promising and over-delivering is the recipe for long-term value creation.

Finally, ASML is seeing an improvement in the utilization of its lithography tools, both at the logic and memory levels. The company shipped additional NXE:3800E systems during the quarter and continues to see increasing demand for them. These systems are being used in a cost-effective manner in the mass production of 2-nanometer logic nodes and cutting-edge DRAM nodes.

Analyst opinion on ASML shares

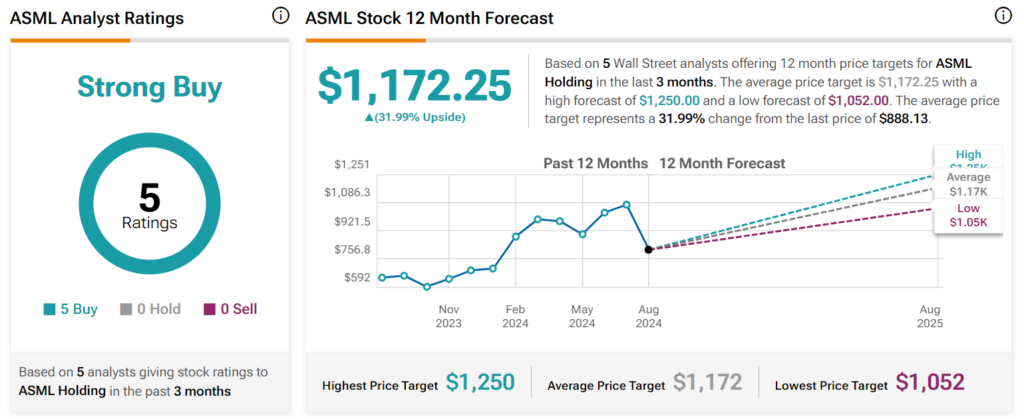

On the Street, ASML stock has a consensus rating of “Strong Buy” based on five unanimous buy recommendations. average price target of USD 1,172.25 represents an increase of almost 32% from the current level.

The conclusion

ASML is a high-profile monopoly holder and a key enabler of numerous structural changes thanks to generative AI. I am bullish on ASML, but the valuation is high (42x forward earnings). If that’s too high for you, wait for a pullback before ASML stock is expected to rise.

notice