Due to weakening share prices, Europe and the US’s largest online food delivery companies have suffered combined operating losses of more than $20 billion (£15.6 billion) over the past seven years.

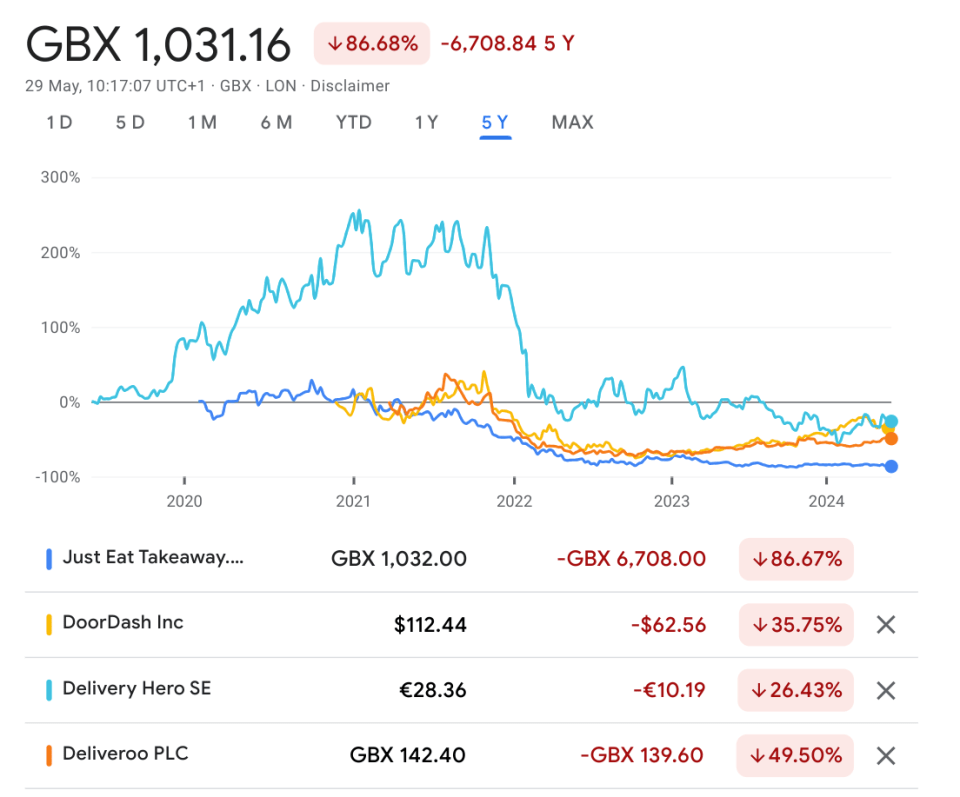

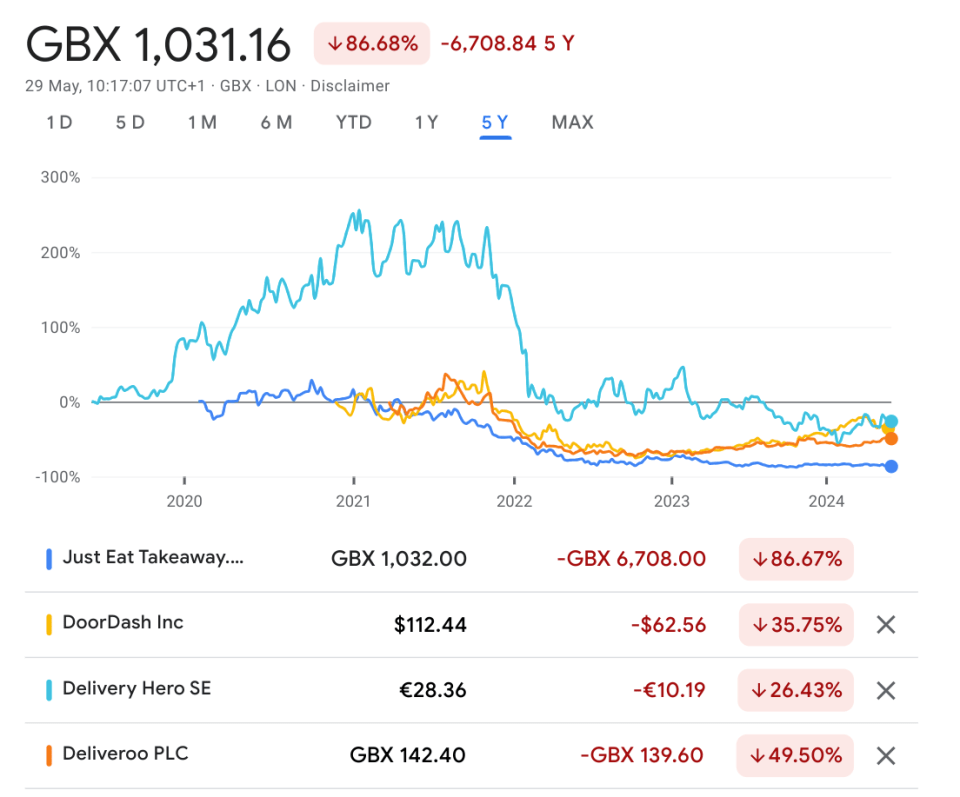

Following the pandemic-led surge in demand, shares of pandemic darlings Deliveroo, Just Eat Takeaway (JET), Delivery Hero and Doordash have fallen sharply in a macroeconomic climate that has led to weaker consumer spending.

According to an analysis by the Financial Times and industry expert Thedelivery.world, the cumulative annual operating losses of these companies amount to $20.3 billion (£15.9 billion).

The figure covers the seven years since Deliveroo, Delivery Hero and Doordash went public and includes the period after Just Eat Takeaway emerged from a merger in 2020.

The total also includes significant write-downs from acquisitions and share-based compensation.

JET, the merger of British company Just Eat and Dutch company Takeaway.com, has amassed operating losses of $9.1 billion (£7.1 billion) since its formation in 2020.

Delivery Hero, which went public in 2017, reported operating losses of $7.8 billion (£6.1 billion), while Doordash, which went public in 2020, reported operating losses of $2.6 billion (£2 billion).

Deliveroo, which went public in 2021, reported operating losses of $777 million (£609 million).

UBS analyst Jo Barnet-Lamb said: “Investors’ willingness to take losses has changed” and they now expect food delivery companies to “demonstrate sustainable, profitable growth” after a rise in interest rates.

In February, Uber reported a full-year operating profit for the first time after years of losses. CEO Dara Khosrowshahi said “2023 was a turning point” for the company. Uber said its Eats division became profitable for the first time in 2022.

The stock, listed on the New York Stock Exchange, has risen 58 percent over the past five years and is well above its peak during the pandemic.

Deliveroo said: “We continue to make strong progress in delivering on our strategic priorities and remain confident in our ability to deliver profitable growth.”

DoorDash said the company expects to “achieve profitability (under generally accepted accounting principles) over time” and has invested billions to help sellers build successful businesses.

Emmanuel Thomassin, chief financial officer at Delivery Hero, said the operating losses included “items that are not considered economically relevant to measure the economic development of the company.” He said the company was focusing more on other metrics such as free cash flow.

JET declined to comment.