Alistair Berg/DigitalVision via Getty Images

One of the most attractive companies out there today is, at least for me, The Monarch Cement Company (OTCPK:MCEM). For those who don’t know the business, it operates as a producer and seller of Portland cement. This is a type of cement that is mainly used in the production of ready-mixed concrete for the construction of highways, bridges, buildings and more. My first Article about the company was published in December last year. In that article, I rated the company as a “buy.” But in a subsequent Articlepublished in April of this year, I finally upgraded it to a “strong buy,” although I acknowledged that my previous buy recommendation was probably a mistake.

Ultimately, Monarch Cement Company is a healthy, growing and dynamic company. The company has a net cash flow position and it is trading at a discount to many other similar companies. Given these facts, and despite the fact that shares have risen 3.4% since I last wrote about the company earlier this year, I still think it deserves a Strong Buy rating, suggesting that the upside potential relative to the broader market should be quite attractive over the foreseeable future.

A solid perspective

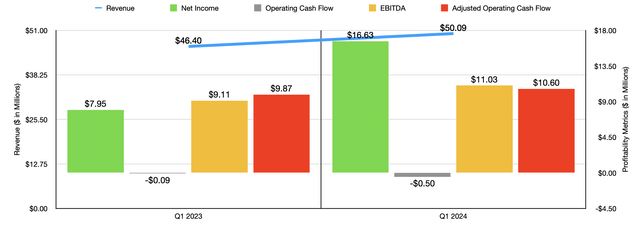

When I wrote about The Monarch Cement Company in April of this year, we only had data through the end of fiscal 2023. The results now extend through the second quarter of 2024. But before we get to those latest results, it would be useful to briefly touch on the performance in the first quarter of 2024. In the first quarter, for example, the company generated revenue of $50.1 million, a 7.9% increase from the $46.4 million the company reported just a year earlier.

Author – SEC EDGAR Data

This revenue growth is primarily attributable to the ready-mix concrete business. Total revenue of $23.8 million was 15.5 percent higher than the previous year’s figure of $20.6 million. In comparison, growth in the company’s cement business was much lower: revenue increased by only 4.6 percent from $30.1 million to $31.5 million.

As nice as this revenue growth was, the real surprise for investors came in the bottom line. Net income doubled from about $8 million to $16.6 million. In addition to the increase in revenue, the company also saw improvements elsewhere. In the first quarter, the company recorded nearly $10.9 million in unrealized gains related to certain investments.

These investments totaled $67.9 million at the end of the last quarter. For comparison, in the first quarter of 2023, profits from investments were only $2.6 million. For comparison, about $28.2 million of these investments are dedicated to the cement industry. However, the company also holds interests in the general building materials industry, the oil and gas refining and marketing industry, and the home construction industry. In addition, management also reported a near doubling of dividend income from $0.6 million to $1.1 million.

Of course, there are other profitability metrics that investors should pay attention to. For example, it is true that operating cash flow deteriorated from minus $0.1 million to minus $0.5 million. But if we take into account the changes in working capital, we would get an increase from $9.9 million to $10.6 million. And over the same period, the company’s EBITDA increased from $9.1 million to $11 million.

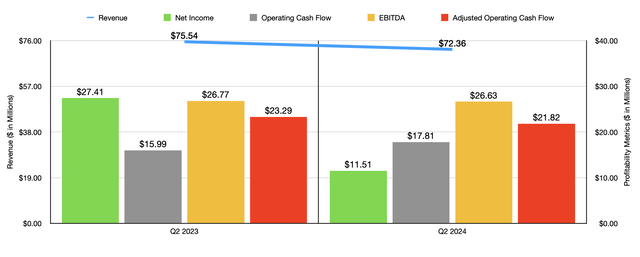

As I mentioned at the beginning of this article, we also have data covering the second quarter of 2024. Here, the picture was a little less convincing. For example, revenue fell slightly year-over-year from $75.5 million to $72.4 million. The company saw weakness in both sales categories. For example, the cement business reported a decline in revenue from $51.7 million to $50 million. And the ready-mix concrete business reported a decline from $30.4 million to $29.5 million.

Author – SEC EDGAR Data

Profitability was also affected, with net income falling from $27.4 million last year to $11.5 million this year. Like the first quarter, the second quarter was heavily impacted by equity returns. In the second quarter, The Monarch Cement Company reported unrealized losses on equity investments of $10.6 million. This is a significant departure from the $9.9 million profit reported for the second quarter of 2023. While the company did see other benefits, such as an increase in interest income, a larger gain on equity sales, and lower income taxes, these were not enough to offset these massive fluctuations. Fortunately, cash flow metrics are much more similar from one year to the next because these are non-cash changes. Operating cash flow increased from $16 million to $17.8 million. On an adjusted basis, it decreased from $23.3 million to $21.8 million. EBITDA, meanwhile, changed little, falling from $26.8 million to $26.6 million.

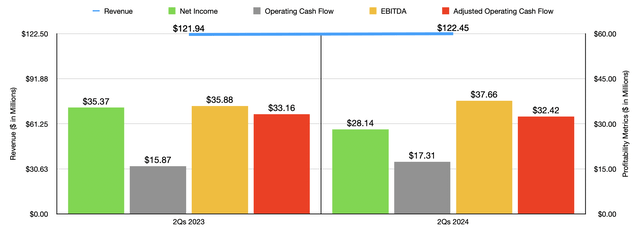

Author – SEC EDGAR Data

In the chart above, you can see results for the entire first half of 2024 compared to the first half of 2023. Despite the revenue weakness in the second quarter, total revenue for this year so far is up slightly to $122.5 million. That’s slightly higher than the $121.9 million reported last year. Net income is down. However, two of the three cash flow metrics I covered in this article are up. The only exception was adjusted operating cash flow, which fell from $33.2 million to $32.4 million. Due to the capex volatility, total capex on the company’s books fell to $57.1 million in the second quarter of this year. But considering the company has net cash on hand and no debt, I still think this is incredibly robust.

Another feature I really like about The Monarch Cement Company is the fact that the company has no debt on its books. It also has cash and cash equivalents of $38.7 million. That doesn’t even take into account the investments mentioned above. It also doesn’t take into account $16.8 million in other investments in subsidiaries. In short, the company’s balance sheet looks incredibly strong. In fact, at the end of the last quarter, the company had a book value of $357.7 million. That’s an improvement over the $334.1 million reported at the end of 2023. And it represents an increase compared to the $260.4 million reported in 2021. And the other great thing about it is that there don’t appear to be any significant amounts in the form of intangible assets like goodwill. Almost all of the company’s assets are tangible.

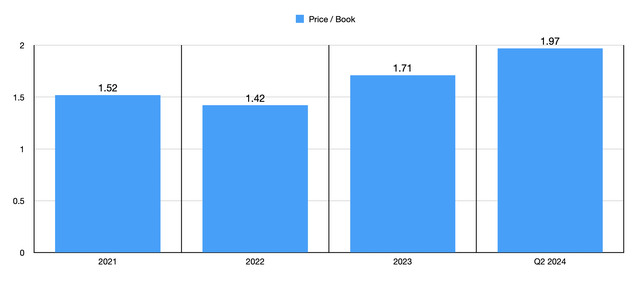

Author – SEC EDGAR Data

Over time, the market has realized how much value there is here for shareholders. In the chart above, you can see the company’s price-to-book ratio from 2021 to 2023. This is based on year-end results combined with the company’s market capitalization at the end of each respective year. For the second quarter of this year, the company is trading significantly higher on this basis. This suggests that the easy money has probably already been made. But I’d argue there is certainly more on the table. For example, in the table below, you can see The Monarch Cement Company’s price-to-book ratio compared to five similar companies. And of the five companies, only one has a price-to-book ratio that is lower than our candidate. The others are substantially higher.

| Pursue |

Price / Book |

| The Monarch Cement Company | 1.97 |

| Summit Materials (SUM) |

1.55 |

| Eagle Materials (EXP) | 6.03 |

| Vulcan Materials (VMC) | 4.19 |

| Martin Marietta Materials (MLM) | 3.69 |

| James Hardie Industries (JHX) | 7.58 |

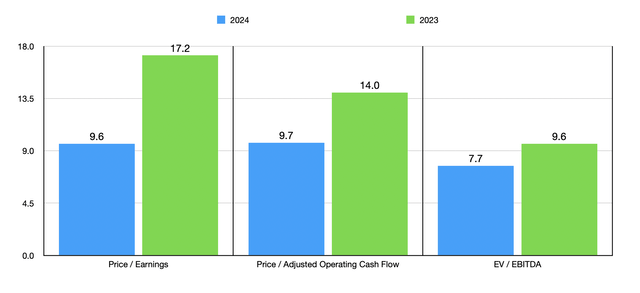

Of course, there are other ways to value the company. In the chart below, you can see how the stock is valued using the price-to-earnings ratio, the price-to-earnings ratio, the EV-EBITDA ratio, and the price-to-sales ratio. And in the table below, I compared our candidate to the same five companies I already compared it to. In terms of price-to-sales, only one of the five companies ended up being cheaper than The Monarch Cement Company. But if we look at the picture using the other three valuation metrics, none of the companies were as cheap as our candidate.

Author – SEC EDGAR Data

| Pursue | Price / Sale | Price/earnings | Price / Op. Cashflow | EBITDA |

| The Monarch Cement Company | 2.7 | 9.6 | 9.7 | 7.7 |

| Summit Materials | 1.7 | 17.9 | 12.3 | 10.4 |

| Eagle Materials | 3.7 | 17.1 | 15.1 | 11.2 |

| Volcanic materials | 4.3 | 35.7 | 23.2 | 17.7 |

| Martin Marietta Materials | 5.0 | 16.2 | 28.0 | 11.1 |

| James Hardie Industries | 3.6 | 28.0 | 15.6 | 15.4 |

Take away

The way I see things, Monarch Cement Company is truly an excellent company. Management continues to grow the business, capitalizing on the company’s solid balance sheet. Shares are cheap both in absolute terms and relative to peers. And when you add all of this together, it’s hard not to be optimistic. This combination of factors allows me to continue to rate the company as a “strong buy” for now.

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Please be aware of the risks associated with these securities.