On August 9, 2024, John Chrystal, Director at MoneyLion Inc (NYSE:ML), bought 10,000 shares of the company, according to a recent SEC filing. Following this transaction, the insider now owns 49,967 shares of MoneyLion Inc.

MoneyLion Inc. is a financial technology company that provides loans, financial advice, and investment services to consumers. The company is known for its digital platform that offers various financial solutions tailored to the needs of its users.

The shares were purchased at a price of $45.88 per share, for a total value of $458,800. This transaction significantly increased the insider’s ownership in the company.

Over the past year, John Chrystal has purchased a total of 13,000 shares of MoneyLion Inc. and sold none. This pattern of insider buying could be an indication that the insider has strong belief in the company’s future prospects.

The overall insider transaction history of MoneyLion Inc. shows a trend with 4 insider purchases and 24 insider sales in the past year.

In terms of valuation, MoneyLion Inc.’s share price is $45.88, giving the company a market capitalization of $478.115 million. The price to earnings ratio is 335.31, which is above the industry average, suggesting a premium valuation.

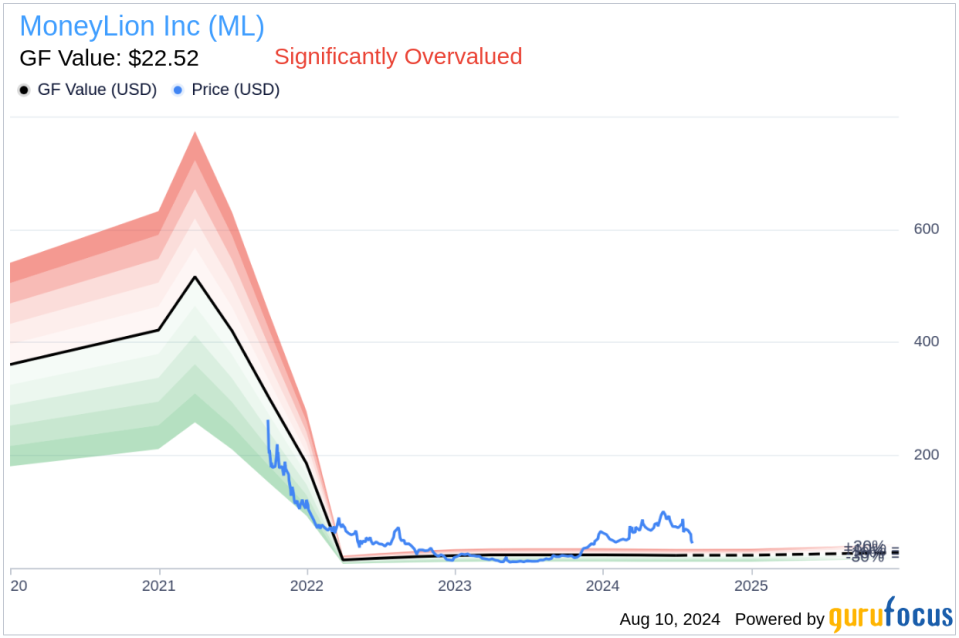

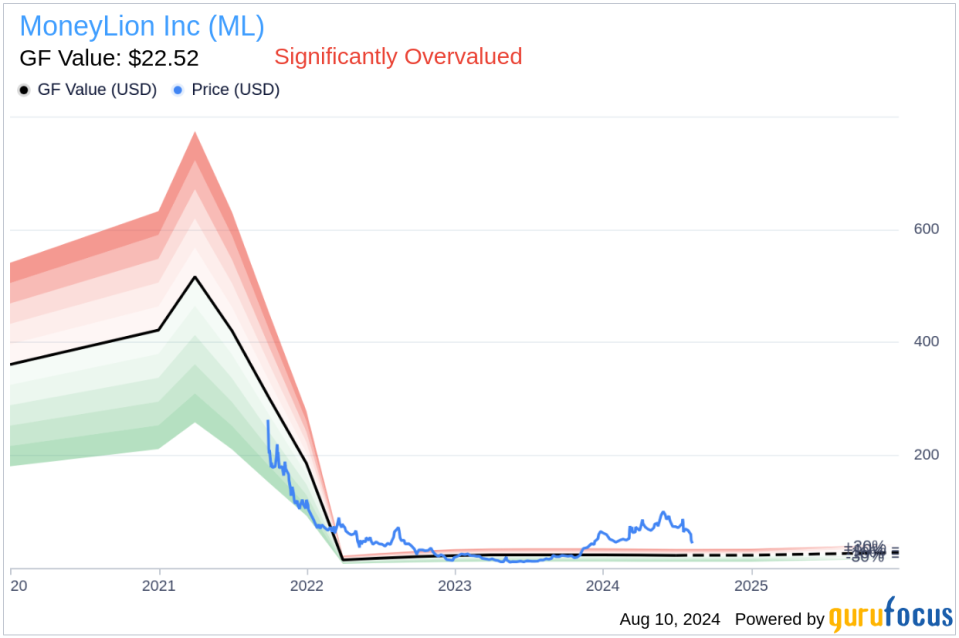

The GF Value of the stock is estimated at $22.52, resulting in a Price to GF Value ratio of 2.04, indicating that the stock is significantly overvalued according to GuruFocus metrics.

This insider purchase could attract investors’ attention given the increasing insider ownership and current valuation metrics of MoneyLion Inc.

This article created by GuruFocus is intended to provide general insights and does not constitute tailored financial advice. Our commentary is based on historical data and analyst forecasts, uses an unbiased methodology and is not intended to serve as specific investment advice. It does not contain a recommendation to buy or sell any stock and does not take into account any individual investment objectives or financial circumstances. Our goal is to provide long-term, fundamental, data-driven analysis. Note that our analysis may not include the most recent, price-sensitive company announcements or qualitative information. GuruFocus does not hold a position in any stocks mentioned here.

This article first appeared on GuruFocus.