Guangdong Green Precision Components Co., Ltd. (SZSE:300968) Shareholders will be pleased to hear that the share price had a great month, gaining 29% and recovering from previous weakness. Looking back a little further, it’s encouraging to see that the stock is up 36% over the past year.

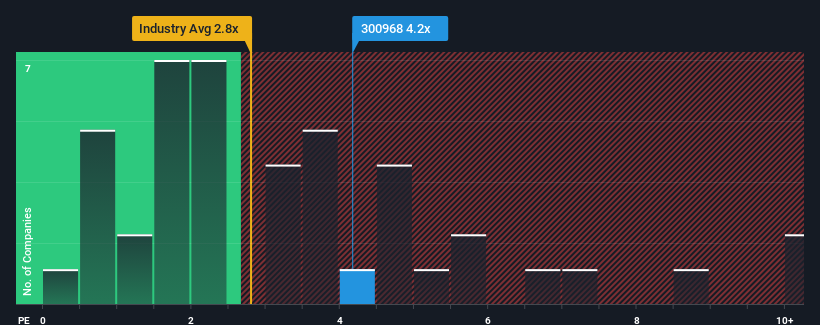

Given such a large price jump, and the fact that nearly half of the companies operating in China’s technology industry have a price-to-sales ratio (or “P/S”) of under 2.8x, you may want to consider Guangdong Green Precision Components, with its P/S ratio of 4.2x, as a stock to avoid. However, it’s not wise to simply take the P/S at face value, as there may be an explanation for why it’s so high.

Check out our latest analysis for Guangdong Green Precision Components

This is how Guangdong Green Precision Components has developed

For example, Guangdong Green Precision Components’ recent declining sales should give cause for concern. One possibility is that the price-to-earnings ratio is high because investors believe the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders could be quite nervous about the profitability of the share price.

We don’t have analyst forecasts, but you can see how recent trends are positioning the company for the future by checking out our free Guangdong Green Precision Components earnings, revenue and cash flow report.

Do the sales forecasts correspond to the high P/S ratio?

A P/S ratio as high as that of Guangdong Green Precision Components would only be truly comfortable if the company’s growth is on track to exceed the industry level.

When we reviewed last year’s financials, we were disheartened to see that the company’s revenues fell by 29%. As a result, the total revenues from three years ago also fell by 44%. So we must sadly admit that the company has not achieved much revenue growth during that time.

If you compare this medium-term sales development with the one-year forecast for the entire industry, which assumes growth of 19 percent, this is not a good prospect.

With this in mind, it is alarming that Guangdong Green Precision Components’ P/S is higher than most other companies. It seems that most investors are ignoring the recent weak growth rate and hoping for a turnaround in the company’s business prospects. Only the bravest would assume that these prices are sustainable, as a continuation of recent revenue trends will likely weigh heavily on the share price eventually.

Conclusion on the P/S of Guangdong Green Precision Components

The sharp rise in Guangdong Green Precision Components’ shares has caused the company’s price-to-sales ratio to rise significantly. While the price-to-sales ratio should not be the deciding factor in whether or not you buy a stock, it is a perfectly useful indicator of sales expectations.

We found that Guangdong Green Precision Components is currently trading at a significantly higher than expected price-to-earnings ratio as the company’s revenues have been declining over the medium term. At the moment, we are not comfortable with the high price-to-earnings ratio as this revenue trend is most likely not going to sustain such a positive sentiment for long. Unless medium-term conditions improve significantly, investors will find it difficult to accept the share price as a fair value.

Please note, however, Guangdong Green Precision Components shows 3 warning signals in our investment analysis, and two of them should not be ignored.

If you are looking for companies with solid earnings growth in the pastyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.