Summary

- Never before have there been so many flights between the USA, Canada and Europe in the important third quarter.

- United is the largest operator and holds a 13.5% share of the nonstop market.

- JetBlue has more than doubled its presence in Europe compared to last year, albeit from a low base.

For airlines in the north, the third quarter (July-September) is crucial for profitability and to strengthen financial reserves for the winter. Against this background, the third quarter saw more flights between the USA, Canada and Europe than ever before this year. Passenger and fare figures will not be published until later, but there is strong demand, including for premium cabins.

Related

French Bee brings very high capacity Airbus A350-1000 with 480 seats to Newark

It would be the largest capacity device in Newark.

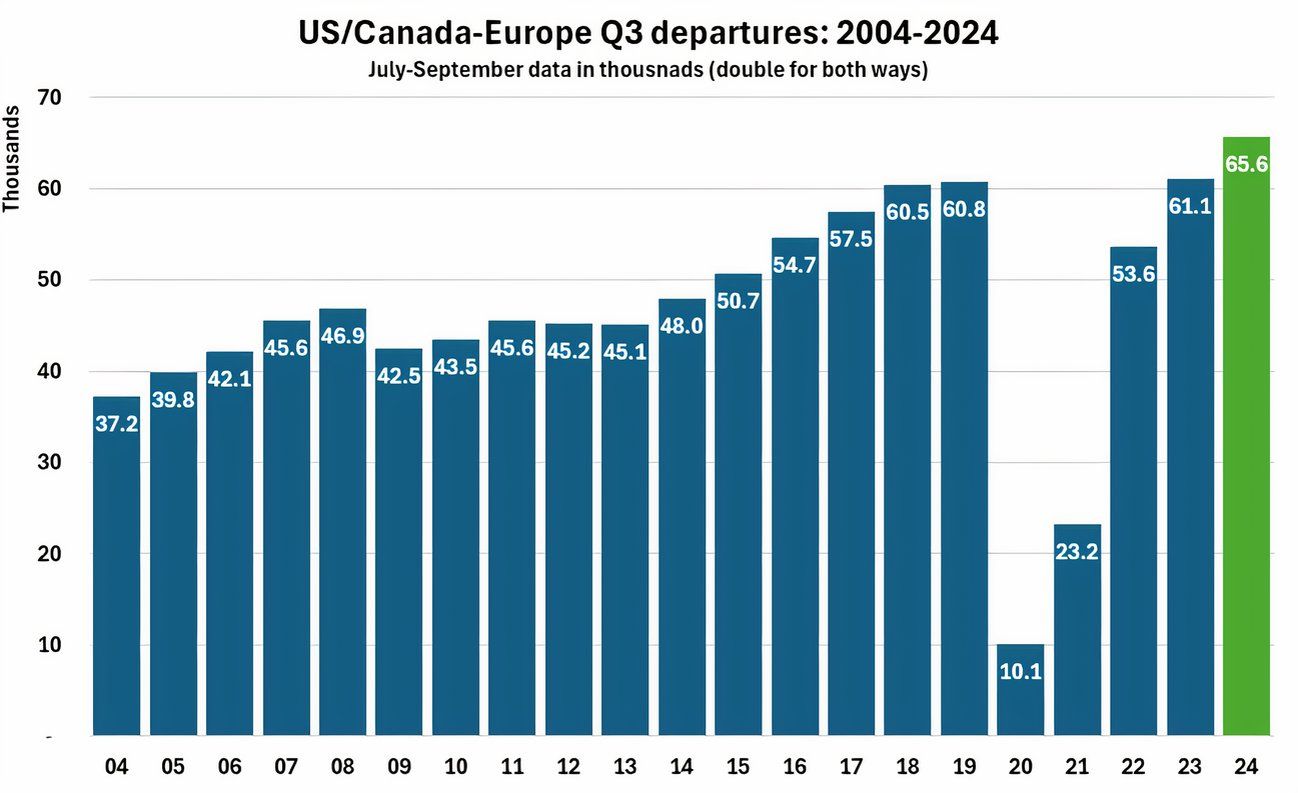

A record number of flights

Using Cirium data to examine all flights between the US, Canada and Europe, there were 65,646 nonstop departures in Q3 2024 (twice as many for round-trip). Spread over 92 days, that’s an average of 714 departures per day. The flights are 7.4% above the previous record, Q3 2023. That’s about 49 additional departures per day.

Slightly smaller aircraft, both wide-body and narrow-body, contributed in part to the development. The average flight now has 273 seats, the lowest number in eight years.

Data source: Cirium. Image: James Pearson

Despite many airline changes, departures have increased sharply in 2019 compared to pre-pandemic times. A comparison of then and now shows that Atlantic Airways, Discover, Iberojet, JetBlue, Neos, Norse Atlantic and PLAY now serve the huge market. In comparison, these airlines no longer do the following:

- Aeroflot (due to the war and sanctions)

- Air Italy (no longer exists)

- Air New Zealand (previously had fifth freedom flights from Auckland via Los Angeles to London Heathrow)

- Eurowings

- Norwegian (long-haul flights discontinued)

- Thomas Cook (no longer exists)

- TUI Fly Belgium

- TUI fly Netherlands

- Ukraine International (due to the war)

- XL Airways France (no longer exists)

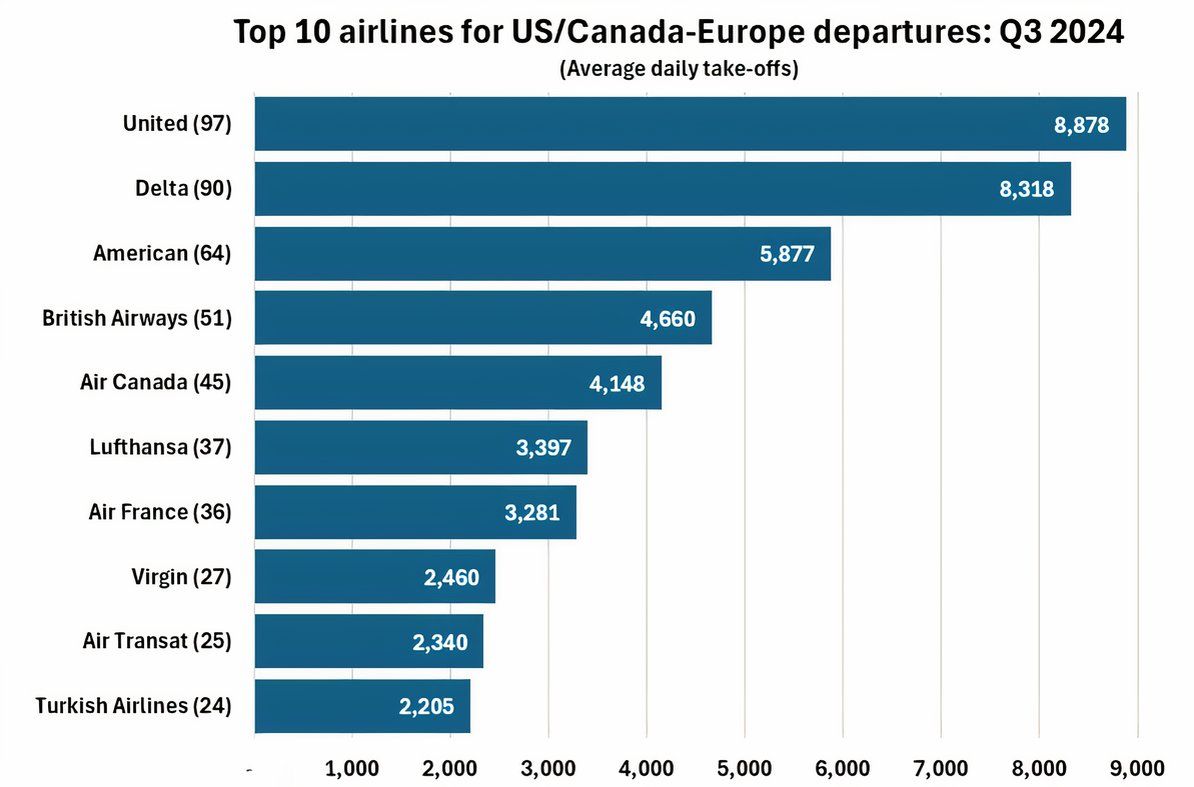

The top 10 airlines: Q3 2024

More than 40 passenger airlines operate flights in this market. The top 10 are listed below. United is number one with about 13.5% of departures. In 2019, Delta was number one. At that time, Norwegian was in seventh place but has left the market. Turkish Airlines is now in the top 10.

United offers an average of 97 flights daily to Europe and 75 routes. As you might expect, British Airways is the leading non-North American carrier, despite being almost half the size of United. At peak times, it typically offers 51 flights daily and 32 routes between the US and Canada.

(As this is an average, half of the days will have more departures and the other half will have fewer.) Data source: Cirium. Image: James Pearson

If you include Delta, American, Air Canada, Air Transat, JetBlue and WestJet, US/Canadian operators have almost half the market (48.1%). The numerous European airlines have 51.2% and the fifth freedom operators Air Tahiti Nui, Emirates and Singapore Airlines, which have stops in Europe en route, have 0.7%.

Related

The remaining 15 long-haul routes in the USA and Canada will begin in 2024

How many of them can you name?

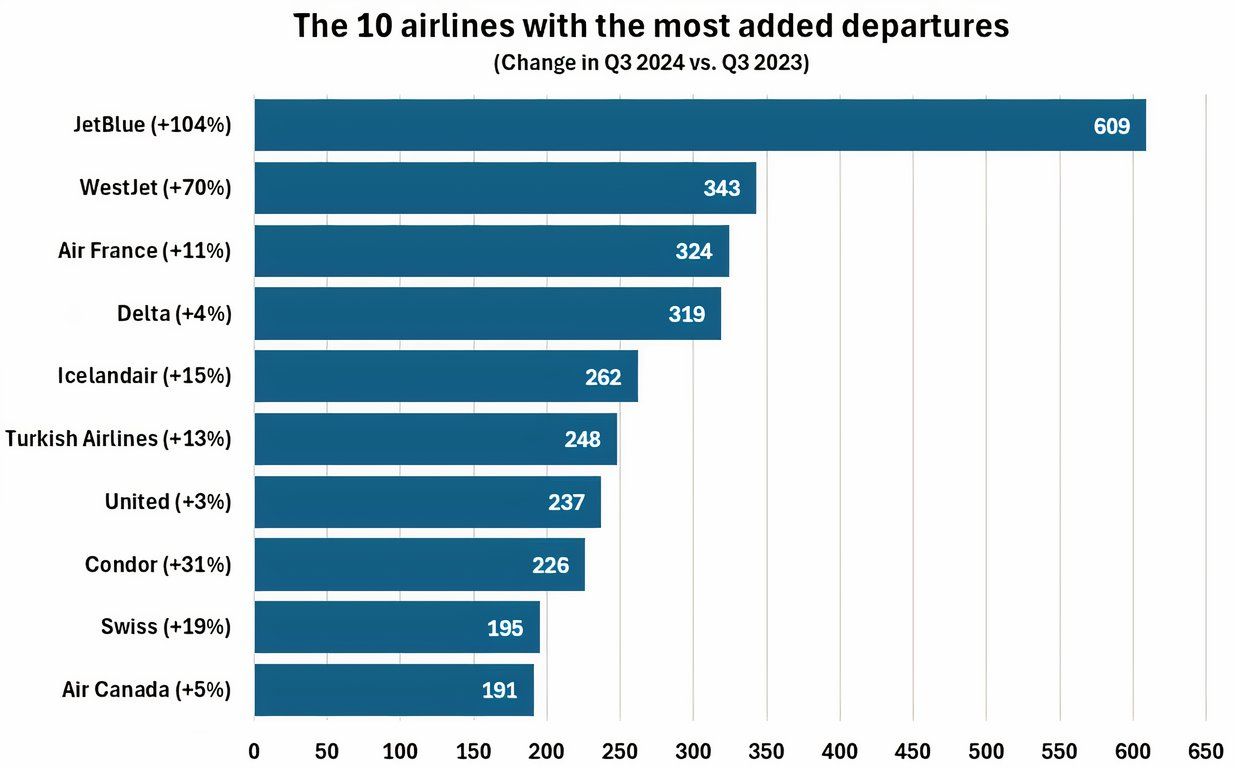

The top 10 winners

JetBlue has seen the most year-on-year growth, adding 609 new departures, or six or more flights per day. The airline has doubled its presence in Europe in one year (+104%) and now serves 11 routes, making it the 18th largest operator. In contrast, about 15 airlines have slightly reduced their flights or left their offerings unchanged.

Data source: Cirium. Image: James Pearson

JetBlue only entered the European market in 2021 and its growth appears disproportionately strong as it is starting from a very low base. Nevertheless, despite the expansion, it only has one departure in 56 (1.6% of the market). Due to its low capacity, it has even less presence when considering seats, available seat miles and passengers.

More exciting is what will happen to JetBlue’s European operations. Faced with ongoing significant challenges, the airline has shelved the A321XLR, eliminated many airports and routes without including Europe, and prioritized east coast markets where it can win. What role will Europe play in the future?

_-_Ukraine_International_Airlines_-_UR-GOA_SA0000118826.jpg)