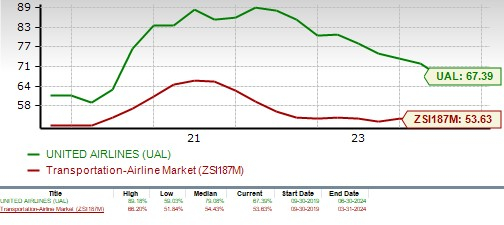

Shares of the Chicago-based airline heavyweight United Airlines (UAL – Free Report) have not had a great time in the stock market recently, losing 23.8% over the past 90 days. The disappointing share price performance caused UAL to lag behind the industry’s three-month decline of 5.6%. It also underperformed the S&P 500, of which the airline is a key member. However, UAL’s share price performance compares favorably with other U.S. airlines. American Airlines (EEL – Free report) and Delta Air Lines (DAL – Free report) during the same period.

Three-month price comparison

Image source: Zacks Investment Research

Image source: Zacks Investment Research

UAL is currently trading at a 25.8% discount from its 52-week high of $56.18 reached on May 16, 2024. In fact, United Airlines shares have plummeted more than 50% over the past five years and are currently trading at levels well below pre-COVID levels. In addition, this airline’s stock has slipped below its 50-day moving average, which is an important indicator for assessing market trends and momentum. A drop below this average indicates a bearish trend, which often causes investors to exercise caution.

50-day average

Image source: Zacks Investment Research

With UAL shares currently on a significant decline, investors may be tempted to buy the stock. But is this the right time to buy UAL? Let’s find out.

Bearish forecast for the September quarter

Last month, United Airlines reported lower-than-expected revenue for the second quarter of 2024. In addition, the airline’s earnings forecast for the third quarter of 2024 was disappointing. Management attributed this to pricing pressure as certain markets are characterized by overcapacity.

The practice of price-cutting by low-cost carriers struggling to fill the excess seats this summer is hurting even larger competitors. Low-cost carriers have added too many seats, which they are now trying to fill by lowering prices, forcing major airlines to do the same to remain competitive. This phenomenon dampened United Airlines’ pricing power. UAL’s management expects third-quarter 2024 adjusted earnings per share in the range of $2.75 to $3.25. The Zacks Consensus Estimate at the time was $3.61. UAL’s revenue decline was attributed to excess capacity related to summer flights.

Other headwinds

Aside from the problems with pricing and revenue, the increase in operating costs is hurting United Airlines’ bottom line and testing the company’s financial stability. In the first half of 2024, total operating expenses rose 5.7% year-over-year to $25.5 billion. The increase in operating expenses was mainly due to an increase in labor and fuel costs. Expenses for wages and benefits rose 14.2% over the same period.

Continued production cuts by major oil producing countries and geopolitical tensions are driving up fuel costs. The average fuel price per gallon increased 3.8% year-over-year to $2.76 in the second quarter of 2024. We expect the figure to be $3.02 per gallon in the third quarter of 2024, an increase of 2.2% from actual levels in the third quarter of 2023.

We are also concerned about the high level of debt. The company’s interest result was 2.9 at the end of 2023, which is unfavorable compared to the industry average of 4.6.

Long-term debt for capitalization  Image source: Zacks Investment Research

Image source: Zacks Investment Research

Given the headwinds facing the stock, earnings estimates for the current quarter and year are trending lower, as shown below.

Image source: Zacks Investment Research

Image source: Zacks Investment Research

Positive demand for air travel: A consolation

High passenger numbers bode well for UAL. While demand for air travel is particularly strong in the private sector, business travel has also made an encouraging comeback. Driven by strong demand for air travel, UAL’s revenue increased 7.5% year-on-year in the first half of 2024, driven by a 7.4% increase in passenger revenue.

From a valuation perspective, UAL is trading at a discount to its industry based on its forward 12-month price-to-sales ratio. It is also below its median over the past five years. The company has a Value Score of A.

Image source: Zacks Investment Research

To sum up

We agree that the stock is attractively valued and rising passenger revenues are benefiting UAL. However, given the headwinds mentioned above, we think it is absolutely not advisable to buy this Zacks Rank #3 (Hold) stock at this time. Instead, investors should closely monitor the company’s developments to find a suitable entry point.

You can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.