The world’s second most-watched football tournament, the quadrennial UEFA European Football Championship returned to the global stage from June 14 to July 14. With the exception of Euro 2020, which was played in numerous countries from England to Azerbaijan, the sporting event is usually held entirely in one or two host countries. This year, Germany hosted the tournament – the first since the 2006 World Cup.

The tournament took place in numerous cities, from traditional visitor markets such as Berlin and Munich to lesser-known cities such as Dortmund.

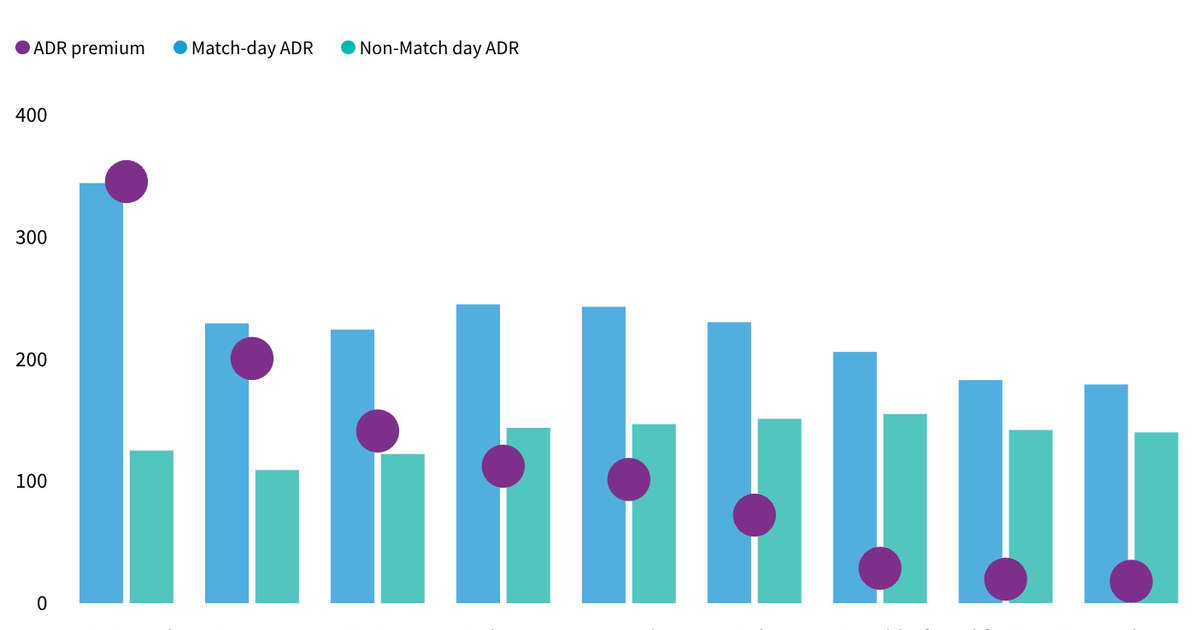

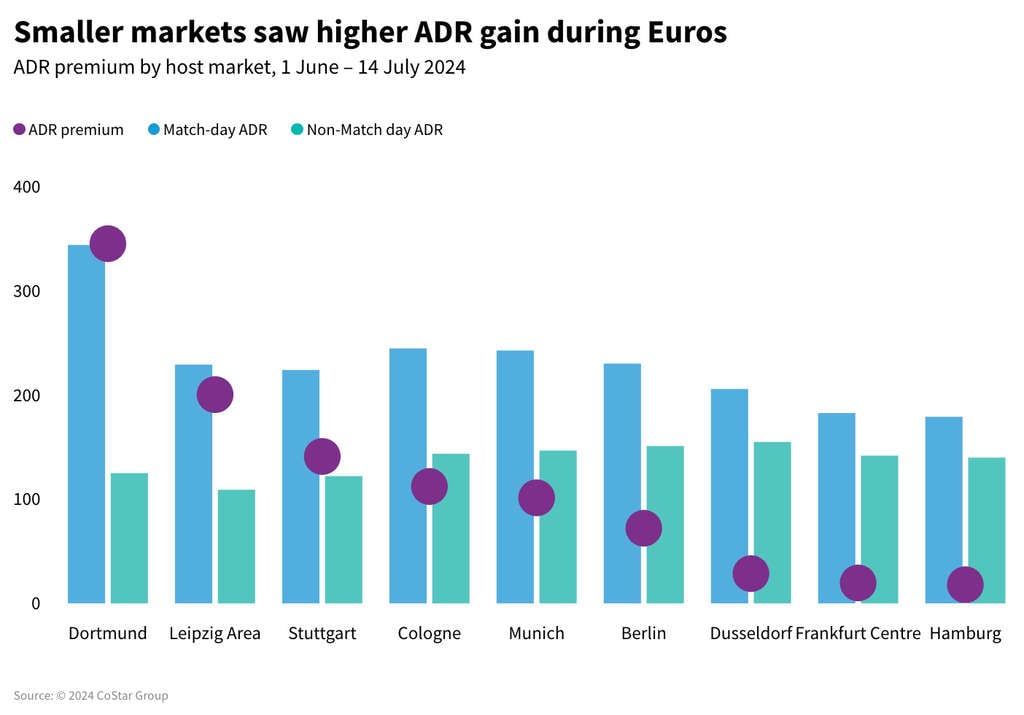

The tournament was a blessing for smaller markets

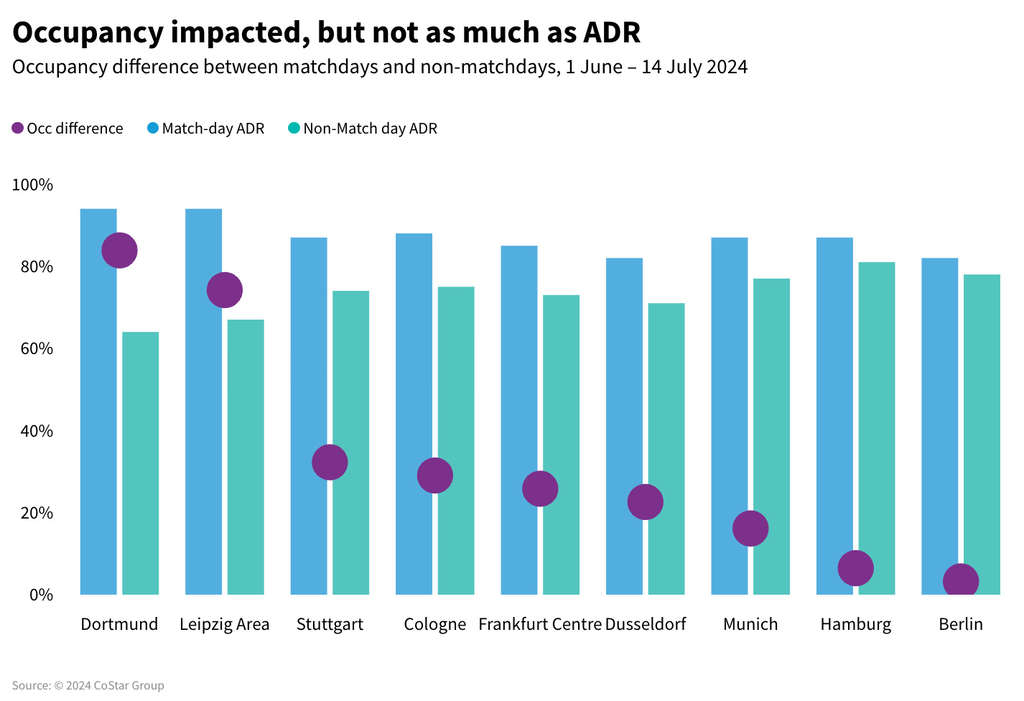

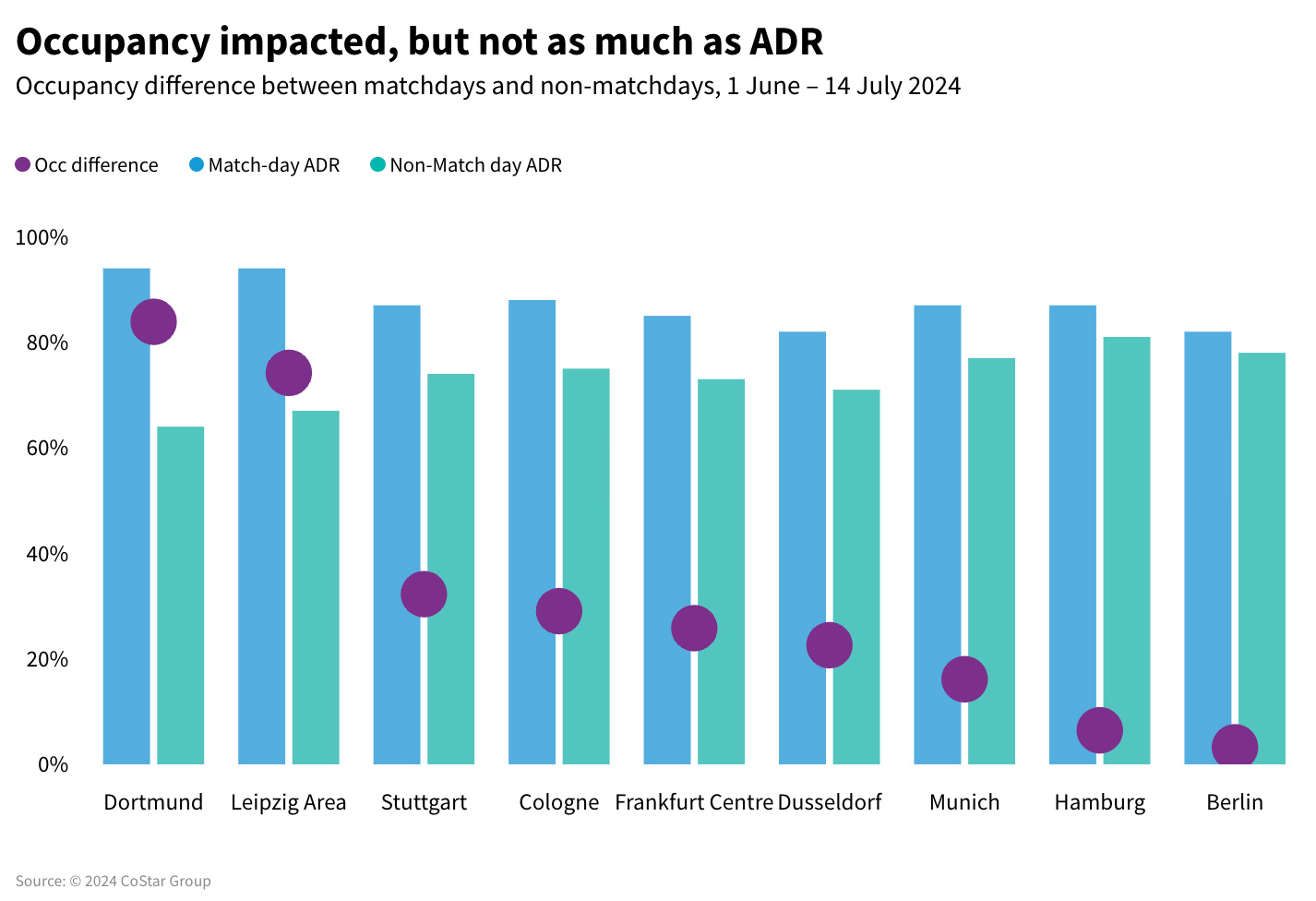

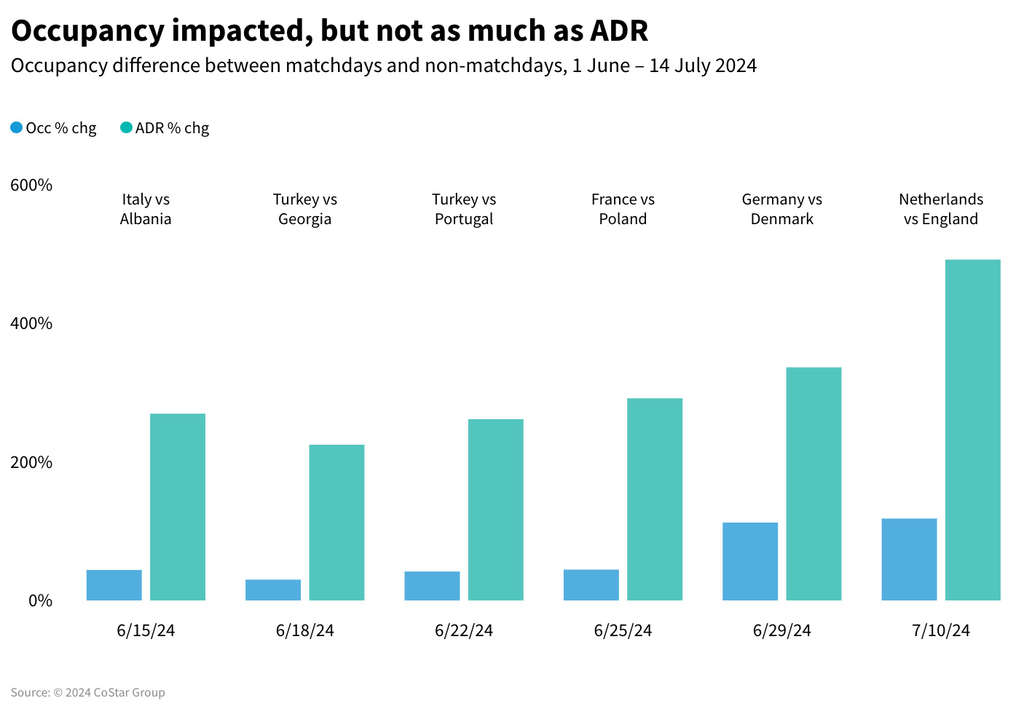

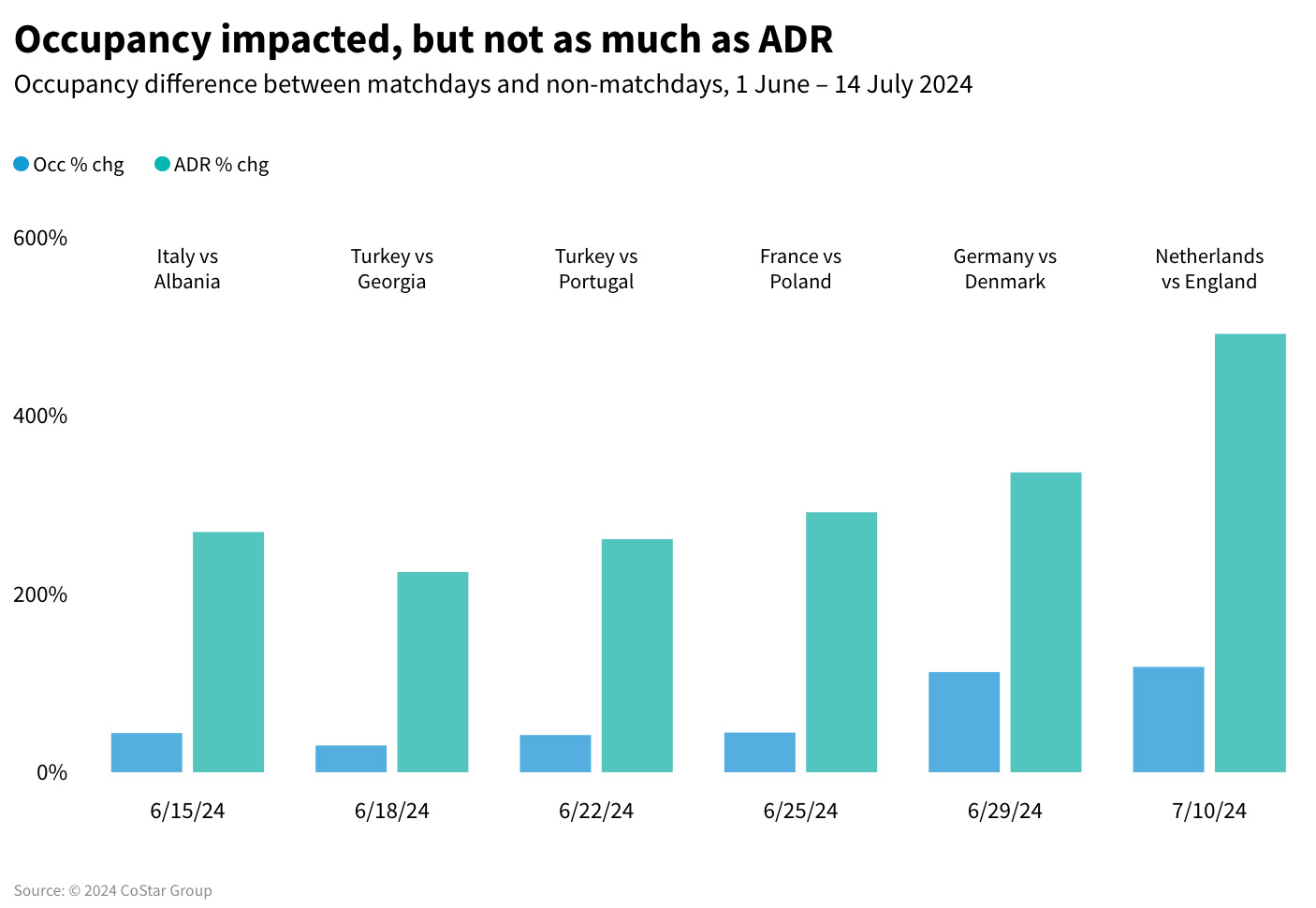

The average daily rate (ADR) in markets like Dortmund shot up during the tournament. BVB Stadium Dortmund hosted six matches, including the England vs Netherlands semi-final, which led to major spikes in revenue and occupancy. Dortmund saw a 30 percent increase in occupancy rates between June 1 and July 14 when comparing match days to non-match days. For the Netherlands vs England semi-final, the market saw an astonishing 118 percent jump in occupancy. In addition, room rates for the aforementioned match rose dramatically to EUR 433, compared to a low of EUR 86 on June 2 and EUR 73 the day after the match on June 12.

Leipzig was also one of the big winners, despite the GDR not being a traditional football stronghold. The market saw a 27% difference between matchdays and non-matchdays during the tournament, and the four games played in Leipzig saw significant ADR spikes, similar to Dortmund. The biggest spike came during the Netherlands vs France group match, with an average ADR of €256.

Traditional markets lagged slightly behind

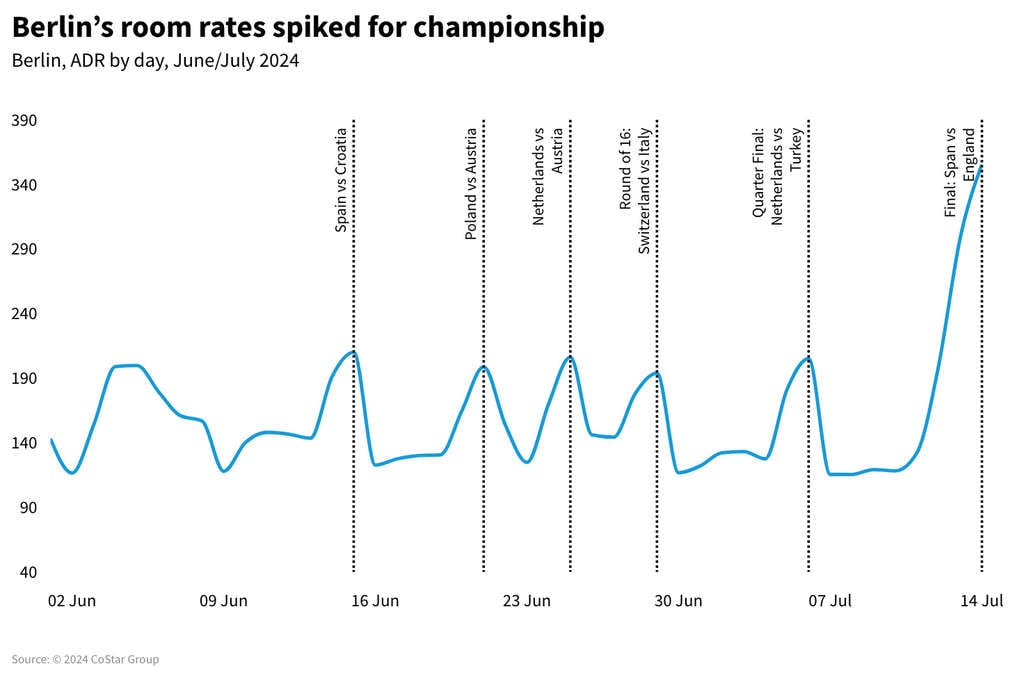

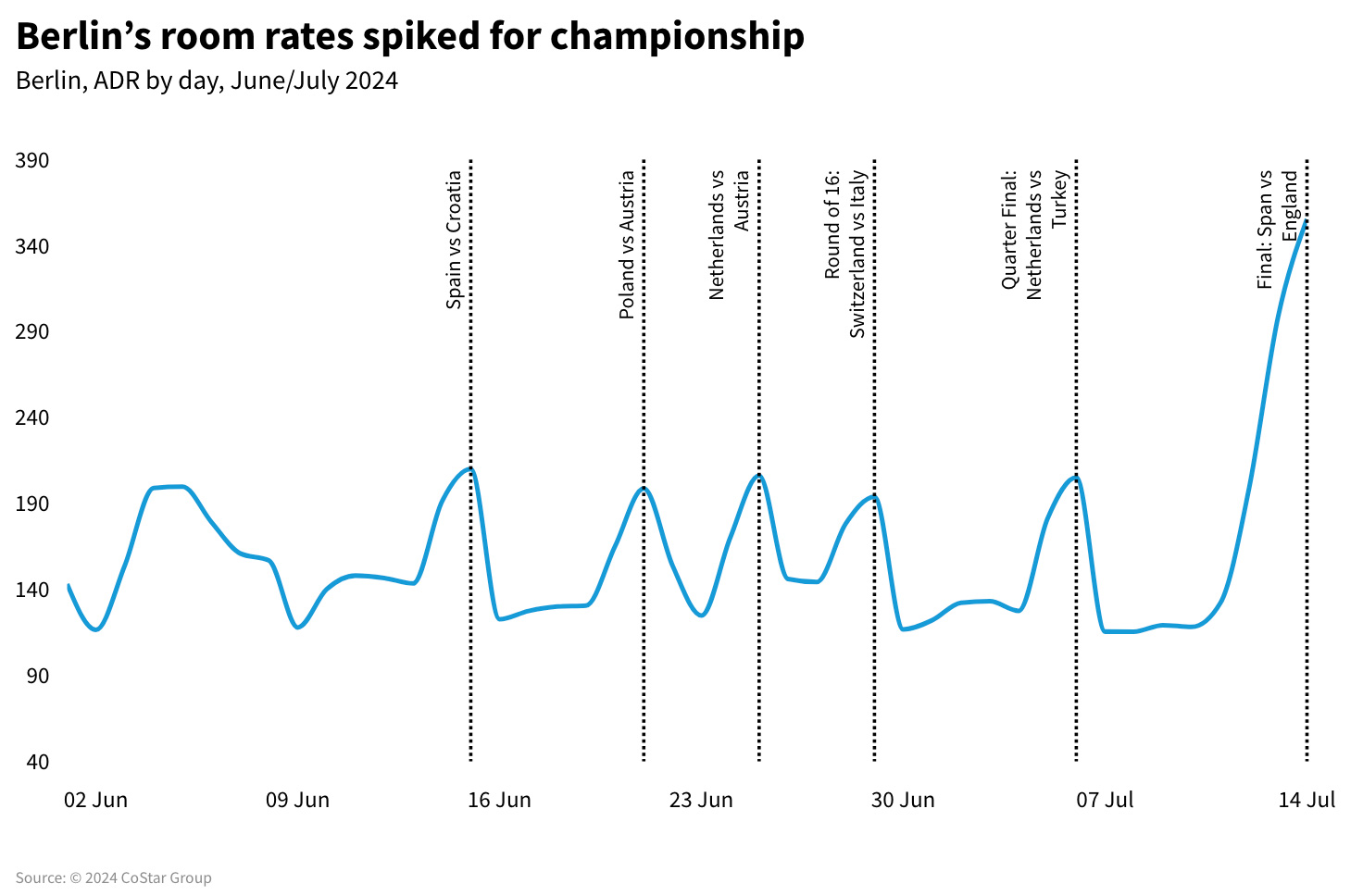

Traditional tourism markets such as Berlin and Munich saw slight increases in both occupancy and ADR, but did not come anywhere close to the results of Dortmund and Leipzig. This is likely due to the shift in “normal” demand, as tourists who would have come in a normal year decided to avoid the larger markets in anticipation of a mass of football fans. In Munich and Berlin, matchday occupancy actually dropped while ADR rose rapidly. The Slovenia vs. Serbia match saw a nearly 140% increase day-over-day with occupancy increasing only minimally.

Berlin saw significantly lower day-on-day ADR increases compared to 2023. Before the final, ADR was around 50%, but on the evening of the championship, there was a 200% increase. Capacity utilization in Berlin also fell day-on-day compared to the same period in 2023.

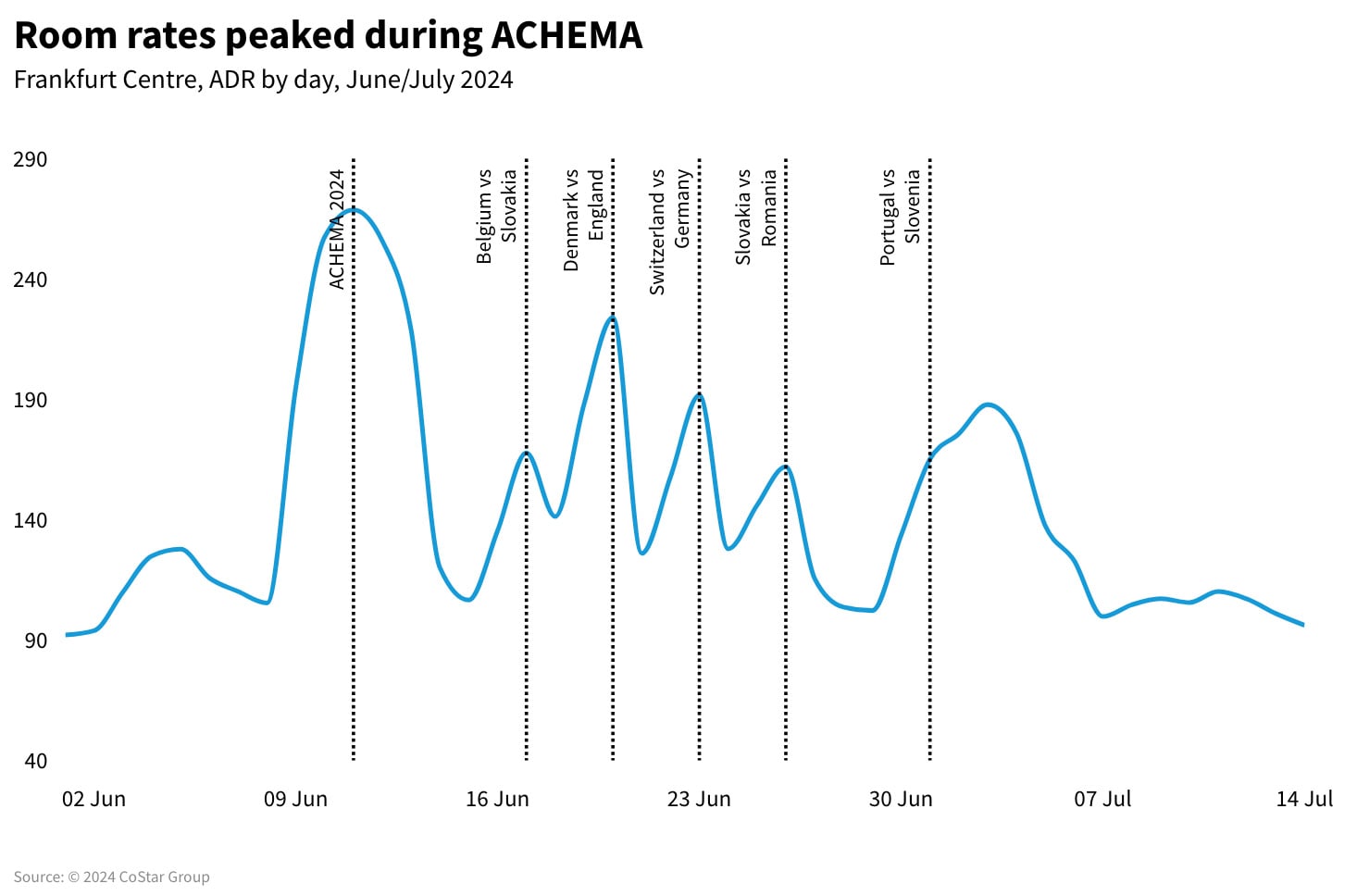

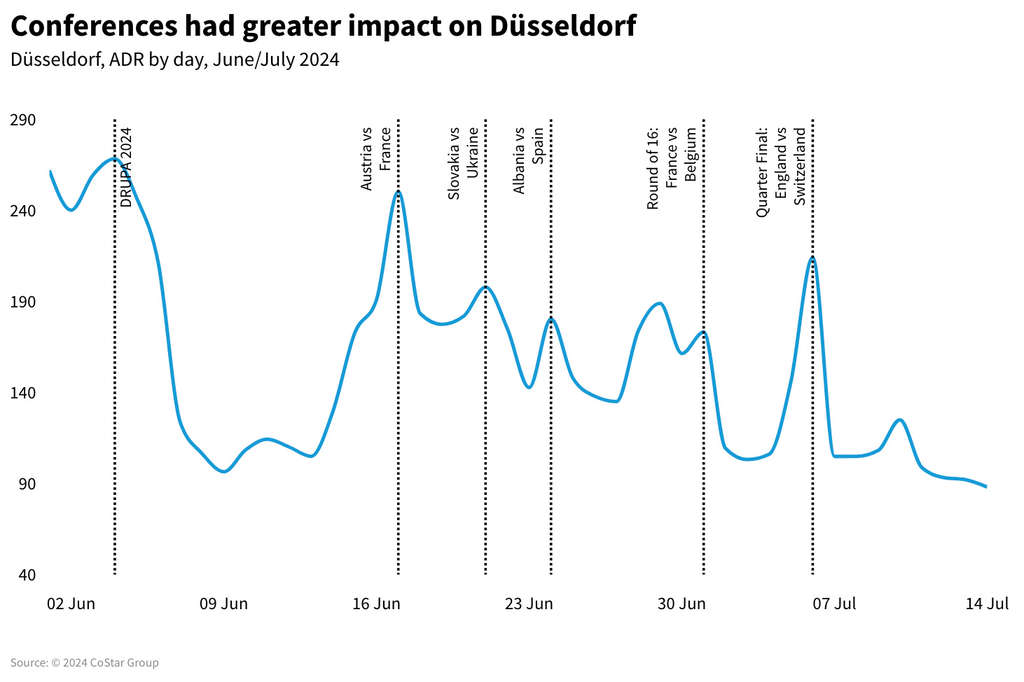

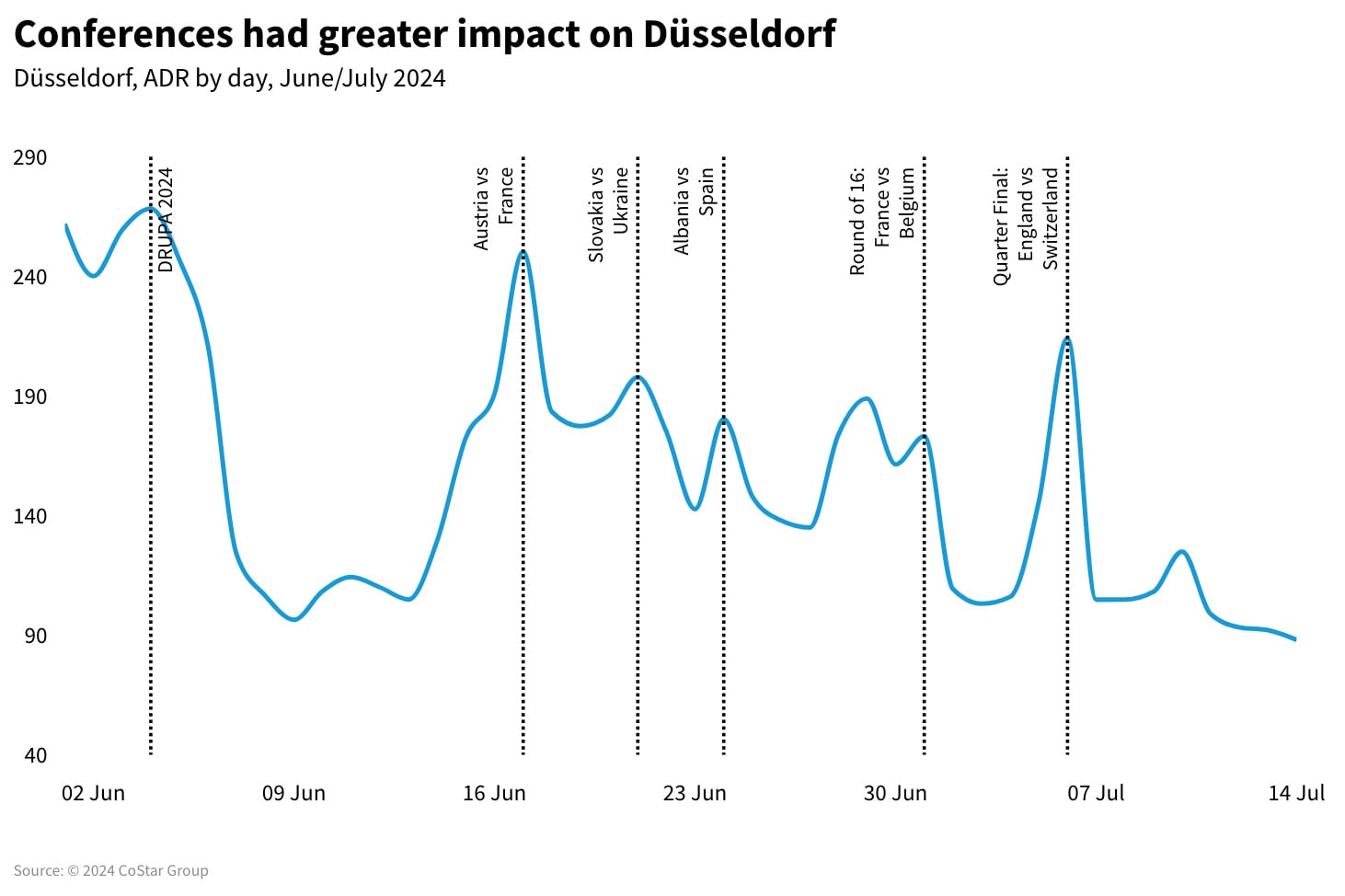

Frankfurt and Düsseldorf in particular saw larger ADR spikes before the tournament at conferences such as ACHEMA and DRUPA than at the matches they hosted. In Frankfurt, the largest ADR spike occurred during the England vs Denmark match, but it was nowhere near the level the market saw at ACHEMA.

Fans did not stay

The data suggests that fans did not stay long in each city. Significant drops in room rates and occupancy the day after a match showed that stays were only temporary and therefore did not generate the same level of revenue for the host cities as an Olympic city would. For example, the ADR premium shows that Dortmund saw a 175% increase on match days compared to non-match days, while Berlin and Munich saw increases of 52% and 66% respectively.

About STR

About STR

STR is the global leader in hospitality benchmarking, analytics and market insights. Founded in 1985, STR has a strong global presence with regional offices in strategic locations in Nashville, London and Singapore. In October 2019, STR was acquired by CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information and analytics in the commercial and residential real estate markets. For more information, visit str.com and costargroup.com.

Show source