Japan Airlines Co., Ltd. (TSE:9201) announced that it will declare a dividend of 40.00 yen per share on December 4. This brings the annual payout to 3.3% of the share price, higher than the amount paid by most companies in the industry.

Check out our latest analysis for Japan Airlines

Japan Airlines’ profits easily cover the distributions

We like to see solid dividend yields, but that doesn’t matter if the payment isn’t sustainable. Before this announcement, Japan Airlines was easily earning enough to cover the dividend. That means the majority of the company’s earnings are being used to support its growth.

Next year, EPS is expected to grow by 11.2%. Assuming dividend payout remains the same, the payout ratio could reach 36% next year, which is in a fairly sustainable range.

Dividend volatility

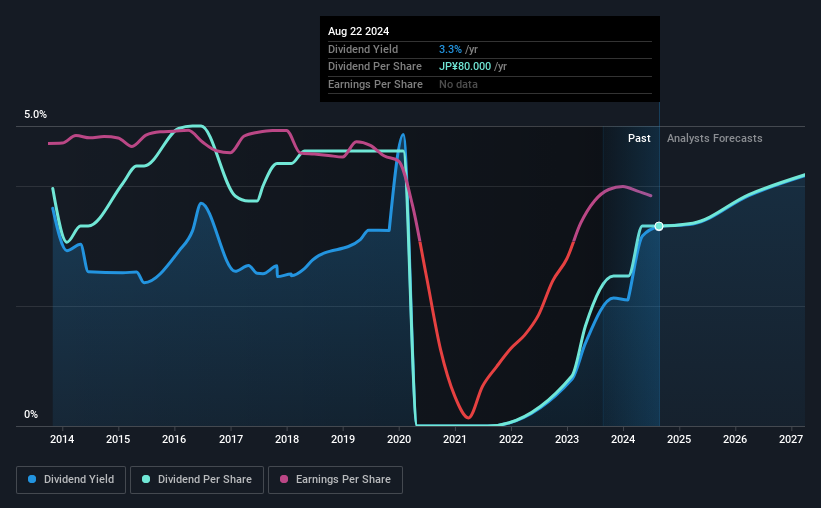

Although the company has a long history of paying dividends, it has cut them at least once in the last 10 years. The dividend has increased from an annual total of ¥95.00 in 2014 to the most recent annual total payout of ¥80.00. This represents a decline of about 1.7% per year over that time. Declining dividends are generally not what we look for, as they can be an indication that the company is facing challenges.

Dividend growth potential is shaky

Rising earnings per share could be a mitigating factor, considering past dividend fluctuations. Over the past five years, Japan Airlines’ earnings per share appear to have declined by about 14% per year. Such rapid declines can definitely limit dividend payments if the trend continues in the future. On the positive side, earnings are expected to increase somewhat next year, but until this proves to be a pattern, we wouldn’t be very happy.

In summary

Overall, we always welcome dividend increases, but we don’t think Japan Airlines will be a great dividend stock. In the past, payments have been unstable, but in the short term, the dividend could be reliable as the company generates enough cash to cover it. This company is not in the top tier of dividend stocks.

Companies with a stable dividend policy are likely to attract more interest from investors than those with a more inconsistent approach. At the same time, there are other factors that our readers should consider before putting capital into a stock. For example, we have selected the following: 1 warning sign for Japan Airlines investors should consider. Is Japan Airlines not quite the opportunity you have been looking for? Check out our Selection of the highest dividend stocks.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.