Roivant Sciences Ltd. (NASDAQ:ROIV) recently released a strong earnings report and the market reacted by sending shares higher. However, we believe shareholders should consider other factors besides the earnings numbers.

Check out our latest analysis for Roivant Sciences

Roivant Sciences’ profits in detail

In high finance, the most important metric that measures how well a company converts reported earnings into free cash flow (FCF) is the Delimitation ratio (from cash flow). To get the accrual ratio, we first subtract FCF from profit for a period and then divide that number by average funds from operations for the period. This ratio indicates how much of a company’s profit is not covered by free cash flow.

Therefore, it is actually considered good if a company has a negative accrual ratio, but bad if its accrual ratio is positive. This is not to say that we should be concerned about a positive accrual ratio, but it is worth noting if the accrual ratio is quite high. In particular, there is some academic evidence to suggest that a high accrual ratio is generally a bad sign for short-term earnings.

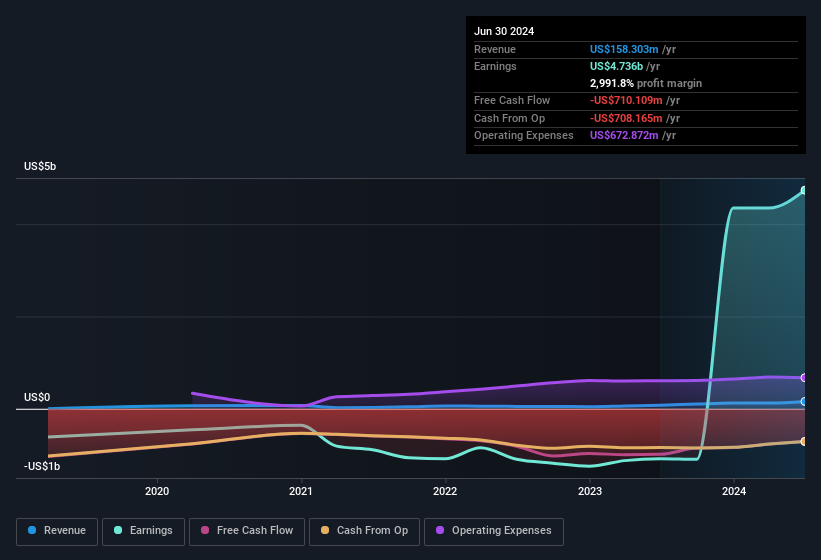

In the twelve months to June 2024, Roivant Sciences recorded an accrual ratio of 12.52. Statistically speaking, this is a real disadvantage for future earnings. And in fact, the company generated no free cash flow at all during this period. In the last twelve months, it even had Negative free cash flow, with a $710m outflow despite the $4.74b profit mentioned above. We also note that Roivant Sciences’ free cash flow was actually negative last year too, so we can understand if shareholders are bothered by the $710m outflow. However, there’s more to the story. We can see that unusual items have impacted statutory profit and therefore accruals. The good news for shareholders is that Roivant Sciences’ accruals were much better last year, so the poor reading this year could simply be due to a short-term mismatch between profit and FCF. As a result, some shareholders might expect stronger cash conversion in the current year.

You may be wondering what analysts are predicting in terms of future profitability. Fortunately, you can click here to see an interactive chart depicting future profitability based on their estimates.

How do unusual items affect profits?

The fact that the company had unusual items last year that boosted earnings by $5.4 billion probably explains in part why its accrual ratio was so weak. While we like to see earnings increases, we tend to be a bit more cautious when unusual items have made a big contribution. When we analyzed the numbers of thousands of publicly traded companies, we found that an increase from unusual items in a given year is often not repeated next year. And that is exactly what the accounting terminology implies. We can see that Roivant Sciences’ positive unusual items in the year to June 2024 were quite significant relative to its profit. If everything else remained unchanged, this would likely result in statutory profit not being a good indicator of underlying earnings power.

Our assessment of Roivant Sciences’ earnings development

To sum up, Roivant Sciences got a nice earnings boost from unusual items, but failed to bring its accounting profit in line with free cash flow. Upon closer inspection, the above factors give us the strong impression that Roivant Sciences’ underlying earnings power is not as good as it may appear based on its statutory profit numbers. With that in mind, we would not consider investing in a stock unless we know the risks well. For example: Roivant Sciences has 2 warning signs In our opinion, you should be aware of this.

Our research into Roivant Sciences has focused on certain factors that can make the company’s earnings look better than they are. For this reason, we are a little skeptical. But there are many other ways to form an opinion about a company. For example, many people consider a high return on equity to indicate a favorable business situation, while others like to “follow the money” and look for stocks that insiders are buying. You may want to check this out. free Collection of companies with high return on equity or this list of stocks with high insider ownership.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.