What trends should we look for when we want to identify stocks that can multiply in value over the long term? In a perfect world, we would like to see a company invest more capital in its business and, ideally, the returns generated from that capital also increase. Basically, this means that a company has profitable initiatives that it can continue to reinvest in, which is a characteristic of a compound interest machine. That’s why we’ve taken a quick look CTS’ (NYSE:CTS) ROCE trend, we were pretty pleased with what we saw.

What is return on capital employed (ROCE)?

For those who aren’t sure what ROCE is, it measures the amount of pre-tax profit a company can generate with the capital employed in its business. The formula for this calculation at CTS is:

Return on capital = earnings before interest and taxes (EBIT) ÷ (total assets – current liabilities)

0.12 = $74 million ÷ ($726 million – $92 million) (Based on the last twelve months to June 2024).

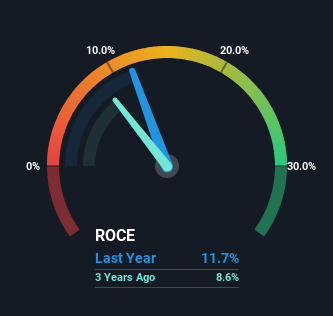

Therefore, CTS has a ROCE of 12%. This is a relatively normal return on capital and is around 9.9%, which is achieved in the electronics industry.

Check out our latest analysis for CTS

In the chart above, we have compared CTS’s ROCE to date with past performance, but the future is arguably more important. If you want, you can see the analysts’ forecasts for CTS for free.

So how is CTS’s ROCE developing?

The ROCE trend is not particularly striking, but returns are decent overall. Over the past five years, ROCE has remained relatively stable at around 12%, and the company has invested 31% more capital in its operations. 12% is a fairly normal return, and it is reassuring to know that CTS has consistently generated this amount. Stable returns of this magnitude can be unexciting, but if they can be sustained over the long term, they often provide nice returns for shareholders.

The conclusion

Ultimately, CTS has demonstrated its ability to reinvest capital appropriately and with good returns. And since the stock has risen sharply over the past five years, the market seems to expect this trend to continue. While investors seem to recognize these promising trends, we still believe the stock deserves further investigation.

And one more thing: We have found 1 warning sign with CTS and understanding it should be part of your investment process.

While CTS may not have the highest returns right now, we have compiled a list of companies that are currently generating more than 25% return on equity. Check it out free List here.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.