An easy way to profit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns and build a portfolio ourselves. For example: Changjiang Publishing & Media GmbH (SHSE:600757) Shareholders have seen a 63% increase in the share price over three years, significantly outpacing the market decline (31%, excluding dividends). However, returns have not been quite as good recently, with shareholders only seeing a 5.9% increase, including dividends.

With the stock’s market cap increasing by CNY 413 million in the past week alone, let’s see if the underlying performance has driven the long-term returns.

Check out our latest analysis for Changjiang Publishing & MediaLtd

There’s no denying that markets are sometimes efficient, but prices don’t always reflect underlying company performance. By comparing earnings per share (EPS) and share price changes over time, we can get a sense of how investor attitudes toward a company have changed over time.

During the three years of the share price, Changjiang Publishing & Media Ltd. recorded a decline in earnings per share (EPS) of 2.0% per year.

Based on these numbers, we believe the decline in earnings per share may not provide a good picture of how the company has changed over the years, so other metrics may be key to understanding what is affecting investors.

We note that the dividend is higher than before, which may have helped the share price. It could be that the company is reaching maturity and dividend investors are buying for the yield.

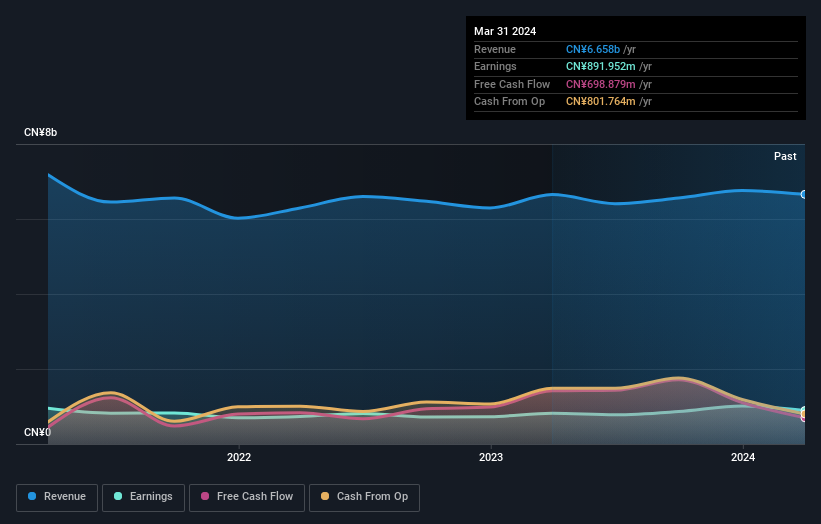

The company’s revenue and profit (over time) are shown in the image below (click to see the exact numbers).

If you want to buy or sell shares of Changjiang Publishing & MediaLtd, you should look at the following FREE detailed report on its balance sheet.

What about dividends?

In addition to measuring the share price return, investors should also consider the total shareholder return (TSR). While the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It could be argued that the TSR gives a more comprehensive picture of the return generated by a stock. We note that the TSR for Changjiang Publishing & Media Ltd. over the last 3 years was 90%, which is better than the share price return mentioned above. This is largely due to the dividend payments!

A different perspective

It’s nice to see that Changjiang Publishing & Media Ltd. shareholders have received a total return of 5.9% over the last year. That includes the dividend, of course. However, the TSR of 11% per year over five years is even better. Potential buyers may understandably feel they missed the opportunity, but it’s always possible that the business is still going strong. I find it very interesting to look at the share price over the long term as an indicator of business performance. But to really gain insight, we need to consider other information too. Consider, for example, the ever-present specter of investment risk. We have identified 1 warning signal with Changjiang Publishing & Media Ltd., and understanding them should be part of your investment process.

Naturally, If you look elsewhere, you may find a fantastic investment. So take a look at the free List of companies we expect to grow their earnings.

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks currently trading on Chinese exchanges.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.