Plug Power (PLUG) is a promising competitor in the hydrogen energy industry and is known for its comprehensive green hydrogen ecosystem. The company’s industry-leading 95 MW of global proton exchange membrane (PEM) electrolyzer systems and the construction of 13 hydrogen refueling stations across Europe over the past two years are impressive achievements. However, the company has posted consistent quarterly operating losses and missed revenue and earnings expectations, and the stock has fallen over 52% year-to-date. In other words, the company lacks positive momentum.

While the long-term outlook is promising, investors may want to wait and look for signs of financial progress before building a position in this stock.

Plug Power has ambitious plans

Plug Power develops hydrogen fuel cell systems such as GenDrive, a hydrogen-powered PEM fuel cell system for electric vehicles, and GenSure, a stationary fuel cell solution for the telecommunications, transportation and utility sectors.

In addition, PLUG produces electrolyzers and liquefaction systems for the production and distribution of clean hydrogen. The company’s products are distributed through direct sales, OEMs and dealer networks.

Plug Power has installed over 69,000 fuel cell systems and 250 fueling stations – more than any other company in the world. The company has ambitious plans to build a green hydrogen highway across North America and Europe, with commercial operations expected to begin by the end of 2028. As part of this effort, Plug has built a state-of-the-art gigafactory to manufacture electrolyzers and fuel cells.

In a strategic move to increase the company’s operational efficiency and profitability, Plug recently appointed Amazon industry veteran Dean Fullerton as its new COO. His extensive 14 years of experience in global engineering services and leading Amazon’s hydrogen economy team is a perfect fit with Plug’s mission and adds another level of expertise to the company’s leadership team.

Plug’s current financial results and outlook

The company recently announced its results for the second quarter of 2024. Revenue came in at $143.4 million, below analyst estimates of $188.15 million. PLUG posted a net loss of $262.3 million, due to strategic investments, market fluctuations, and non-cash expenses totaling approximately $86 million, and reported earnings per share (EPS) of -$0.36, below analyst estimates of -$0.32.

However, during the quarter, Plug Power was one of the first companies to utilize the Clean Hydrogen Production Tax Credit (PTC) for its liquid hydrogen plant in Georgia. The plant was able to increase its production capacity in addition to strategic price increases for its hydrogen products, demonstrating the company’s ability to leverage its production capabilities for improved financial performance.

To further finance its operations, the Company has issued a public offering of approximately 78.74 million common shares at a price of $2.54 per share, raising approximately $200 million in fresh capital to be used for general corporate purposes.

Management has provided guidance for 2024 and expects revenues to be between $825 million and $925 million.

What is the price target for PLUG shares?

The stock has been in a volatile downtrend for several years, losing over 91% of its value while exhibiting a beta of 2.57. It is trading at the lower end of its 52-week price range of $2.21 to $13.17 and has sustained negative price momentum, trading below its 20-day (2.66) and 50-day (2.77) moving averages. Despite the price decline, its P/S ratio of 2.02 is in line with the Electrical Equipment & Parts industry average of 1.8.

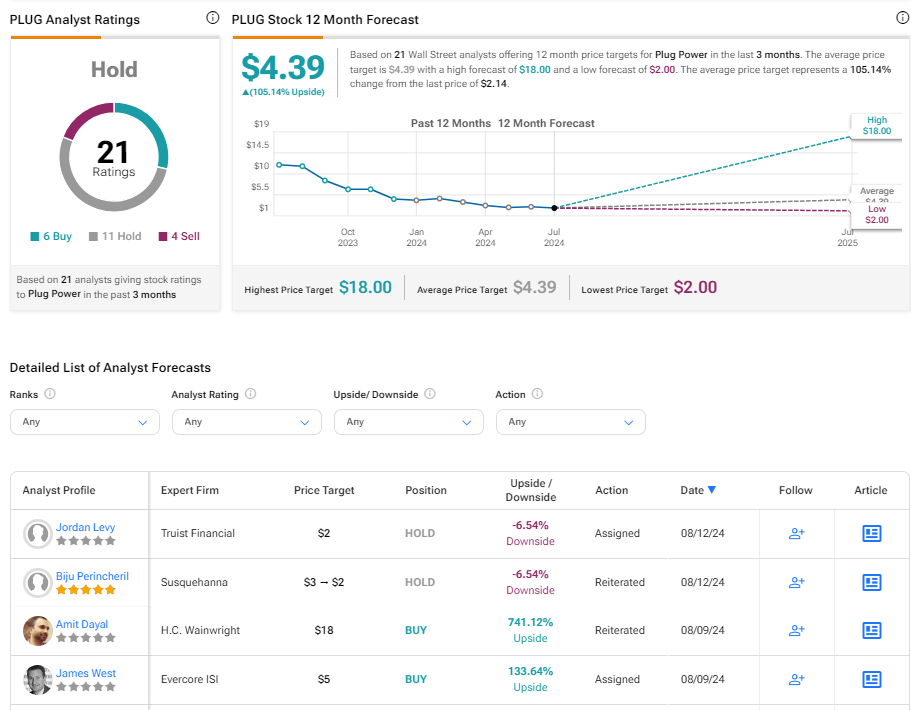

Analysts who cover the company are cautious on the stock. For example, Truist analyst Jordan Levy recently reiterated a hold rating and lowered the price target on the shares from $3 to $2. He pointed out that the company missed earnings targets in the second quarter and believes it still has a long way to go to prove it is on the right path to profitability.

Plug Power is rated a Hold overall based on recommendations and price targets recently published by 21 analysts. The average price target for PLUG shares is $4.39, which represents a potential upside of 105.14% from current levels.

View more PLUG analyst ratings

The big picture on PLUG

Plug Power has made great strides in the hydrogen industry, building an industry-leading hydrogen ecosystem, but the company’s financial stability is concerning as it struggles with persistent operating losses, missed revenue expectations, and a significant decline in stock value this year.

Despite these challenges, the company’s ambitions for a green hydrogen highway, its extensive product portfolio and the appointment of strategic leaders point to potentially promising results. Investors may want to hold back and wait for signs of financial improvement before establishing a position in this stock.

notice