While Gift Holdings Inc. (TSE:9279) Shareholders are probably happy overall because the stock hasn’t performed particularly well recently, falling 11% in the last quarter. But over three years, the returns have been great. In fact, the share price is up a whopping 121% from three years ago. After a run like that, some might not be surprised to see prices slip. If the company can deliver good results in the coming years, the recent decline could be an opportunity.

Last week was a lucrative one for Gift Holdings investors, so let’s see if fundamentals drove the company’s three-year performance.

Check out our latest analysis for Gift Holdings

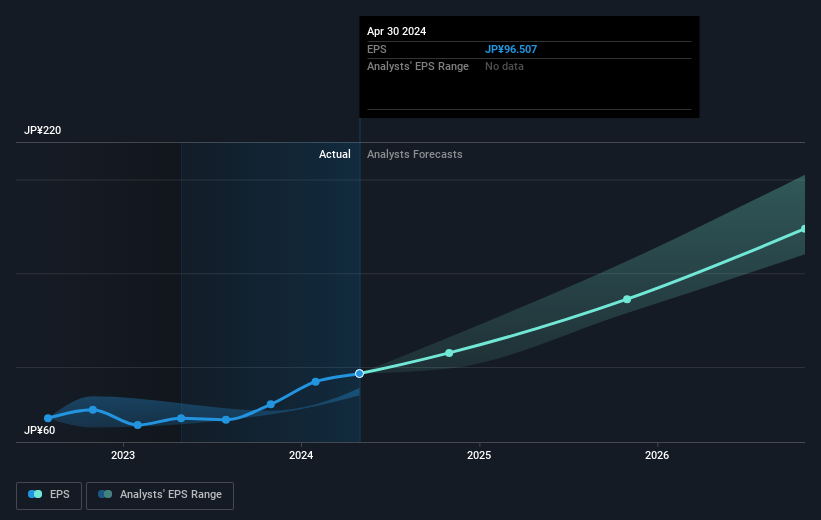

There’s no denying that markets are sometimes efficient, but prices don’t always reflect underlying business performance. A flawed but reasonable way to assess how sentiment toward a company has changed is to compare earnings per share (EPS) with the share price.

Gift Holdings has grown its earnings per share by 86% per year over three years, driving up its share price. The average annual share price increase of 30% is actually less than the earnings per share growth, so one could reasonably conclude that the market for the stock has cooled off.

Below you can see how EPS has changed over time (click on the image to see the exact values).

We know that Gift Holdings has improved its earnings over the last three years, but what does the future hold? It might be worth taking a look at our free Report on how his financial situation has changed over time.

What about dividends?

It is important to consider the total return to shareholders as well as the share price return for any given share. While the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So, for companies that pay a generous dividend, the TSR is often much higher than the share price return. We note that the TSR for Gift Holdings over the last 3 years was 127%, which is better than the share price return mentioned above. So the dividends paid by the company have the in total shareholder return.

A different perspective

Gift Holdings shareholders are up 5.3% for the year (even including dividends). However, that was below the market average. If we look back at the last five years, the returns are even better, coming in at 11% per year for five years. Perhaps the share price is just taking a breather while the company executes its growth strategy. Before you decide if you like the current share price, check out how Gift Holdings stacks up on these 3 valuation metrics.

If you would rather check out another company — one with potentially better financials — then don’t miss this free List of companies that have proven their ability to increase their earnings.

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.