Did you know that there are some financial metrics that can give clues about a potential multi-bagger? Usually we want to identify a trend of growth return on the capital employed (ROCE) and in parallel a growing base of capital employed. Essentially, this means that a company has profitable initiatives in which it can continue to reinvest, which is a characteristic of a compounding machine. So when we looked at Juneyao Airlines’ (SHSE:603885) ROCE trend, we liked what we saw.

Return on Capital Employed (ROCE): What is it?

Just to clarify in case you’re not sure, ROCE is a ratio used to evaluate how much profit before tax (in percent) a company generates with the capital invested in its business. Analysts use this formula to calculate it for Juneyao Airlines:

Return on capital = earnings before interest and taxes (EBIT) ÷ (total assets – current liabilities)

0.11 = CN¥2.9 billion ÷ (CN¥45 billion – CN¥18 billion) (Based on the last twelve months to March 2024).

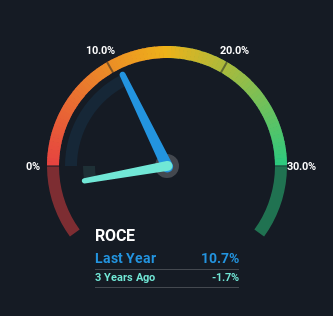

Therefore, Juneyao Airlines has a ROCE of 11%. In absolute terms, this is a satisfactory return, but it is much better than the airline industry average of 8.7%.

Check out our latest analysis for Juneyao Airlines

In the chart above, we’ve compared Juneyao Airlines’ ROCE with its past performance, but the future is arguably more important. If you want to know what analysts are forecasting for the future, you should check out our free analyst report for Juneyao Airlines.

What does the ROCE trend tell us for Juneyao Airlines?

Although the return on capital is good, it hasn’t changed much. The company has consistently returned 11% over the past five years, and capital employed in the company has grown 82% in that time. 11% is a fairly normal return, and it’s a little reassuring to know that Juneyao Airlines has consistently returned that amount. Stable returns of this magnitude can be unexciting, but if they can be sustained over the long term, they often provide shareholders with nice returns.

The most important things to take away

Ultimately, Juneyao Airlines has proven that it is capable of reinvesting capital appropriately and with good returns. However, over the past five years, the stock has not delivered big gains to shareholders. For this reason, savvy investors should take a closer look at this company in case it is a top-notch investment.

We also found 1 warning sign for Juneyao Airlines You probably want to know more about it.

Even though Juneyao Airlines doesn’t have the highest return, check it out here free List of companies with solid balance sheets and high returns on equity.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.