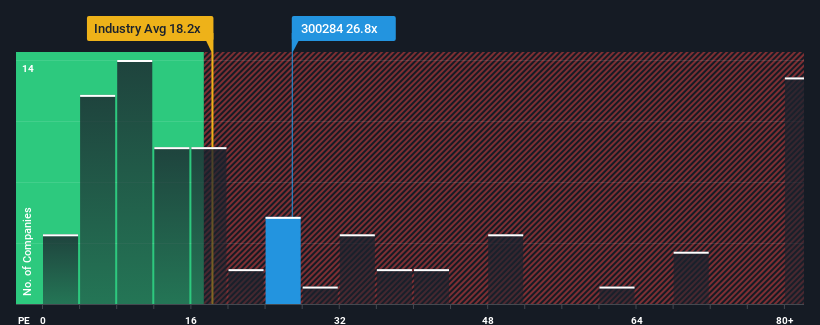

There are not many who think The (SZSE:300284) price-to-earnings ratio (or “P/E”) of 26.8 is worth noting when the median P/E in China is similarly high at around 27. However, it is not advisable to simply ignore the P/E without explanation as investors may miss a special opportunity or make a costly mistake.

While the market has seen earnings growth recently, JSTI Group’s earnings have been in reverse gear, which is not good. One possibility is that the P/E ratio is modest because investors believe this poor earnings performance will change. If not, existing shareholders might be a little nervous about the profitability of the share price.

Check out our latest analysis for JSTI Group

Do you want the full picture of analyst estimates for the company? Then our free The JSTI Group report will help you find out what’s on the horizon.

How is the JSTI Group growing?

A P/E ratio like that of the JSTI Group is only safe if the company’s growth is closely in line with the market.

If we look at the earnings over the last year, the company’s earnings have fallen by a disheartening 47%. As a result, the earnings from three years ago have also fallen by a total of 42%. So, it is fair to say that the earnings growth of late has been undesirable for the company.

As for the outlook, the next three years should bring growth of 16% per year, according to estimates from the three analysts who cover the company. This is likely to be well below the 23% per year growth forecast for the overall market.

With this in mind, it is curious that JSTI Group’s P/E ratio is in line with most other companies. It seems that most investors are ignoring the fairly limited growth expectations and are willing to pay more to own the stock. Maintaining these prices will be difficult, as this level of earnings growth will likely weigh on the shares at some point.

The conclusion on the P/E ratio of the JSTI Group

Although the price-earnings ratio should not be the deciding factor in whether or not you buy a stock, it is still a useful indicator of earnings expectations.

Our study of analyst forecasts for JSTI Group found that the weaker earnings outlook is not impacting the P/E as much as we would have expected. At the moment, we are unhappy with the P/E as the forecast future earnings are unlikely to support a more positive sentiment for long. This puts shareholders’ investments at risk and potential investors risk paying an unnecessary premium.

You must consider risks, for example – JSTI Group has 3 warning signs (and 1 that is causing a little concern) that we think you should know about.

If you uncertain about the strength of the JSTI Group’s businesswhy not explore our interactive stock list with solid business fundamentals for some other companies you may have missed.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.