Singapore has become a destination for large law firms seeking work across Asia, but high costs and a sharp decline in workloads are making it difficult to make a profit.

Market pressures and declining business activity are limiting the prices that companies can charge their customers in the region.

“Asian clients are simply not used to paying New York private equity rates,” says Giji John, a partner at Orrick, which has six lawyers in the country. “You have to meet those clients where they are and build a team that can achieve that level of profitability.”

Leading U.S. law firms are increasingly moving their offices to Singapore while scaling back their operations in China and Hong Kong. Many are keeping their offices small and requiring their lawyers to be flexible by focusing on work across the Asia-Pacific region.

Lower fee rates mean that firms generally do not pay lawyers the usual salary in the US and UK, even though the cost of living there is higher than in New York and London. Most have also abandoned the seniority-based fixed salary system in favour of an “eat what you kill” model.

“If you had to pay in some sort of standard lockstep, maybe the office wouldn’t make sense anymore,” Richard Rosenbaum, chief executive of global law firm Greenberg Traurig, said in an interview. “We pay based on what people contribute to the firm, including the profitability of their work.”

The firm, which opened an office in Singapore in 2023, currently employs 10 lawyers in the country. Other U.S. firms that have opened in the country in the past five years include Orrick, Cooley LLP, Baker Botts, McDermott Will & Emery and Goodwin Procter. Each of these firms employs fewer than 20 lawyers in the country.

Only two of the 30 largest US-headquartered firms – Baker McKenzie and Norton Rose Fulbright – have more than 50 lawyers in Singapore. Both operate under Swiss corporate structures and use a loose network of offices to gain scale.

Offers are falling

Orrick announced earlier this year that it would close its Shanghai office and consolidate its China presence in Beijing. Deteriorating relations with the US, tighter security regulations in the country and an economic downturn have prompted other firms to take similar steps.

Singapore is an attractive alternative and serves as a hub for access to regional Asian markets including India, Indonesia, Thailand, South Korea, Vietnam and China.

Lawyers in outposts in Singapore have been using the country as a base for regional business for several years.

Jake Robson, Greenberg Traurig’s co-managing director for the Singapore office and head of M&A for South and Southeast Asia, joined Greenberg Traurig in March from Asian law firm King & Wood, where his roles included advising REA Group on a deal to increase its stake in Elara Technologies, an Indian real estate company, and on the divestment of its Malaysian and Thai businesses to Property Guru. Robson also advised Softbank Vision Fund on multiple investment rounds in Grab, including companies across Asia totaling over $2 billion.

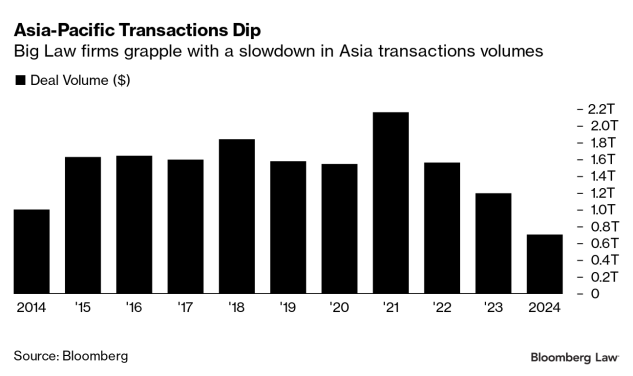

The short-term ambitions of the region’s major law firms have been curbed by a downturn in the transaction market.

The volume of merger and acquisition transactions fell last year to its lowest level since 2014. The decline was partly due to a slowdown in Hong Kong, where the economy shrank due to a population exodus.

Singapore is benefiting from an increase in investment inflows and relocation of Chinese companies. According to the Singapore Bureau of Statistics, the country attracted S$62 billion (US$46.9 billion) in foreign direct investment from China in 2022 – nearly 10% of its GDP.

Still, the country’s major lawyers continue to focus on work outside the country’s borders, says Rishab Kumar, partner at Cooley.

“They focus on large, cross-border transaction practices and cross-border litigation – the development of resources in new regions depends on the volume of these transactions.”