Anyone interested in Large Technologies PLC (LON:BIG) should probably be aware that COO and Executive Director, Charles Lewinton, recently disposed of £216,000 worth of the company’s shares at an average price of £1.24 per share. The surprise move represented a 12% reduction in their holding.

Check out our latest analysis for Big Technologies

Insider transactions of large technology companies in the last year

Notably, this recent sale by Charles Lewinton is the largest insider sale of Big Tech shares we’ve seen in the last year, so it’s clear that an insider saw fit to sell at the current price of around £1.20. While insider selling is a negative, it’s even more of a negative for us if the shares are sold at a lower price. In this case, the big sale occurred at the current price, so it’s not that bad (but still not positive).

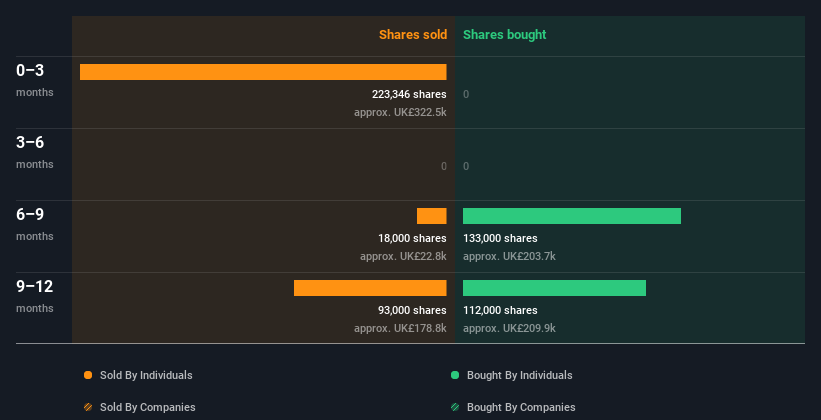

Over the last year, insiders have bought 245,000 shares worth £453,000. On the other hand, they have sold 334,350 shares worth £469,000. Overall, insiders have sold more Big Technologies shares over the last year than they have bought. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all individual transactions, including share price, individual and date!

If you like buying stocks that insiders are buying and not selling, you might like this free List of companies. (Note: most of them stay under the radar).

Insider ownership of major technologies

Looking at the total insider ownership in a company can help you assess whether it is well aligned with ordinary shareholders. Typically, the higher the insider ownership percentage, the more likely it is that insiders have incentives to build the company for the long term. Insiders from large technology companies own 28% of the company, which is currently worth around £98 million based on the current share price. Most shareholders would be happy to see this level of insider ownership, as it suggests that management’s incentives are well aligned with those of other shareholders.

So what do the insider transactions of the big technology companies mean?

Insiders have recently sold shares, but they haven’t bought. Despite some insider buying, the long-term picture doesn’t make us much more optimistic. Insiders own shares, but we’re still quite cautious given the selling history, so we would only buy after careful consideration. In addition to knowing about ongoing insider transactions, it’s beneficial to identify the risks facing large technology companies. You’ll be interested to know that we found 1 warning signal for Big Technologies and we recommend you take a look.

But please note: Large technology companies may not be the best buying opportunitySo take a look at the free List of interesting companies with high return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulator. Currently, we only consider open market transactions and private disposals of direct holdings, but not derivative transactions or indirect holdings.

Valuation is complex, but we are here to simplify it.

Discover whether major technologies could be undervalued or overvalued with our detailed analysis, Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.